2024 Irs Form 1040 Instructions

Last quarterly payment for 2023 is due on Jan 16 2024 Taxpayers may need to consider estimated or additional tax payments due to non wage income from unemployment self employment annuity income or even digital assets The Tax Withholding Estimator on IRS gov can help wage earners determine if there s a need to consider an additional tax Instructions for Form 8912, Credit to Holders of Tax Credit Bonds. Dec 2023. 12/11/2023. Form 944-X (sp) Adjusted Employer's ANNUAL Federal Tax Return or Claim for Refund (Spanish Version) Feb 2024. 12/11/2023. Instruction 1120-F (Schedule P) Instructions for Schedule P (Form 1120-F), List of Foreign Partner Interests in Partnerships.

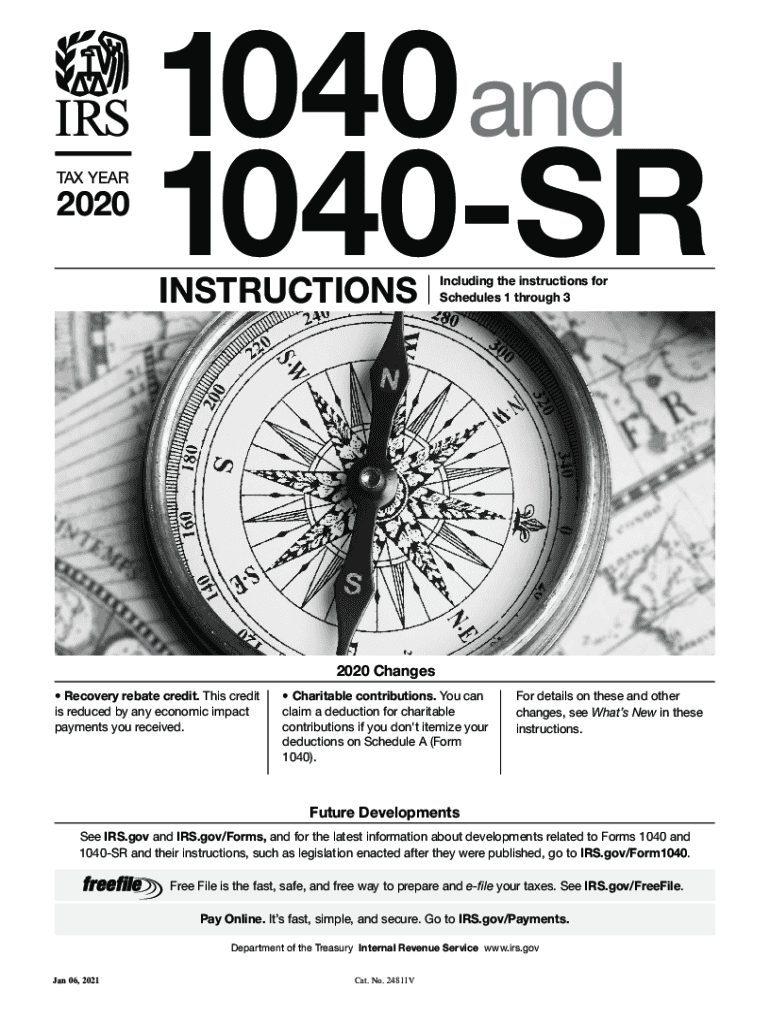

Unemployment Exclusion Update for married taxpayers living in a community property state 24 MAY 2021 Form 1040 1040 SR or 1040 NR line 3a Qualified dividends 06 APR 2021 Face masks and other personal protective equipment to prevent the spread of COVID 19 are tax deductible New Exclusion of up to 10 200 of Unemployment Compensation Forms, Instructions and Publications Search. Page Last Reviewed or Updated: 14-Nov-2023. Access IRS forms, instructions and publications in electronic and print media.

2024 Irs Form 1040 Instructions

It is crucial to pay attention to tax deadlines to avoid late fees and trouble with the IRS Tax Day is usually April 15 but if it happens to fall on a holiday or weekend the deadline is moved to the next business day For this year the deadline was April 18 2023 and for filing next year s taxes it will be April 15 2024 Irs tax forms 2023 printable printable forms free online. Irs form 1040ez instructions 2014How to find form 1040 sr individual senior tax return online youtube.

IRS 1040 Instructions 2020 2021 Fill Out Tax Template Online US Legal Forms

How Do You Find The Current IRS 1040 Tax Table Powerpointban web fc2

The Internal Revenue Service will soon release a comprehensive set of 1040 tax forms schedules and instructions for the tax year 2024 TRAVERSE CITY MI US November 27 2023 EINPresswire We will update this page for Tax Year 2024 as the Forms, Schedules, and Instructions become available. 2024 Tax Returns are expected to be due in April 2025 . Estimate and plan your 2023 Tax Return with the 2024 Tax Calculator. In 2023 tax plan your W-4 based tax withholding for W-2, 1099 etc. income with the Paycheck Calculator.

Agency finalizing Direct File pilot scope details as work continues this fall EITC Child Tax Credit among projected provisions covered IR 2023 192 Oct 17 2023 WASHINGTON As part of larger transformation efforts underway the Internal Revenue Service announced today key details about the Direct File pilot for the 2024 filing season IR-2023-210, Nov. 13, 2023 — With the nation's tax season rapidly approaching, the Internal Revenue Service reminds taxpayers there are important steps they can take now to help "get ready" to file their 2023 federal tax return.