2024 Irs 1040 Form Printable

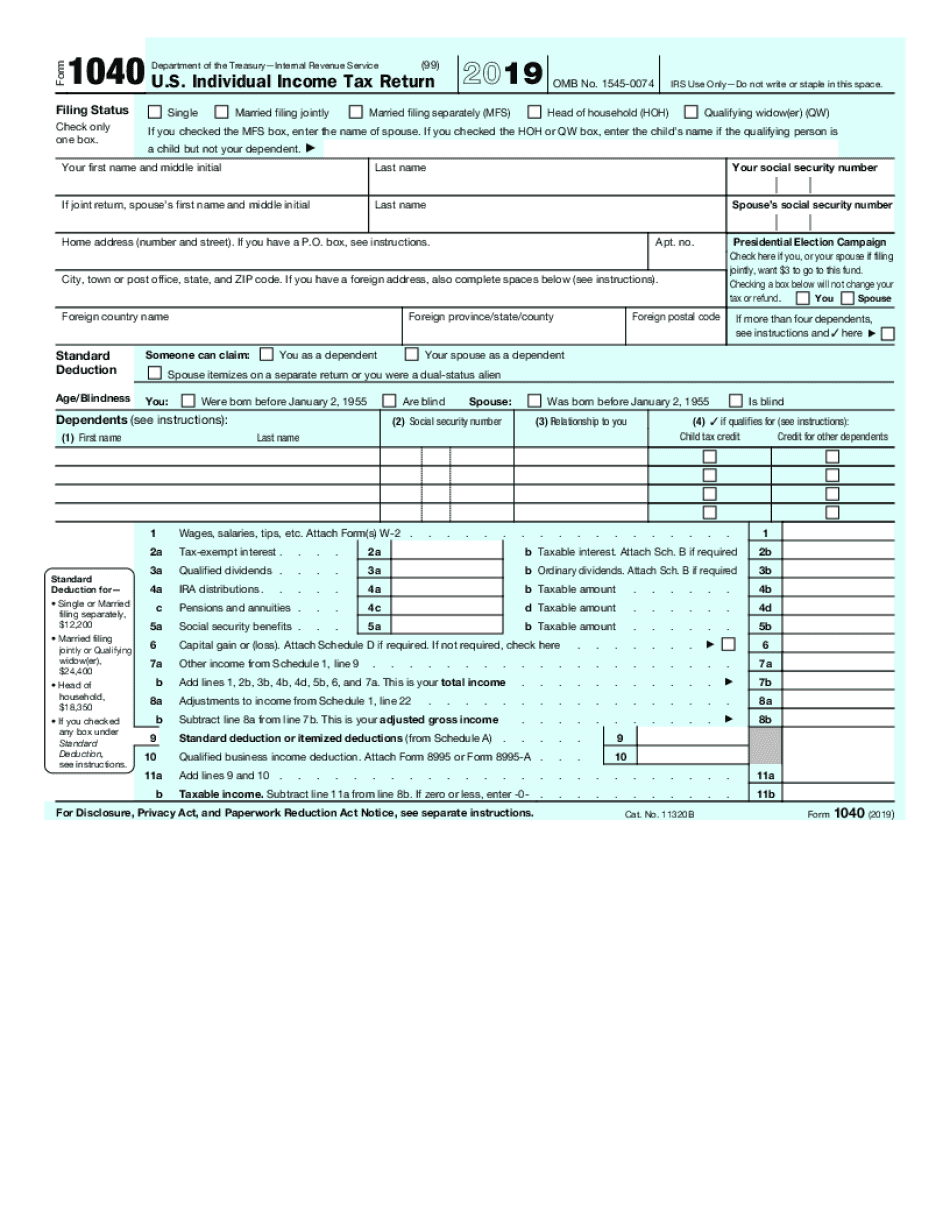

Form 1040 PDF Instructions for Form 1040 and Form 1040 SR Print version PDF eBook epub EPUB Below is a general guide to what Schedule s you will need to file See the instructions for Form 1040 for more information on the numbered schedules · If your income is below the threshold, Free File software allows you to use trusted brand-name software to prepare and e-file your federal tax return for free. You can use this option for 2023 tax returns if your income is below $79,000. Learn more about Free File on the IRS.gov website.

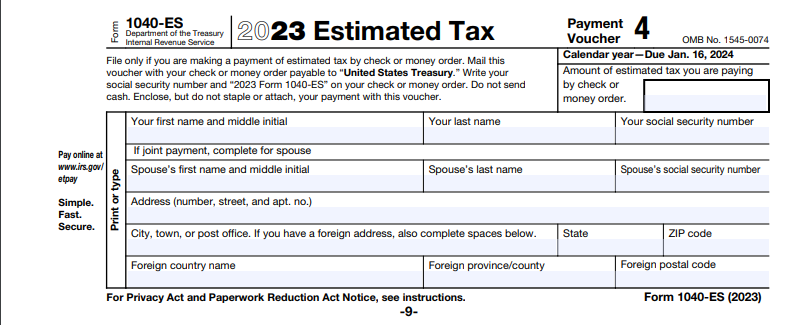

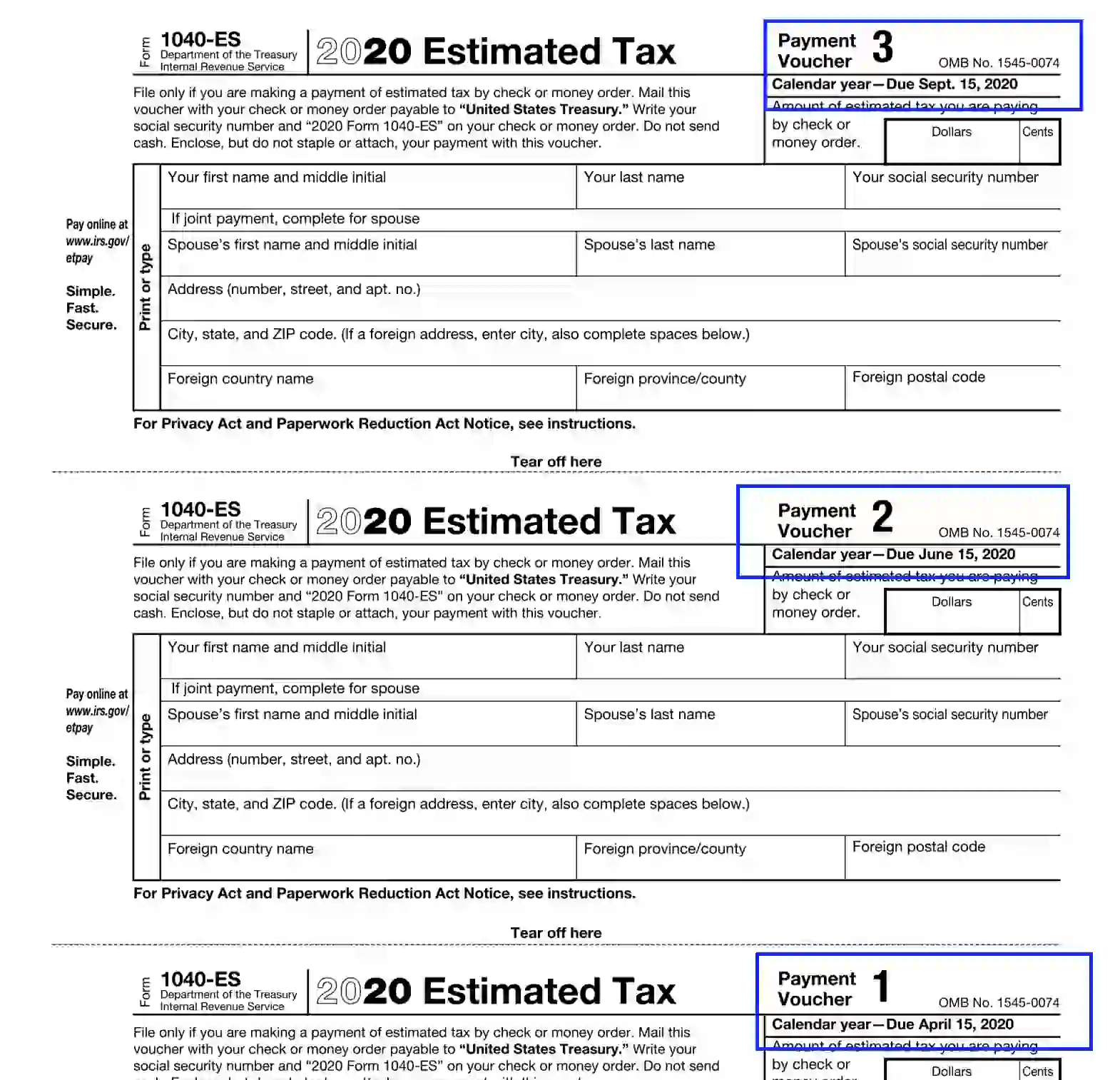

2024 Form 1040 ES Estimated Tax for Individuals Department of the Treasury Internal Revenue Service Purpose of This Package Use Form 1040 ES to figure and pay your estimated tax for 2024 Form 1040; Individual Tax Return Form 1040 Instructions; Instructions for Form 1040 Form W-9; Request for Taxpayer Identification Number (TIN) and Certification Form 4506-T; Request for Transcript of Tax Return

2024 Irs 1040 Form Printable

Form 1040 U S Individual Income Tax Return 2023 Department of the Treasury Internal Revenue Service OMB No 1545 0074 IRS Use Only Do not write or staple in this space For the year Jan 1 Dec 31 2023 or other tax year beginning 2023 ending 20 See separate instructions Your first name and middle initial Last name Irs tax return 2023 form printable forms free online. 2021 child support forms fillable printable pdf forms handypdf gambaranFederal tax return 1040ez table brokeasshome.

Federal Estimated Tax Payment Form 2023 Printable Forms Free Online

2023 Es 1040 Form Printable Forms Free Online

Here s how to get a Form 1040 Schedule A Schedule D or other popular IRS forms and tax publications for 2024 plus learn what the most common IRS forms are for The IRS has released a new tax filing form for people 65 and older. It is an easier-to-read version of the 1040 form. It has bigger print, less shading, and features like a standard deduction chart. The form is optional and uses the same schedules, instructions, and attachments as the regular 1040.

The IRS Form 1040 is the standard federal tax income form used to report your income and tax deductions calculate your taxes and your refund or balance due for the year There are two different types Form 1040 and Form 1040 SR Form 1040 SR is specifically designed for people 65 and over Department of the Treasury—Internal Revenue Service. Amended U.S. Individual Income Tax Return. OMB No. 1545-0074. (Rev. February 2024) Go to www.irs.gov/Form1040X for instructions and the latest information. This return is for calendar year (enter year) or fiscal year (enter month and year ended) Amended return filing status.