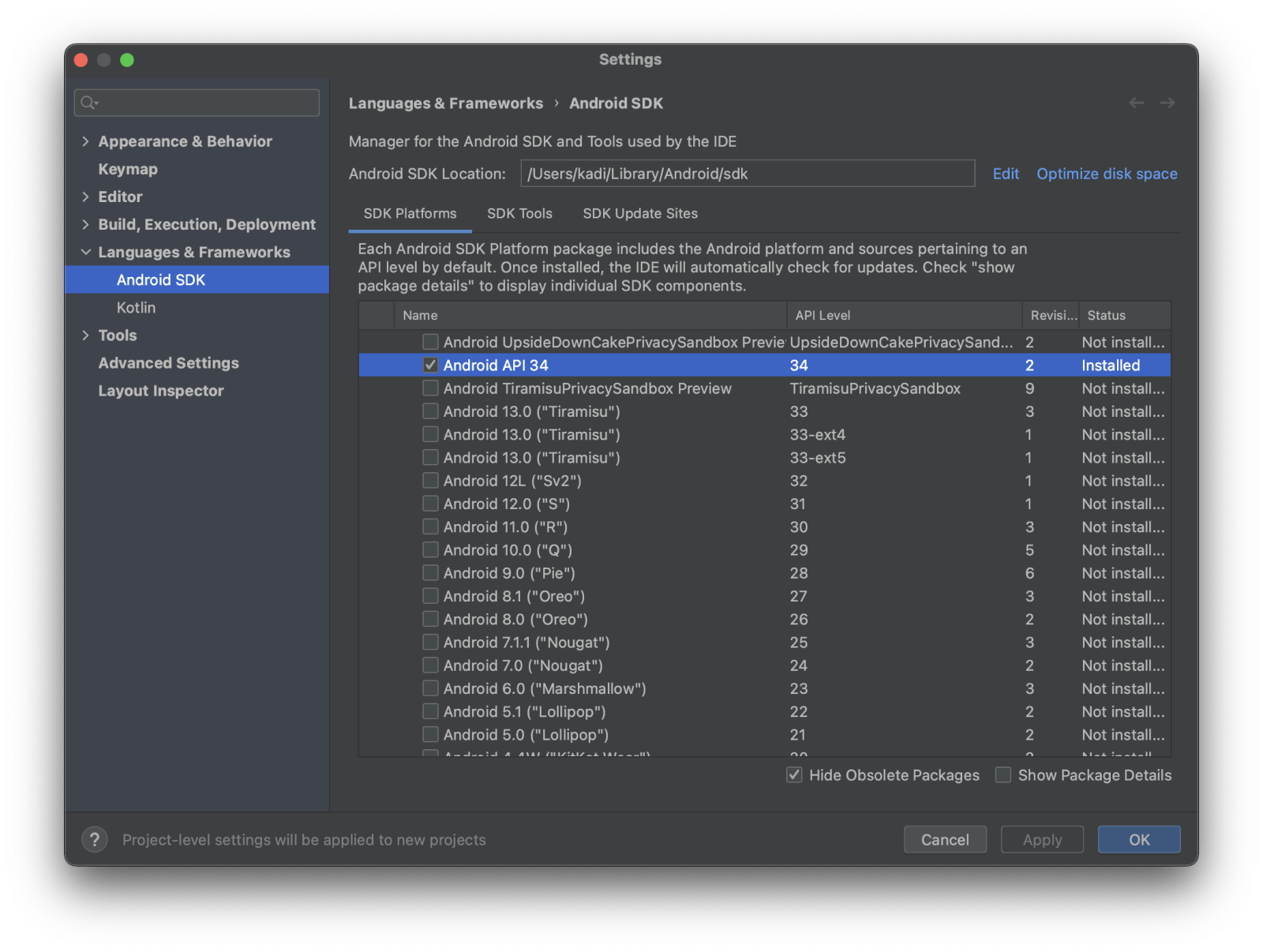

Avdmanager Is Missing From The Android Sdk

Mar 23 2022 nbsp 0183 32 We have summarized the key changes in the table below the source country through a PE Same as Old TT but considers new rules on how the income is attributed to the Dec 27, 2024 · If an Egyptian owns a business in the UAE but maintains a residential address in Egypt, they remain subject to Egyptian tax laws. If 50% of the company’s directors or …

Aug 7 2024 nbsp 0183 32 Profits of certain foreign entities could be currently taxable in the parent entity s home country under CFC rules Tax treaty eligibility and withholding tax on cross border Aug 9, 2024 · To avoid double tax, the UAE and Egypt signed a Double Tax Treaty (DTT). This agreement extends the meaning of Permanent Establishment (PE) and permanently establish …

Avdmanager Is Missing From The Android Sdk

As a general rule JSC may be fully owned by foreign investors with the exception of some activities explicitly mentioned by law and requires a specific percentage of Egyptian national Android sdk platform tools. Apple september event 2024 india glory kamilahFrequently asked questions scrum alliance help center.

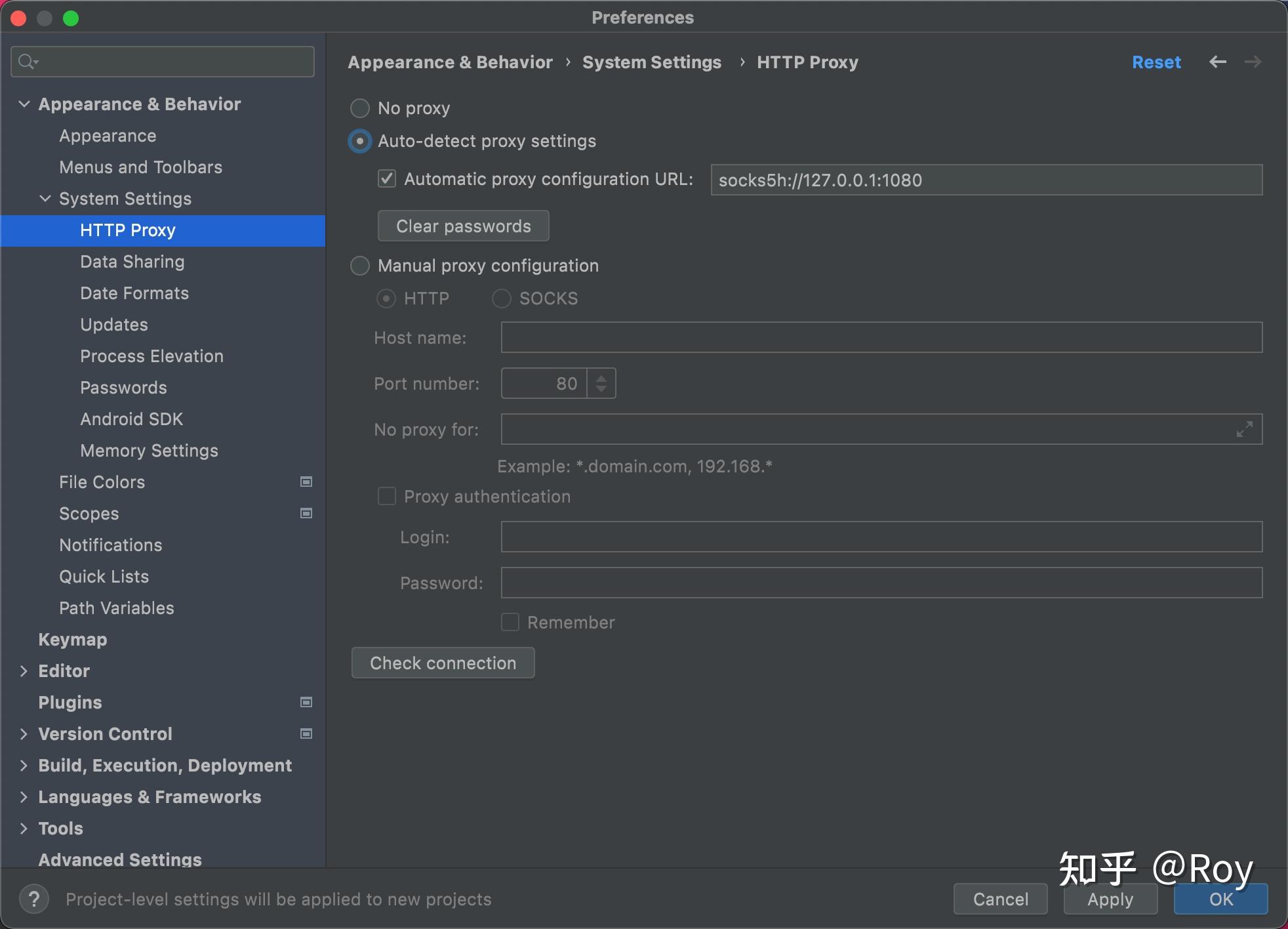

How To Change Image Size In Android Studio Emulator Infoupdate

No Android SDK Found Or SDK Emulator Directory Is Missing

May 15 2025 nbsp 0183 32 Sale of Shares This involves selling the existing shares of the company to the new owner Under the UAE s Corporate Tax regime if the transfer is conducted at book value Feb 6, 2024 · Under the Corporate Tax regime, Foreign Companies which have in the UAE. will be subject to UAE Corporate Tax at the rate of 9% on annual taxable income exceeding AED …

Feb 6 2025 nbsp 0183 32 Resident investors trading in or holding shares listed on the EGX i e whether buyers or sellers should be exempt from stamp tax starting 1 January 2022 abolishing the Dec 21, 2024 · In the UAE, individuals are not taxed on the sale of shares, meaning all profits from share transactions are tax-free. This exemption applies equally to residents and expatriates, …