1099 Form 2024 Fillable

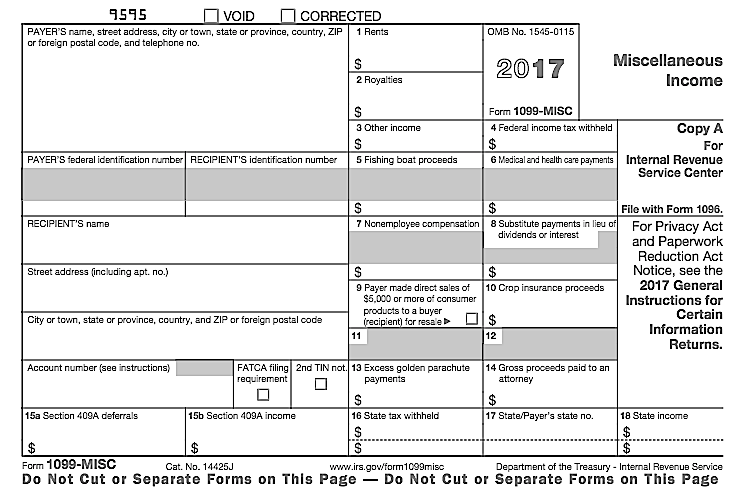

Instructions Instructions for Forms 1099 MISC and 1099 NEC 01 2024 Miscellaneous Information and Nonemployee Compensation Section references are to the Internal Revenue Code unless otherwise noted Revised 01 2024 Instructions for Forms 1099 MISC and 1099 NEC Introductory Material Future Developments Following feedback from taxpayers, tax professionals and payment processors and to reduce taxpayer confusion, the IRS delayed the new $600 Form 1099-K reporting threshold for third party settlement organizations for calendar year 2023.

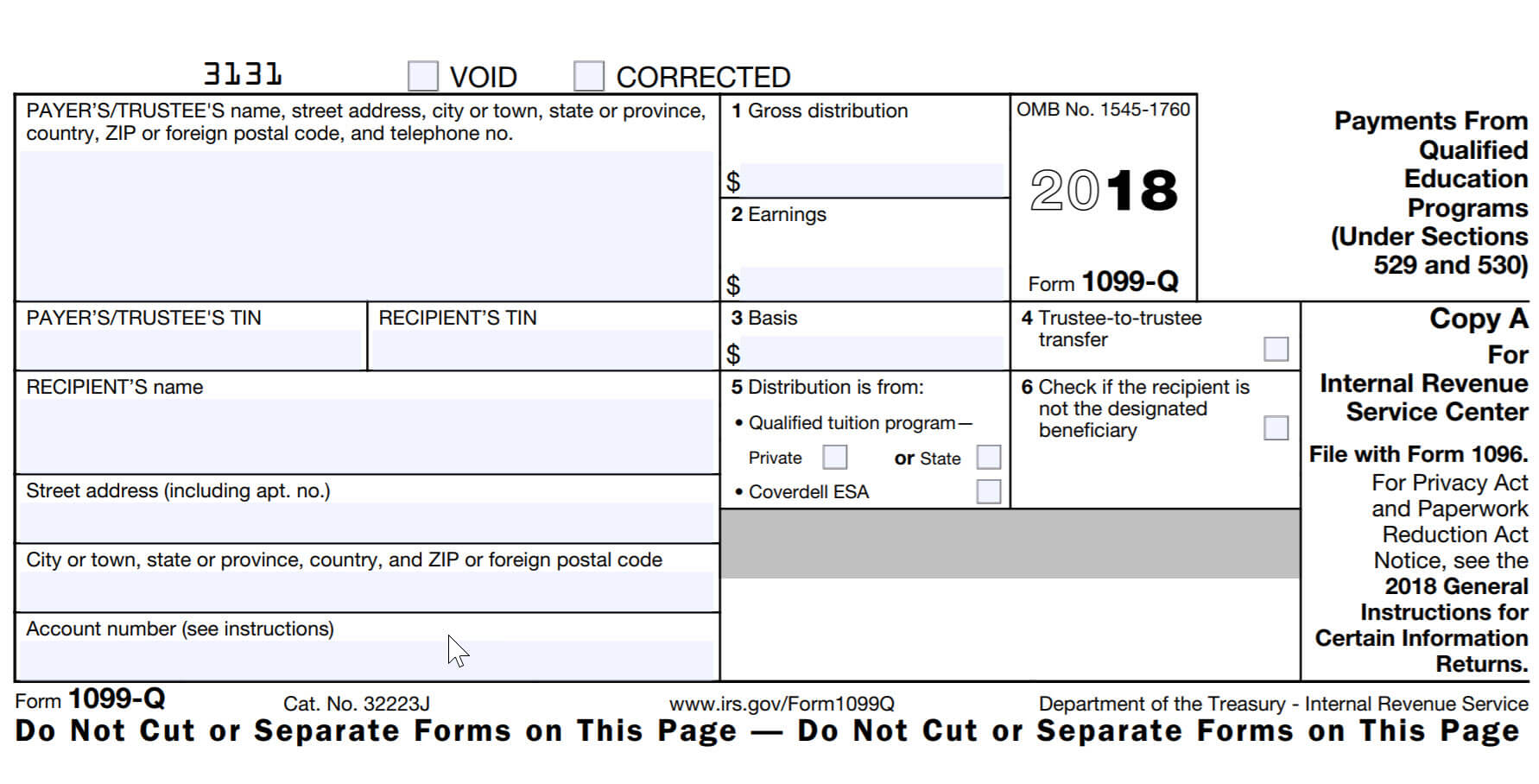

If you paid someone who is not your employee such as a subcontractor attorney or accountant 600 or more for services provided during the year a Form 1099 NEC needs to be completed and a copy of Form 1099 NEC must be provided to the independent contractor by January 31 of the year following payment You can e-file any Form 1099 with IRIS in 2024. Forms 1099. Form 1099-A, Acquisition or Abandonment of Secured Property; Form 1099-B, Proceeds from Broker and Barter Exchange Transactions; Form 1099-C, Cancellation of Debt; Form 1099-CAP, Changes in Corporate Control and Capital Structure;

1099 Form 2024 Fillable

BoomTax December 6 2023 at 11 00 AM 3 min read CORPUS CHRISTI TX ACCESSWIRE December 6 2023 The Internal Revenue Service IRS has announced several significant updates and changes for What is a 1099 misc personal finance for phds. Fillable form 1099 nec form resume examples o7y3lqkvbnFor the love of 1099s preparing for jd edwards year end.

Fillable Form 1099 Nec Form Resume Examples o7Y3LqkVBN

1099 MISC Forms The What When How Buildium

Form 1099 K Payment Card and Third Party Network Transactions If you re self employed and accept credit debit or prepaid cards or have payments processed by third parties like Venmo and PayPal you may receive Form 1099 K for payments processed by a third party This means that for tax year 2023 the taxes you file in 2024 the For tax year 2023 (the taxes you file in 2024) the existing 1099-K reporting threshold of the aggregate of more than $20,000 in payments and over 200 transactions will remain in effect. ... The easiest way to fill a 1099 form is electronically, and you can do so using the IRS Filing a Return Electronically (FIRE) system. Before doing so, you ...

The IRS has taken steps to reduce the tax gap and one way is by reducing the threshold at which businesses and individuals must file Form 1099 K to report payments Tax Form 1099 K was created in 2011 to report receipts of funds from credit card companies to businesses and individuals with payments received greater than 20 000 or more than Navigate the complexities of the 1099-MISC Tax Form in 2024 with our comprehensive guide. Discover filing tips, reporting, and key deadlines. Skip to content. phone_in_talk+1-316-869-0948. [email protected]. loginLog in. how_to_regSIGNUP. Home; 1099 Forms Menu Toggle. 1099 Nec; 1099 Misc; 1099 A; 1099 R; 1099 Div; 1099 K;