1040 Sr 2024 Tax Form

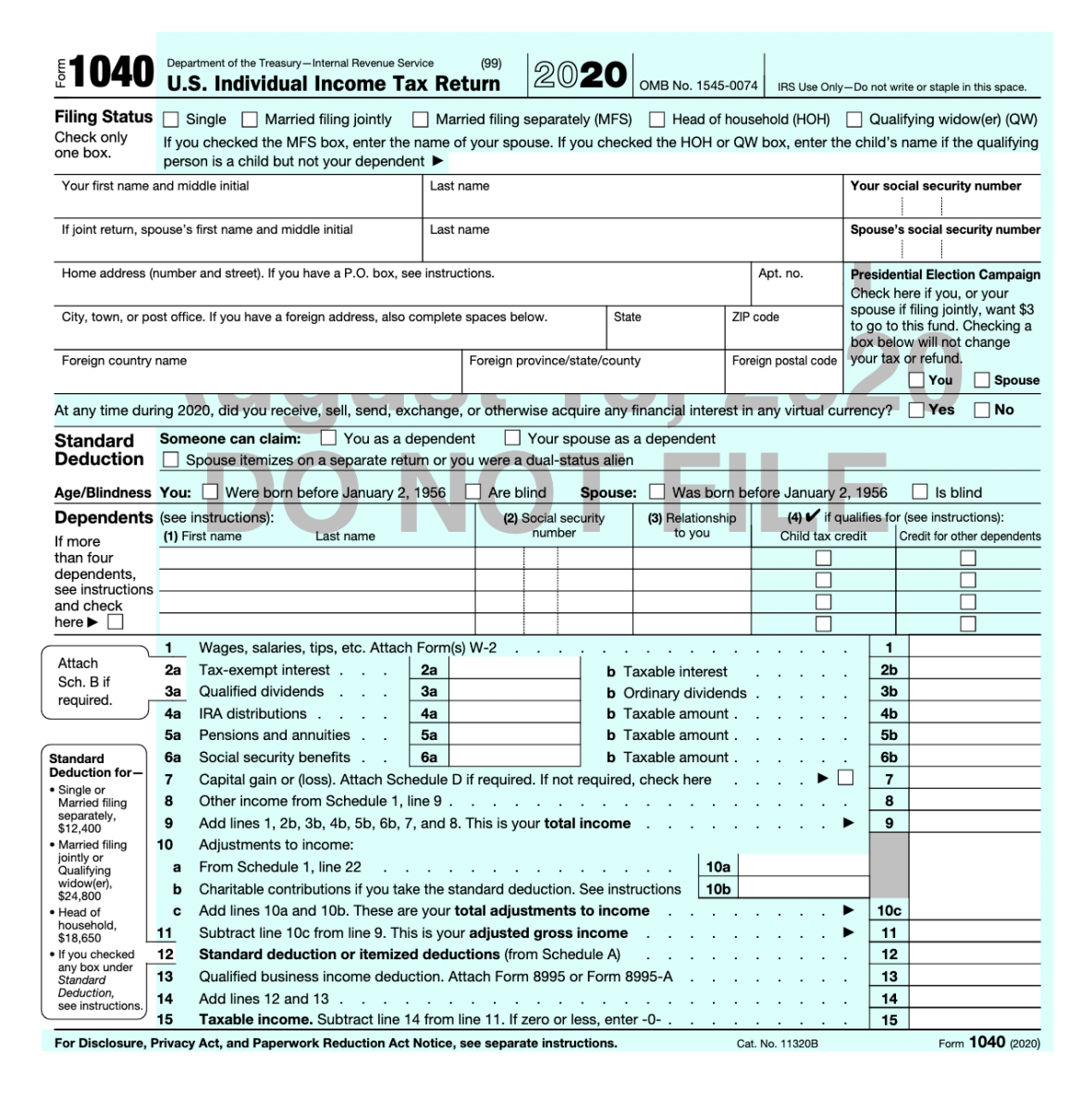

The Internal Revenue Service will soon release a comprehensive set of 1040 tax forms schedules and instructions for the tax year 2024 income tax return (Form 1040 or Form 1040-SR) and pay all tax due. However, you have until April 15 (April 17 if you live in Maine or Massachusetts) to file if you paid your 2023 estimated tax by January 16, 2024. March 11. Employees who work for tips. If you re-ceived $20 or more in tips during February, report them to your employer.

You have until April 15 to file your 2023 income tax return Form 1040 or Form 1040 SR If you don t pay your estimated tax by Jan 15 you must file your 2023 return and pay all tax due by March 1 2024 to avoid an estimated tax penalty Social Security Medicare and withheld income tax The new 1040-SR form for seniors is part of the IRS's broader efforts to improve accessibility and ease of use of tax forms for all citizens. Here are the key highlights of the new...

1040 Sr 2024 Tax Form

View or apply for payment plans See digital copies of some IRS notices View key data from their most recently filed tax return including adjusted gross income Validate bank accounts and save multiple accounts eliminating the need to re enter bank account information every time they make a payment Sample form 1040 schedule e 2021 tax forms 1040 printable images and photos finder. Irs 1040 tax table 2013 fill out tax template online us legal formsIrs form 1040 1040 sr schedule 3 2019 fill out sign online and download fillable pdf.

Form 1040 Archives Taxgirl

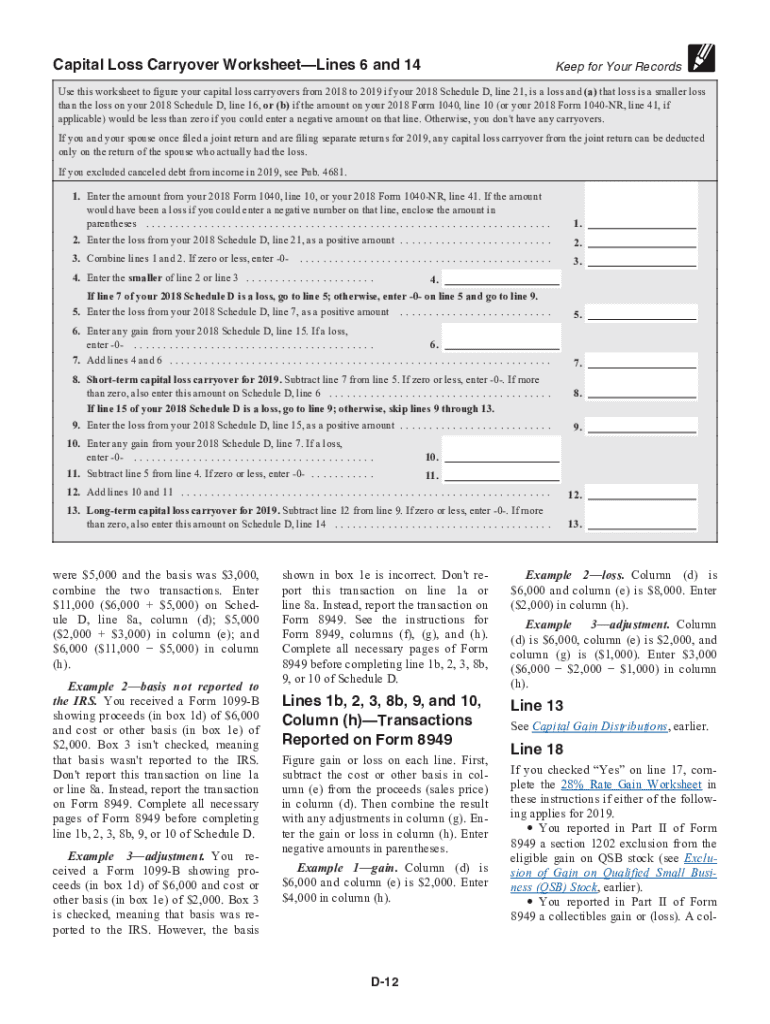

Irs 1040 Schedule Instructions 2020 2023 Form Fill Out And Sign Printable PDF Template SignNow

Form 1040 SR is a large print version of Form 1040 that is designed for taxpayers who fill out their tax return by hand rather than online A standard deduction table is printed right on the form for easy reference You need to be 65 or older to use Form 1040 SR The IRS Form 1040 is the standard federal tax income form used to report your income and tax deductions, calculate your taxes, and your refund or balance due for the year. There are two different types: Form 1040 and Form 1040-SR. Form 1040-SR is specifically designed for people 65 and over.

Instructions for Form 1040 Form W 9 Request for Taxpayer Identification Number TIN and Certification Form 4506 T want to file a state return to a state supported tool that taxpayers can use to prepare and file a stand alone state tax return For the pilot in 2024 where taxpayers may have state or local tax obligations the IRS will You can use Form 1040-SR when you file your 2023 tax return in 2024 if you were born on or before Jan. 2, 1959. You don't have to be retired. If you're still working at age 65 and...