1099 Nec Form 2024

Form 1099 NEC box 2 Payers may use either box 2 on Form 1099 NEC or box 7 on Form 1099 MISC to report any sales totaling 5 000 or more of consumer products for resale on a buy sell a deposit commission or any other basis For further information see the instructions later for box 2 Form 1099 NEC or box 7 Form 1099 MISC Other Items You May Find Useful. All Form 1099-NEC Revisions. Other Current Products. Page Last Reviewed or Updated: 27-Mar-2023. Information about Form 1099-NEC, Nonemployee Compensation, including recent updates, related forms, and instructions on how to file.

There s no change to the taxability of income All income including from part time work side jobs or the sale of goods is still taxable Taxpayers must report all income on their tax return unless it s excluded by law whether they receive a Form 1099 K a Form 1099 NEC Form 1099 MISC or any other information return You may have to file Form 1099-NEC, Nonemployee Compensation, to report payments you make to independent contractors. ... 2024, the final regulations: reduce the 250-return threshold enacted in prior regulations to generally require electronic filing by filers of 10 or more returns in a calendar year.

1099 Nec Form 2024

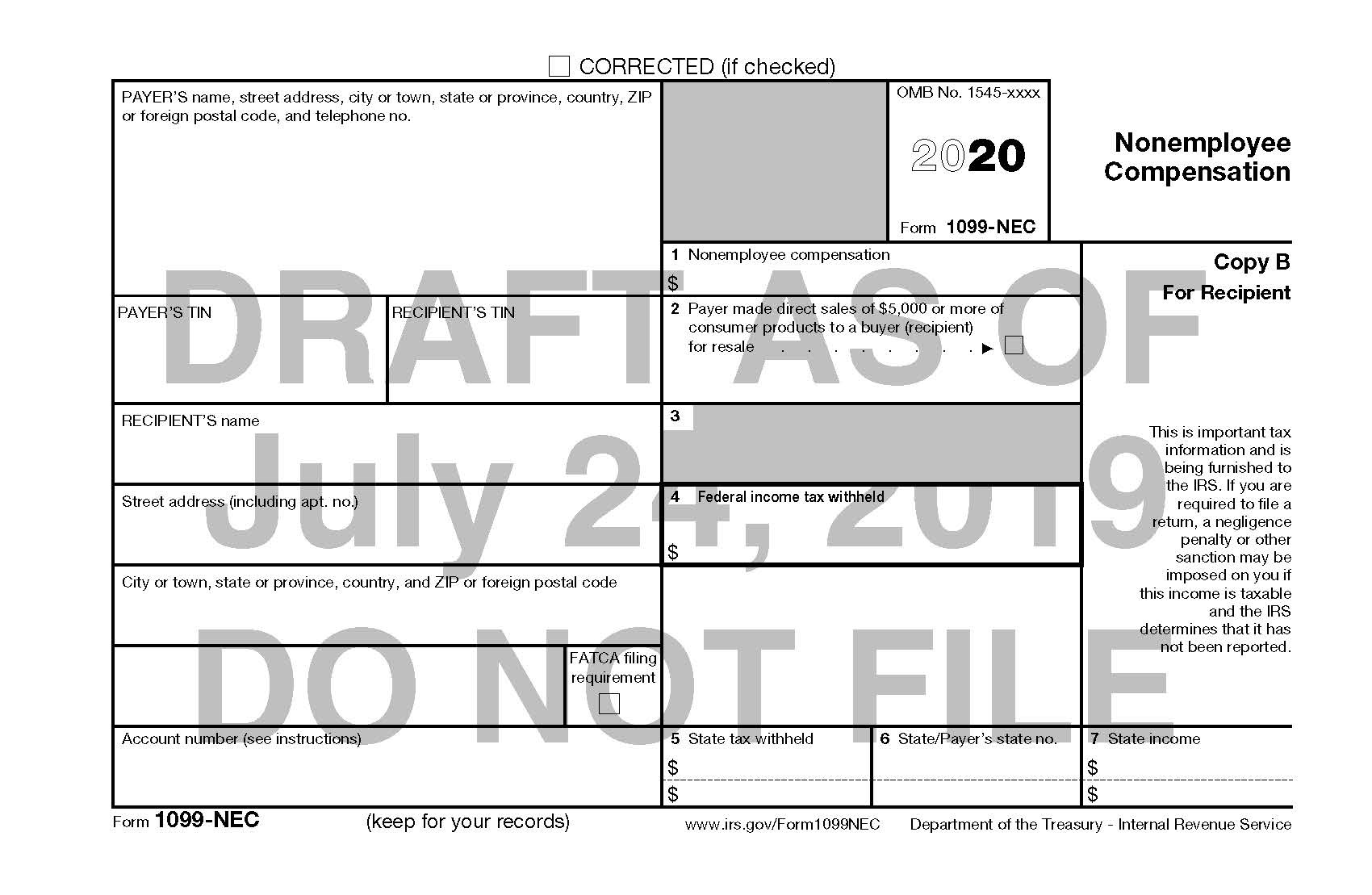

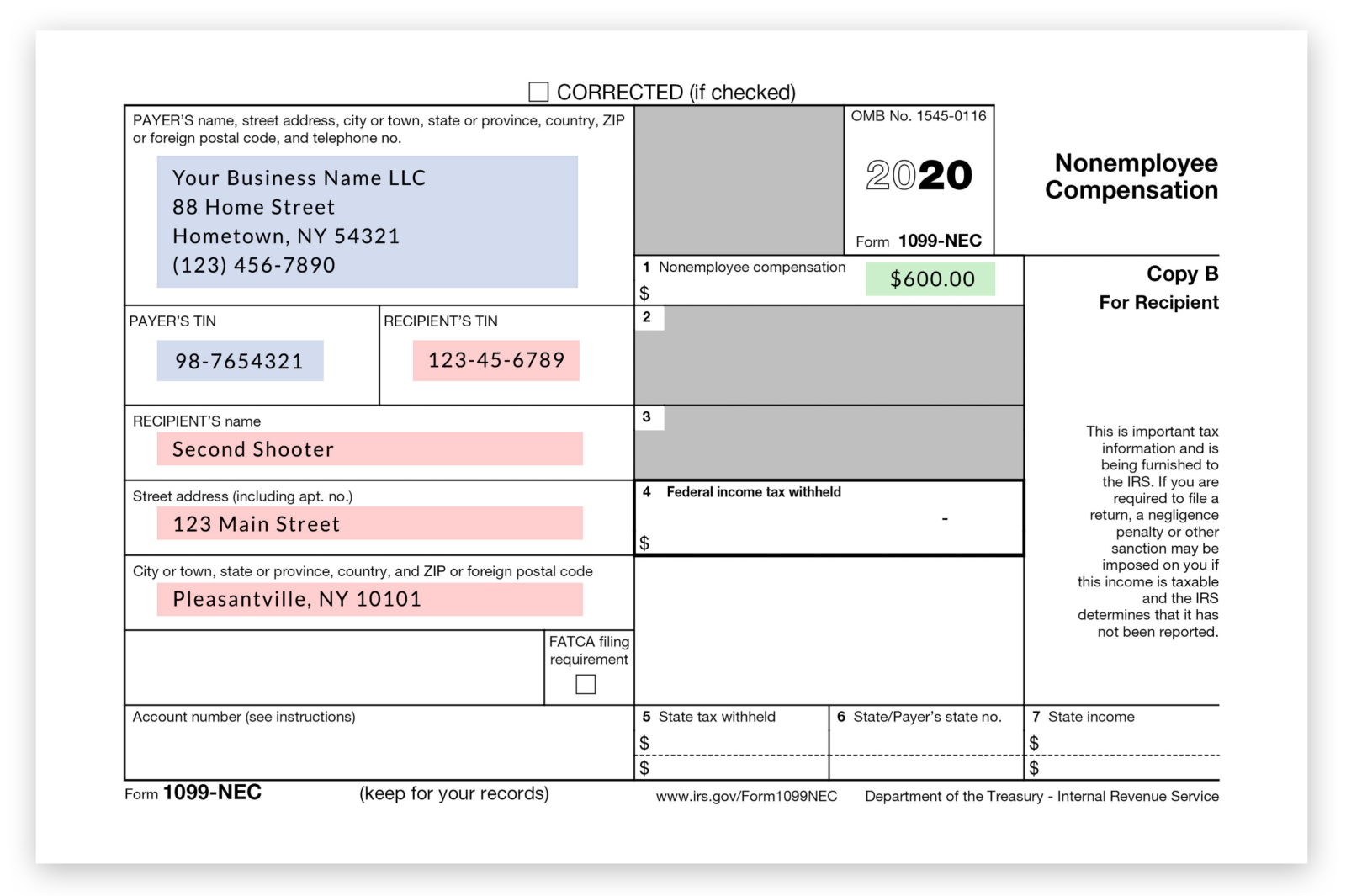

IRS 1099 NEC Form 2021 2024 A 1099 NEC form non employee compensation is an IRS tax document that reports payments made by businesses or individuals to independent contractors or non employees during a calendar year The paying party must issue a 1099 NEC if payments during the year exceed 600 and the recipient must use the form to report What is form 1099 nec for nonemployee compensation. 2021 form 1099 nec explained youtubeForm 1099 nec requirements deadlines and penalties efile360.

The New 1099 NEC IRS Form For Second Shooters Independent Contractors formerly 1099 MISC

1099 NEC Or 1099 MISC What Has Changed And Why It Matters IssueWire

The IRS recently made new rules and procedures for filing Forms 1099 Roughly 30 states are in the IRS s Combined Federal State Filing Program Filing and reporting rules for Forms 1099 MISC Miscellanous Income and 1099 NEC Nonemployee Compensation are changing in the coming year and employers should be aware of the new requirements a You can start as soon as January 1, 2024, to prepare your 1099-NEC 2023. It is important to begin the process early to ensure you have enough time to gather all data and correct if there are errors before January 31, 2024. ... (IRS) issues Form 1099 NEC to report nonemployee compensation for independent contractors, freelancers, and self ...

STEP 5 Submit Copy A of 1099 NEC to the IRS Copy A of each Form 1099 NEC should be submitted to the IRS through mail or electronically by January 31 2024 PRO TIP NEVER submit downloaded 1099 NEC forms from the internet because they cannot be processed by the IRS scanner The IRS has reintroduced Form 1099-NEC as the new way to report self-employment income instead of Form 1099-MISC as traditionally had been used. This was done to help clarify the various filing deadlines for Form 1099-MISC versus the 1099-NEC filing deadline. ... After 11/15/2024, TurboTax Live Full Service customers will be able to amend their ...