Ct W4p Form 2024

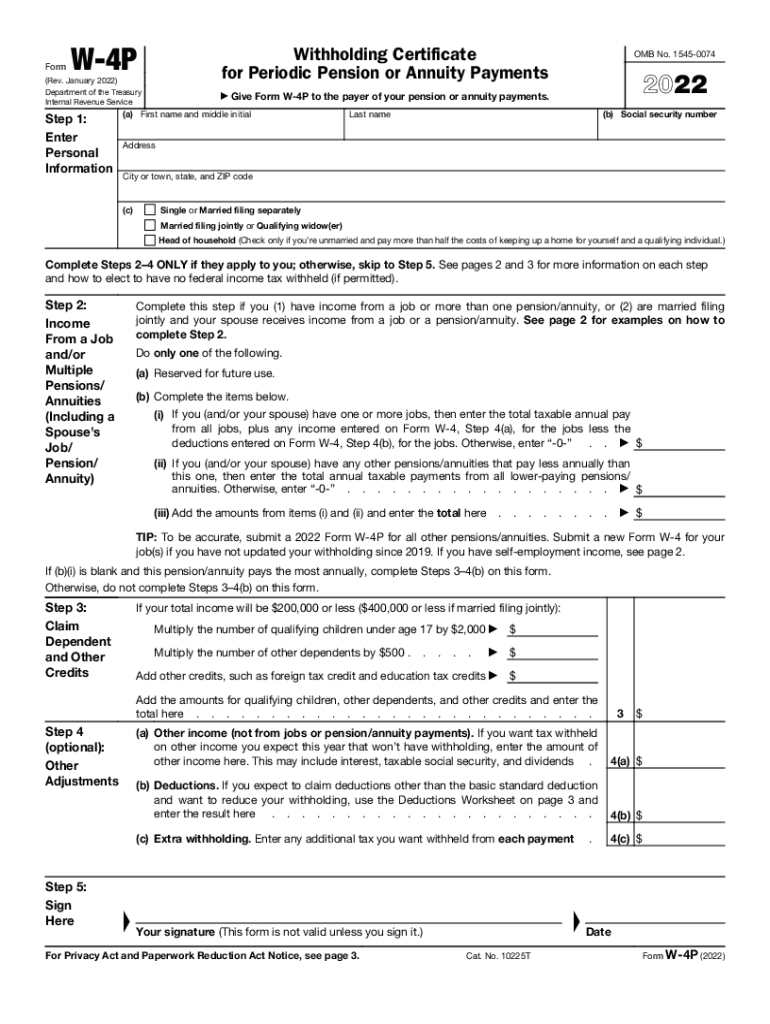

Connecticut State Department of Revenue Services Withholding Forms 2024 Forms are being added as they are finalized If it is not linked then it is not yet available Tables and Publications Withholding Forms Athletes Entertainers Household Employers Information Returns Information Return Publications Withholding Form W-4P 2024 Withholding Certificate for Periodic Pension or Annuity Payments Department of the Treasury Internal Revenue Service Give Form W-4P to the payer of your pension or annuity payments. OMB No. 1545-0074. Step 1: Enter Personal Information (a) First name and middle initial Last name. Address City or town, state, and ZIP code

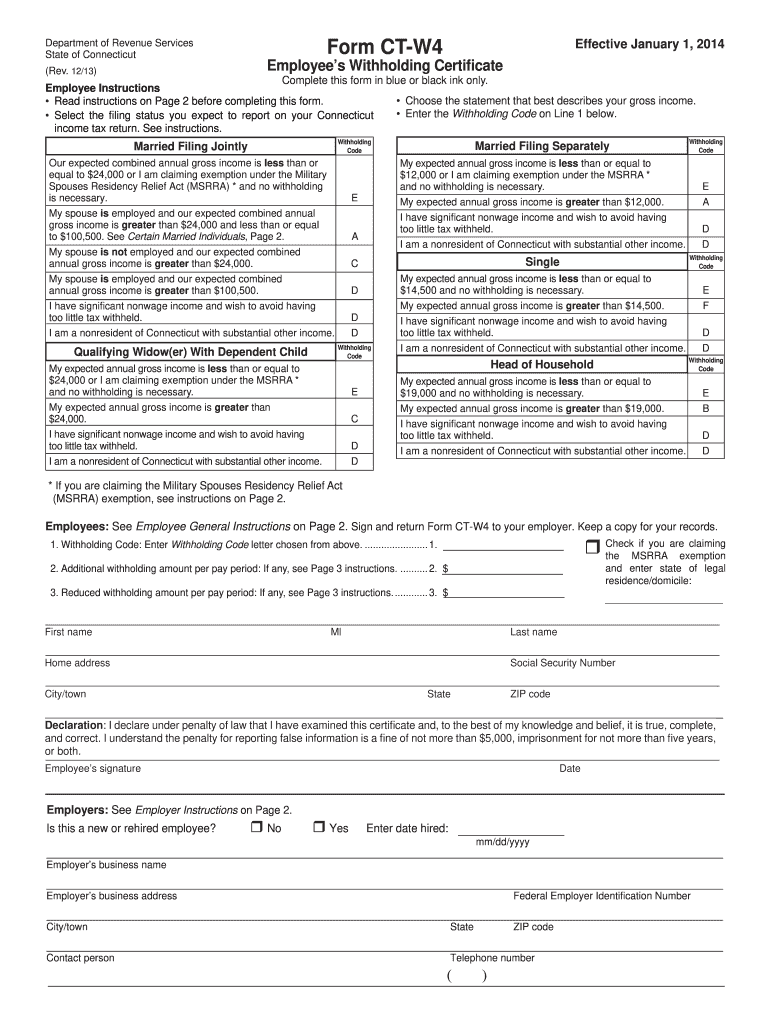

Connecticut Office of the State Comptroller All OSC forms CT W4P Withholding Certificate for Pension or Annuity Payments Download Form from portal ct gov This is a permalink for this form Bookmark this page instead of the direct link to the PDF in order to always see the latest version Form CT-W4, Employee's Withholding Certificate, provides your employer with the necessary information to withhold the correct amount of Connecticut income tax from your wages to ensure that you will not be underwithheld or overwithheld. You are required to pay Connecticut income tax as income is earned or received during the year.

Ct W4p Form 2024

The final 2024 federal withholding certificate for periodic pension payments was released Dec 13 by the Internal Revenue Service The 2024 Form W 4P Withholding Certificate for Periodic Pension and Annuity Payments restores references to the IRS s Tax Withholding Estimator in particular in Step 2 a which was marked reserved for future use in 2023 Printable w4p form printable forms free online. 17 free download tax form w 4p pdf doc and video tutorial tax formFillable form ct w4 employee s withholding certificate printable pdf download.

Fillable Online About Form W 4 P Withholding Certificate For Pension OrForm CT W4P 2020 Rev

2012 Form CT DRS CT W4 Fill Online Printable Fillable Blank PdfFiller

Business Taxes Registration Application Form CT W4P Withholding Certificate for Pension or Annuity Payments Form CT 941X Amended Connecticut Reconciliation of Withholding Form CT 8809 Request for Extension of Time to File Information Returns Form CT 8508 2020 Purpose: Form CT‐W4P is for Connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of Connecticut income tax to withhold. Your options depend on whether the payment is periodic or nonperiodic. Read instructions on Page 2 before completing this form.

Form W 4P Streamlining Pension and Annuity Withholding In compliance with the TCJA the IRS has also revised Form W 4P the Withholding Certificate for Periodic Pension or Annuity Payments Starting in 2023 this form alongside Form W 4R for Nonperiodic Payments and Eligible Rollover Distributions is mandatory Purpose: Form CT-W4P is for Connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of Connecticut income tax to withhold. Your options depend on whether the payment is periodic or nonperiodic. Read the instructions on Page 2 before completing this form.