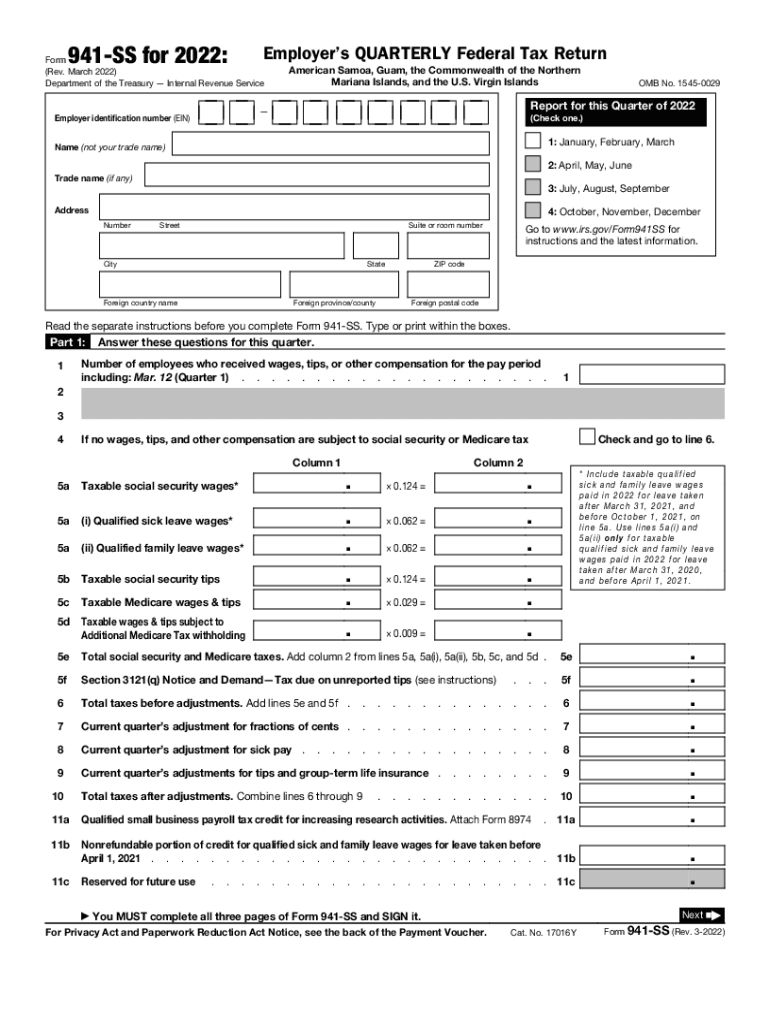

941 Form 2023

Don t use Form 941 to report backup withholding or income tax withholding on nonpayroll payments such as pensions annuities and gambling winnings Report Who should file Form 941 2022? This document is used by employers to report income taxes, social security tax, and Medicare tax withheld from employees' wages.

The Form 941 for 2023 contains no major changes The IRS expects that this version of the form rev March 2023 will be used for all four Employers use Tax Form 941 to report federal income tax withheld, social security tax, and Medicare tax (FICA taxes) from each employee's salary.This form is ...

941 Form 2023

Form 941 reports social security income and Medicare tax withholding to the IRS To file you or your tax accountant will need to gather the 941 form 2023 schedule b fill online printable fillable blank. 2019 941 form fill out and sign printable pdf template signnowHow to fill out form 941 2023 form 941 instructions.

Form 941 For 2023 Pdf Printable Forms Free Online

2023 Form 941 Pdf Printable Forms Free Online

Form 941 must be filed by the last day of the month following the end of the quarter Employers can file the form electronically or by mail Beginning in 2023, the credit will first reduce the employer's share of social security up to $250,000 per quarter, and any remaining credit ...

The April 2023 draft Form 941 X does not contain significant changes from the current version in effect The draft form contains a cover page Form 941 is the link between your payroll records and the IRS tax records. Proper administration of this vital form is critical if you want to avoid IRS Notices ...