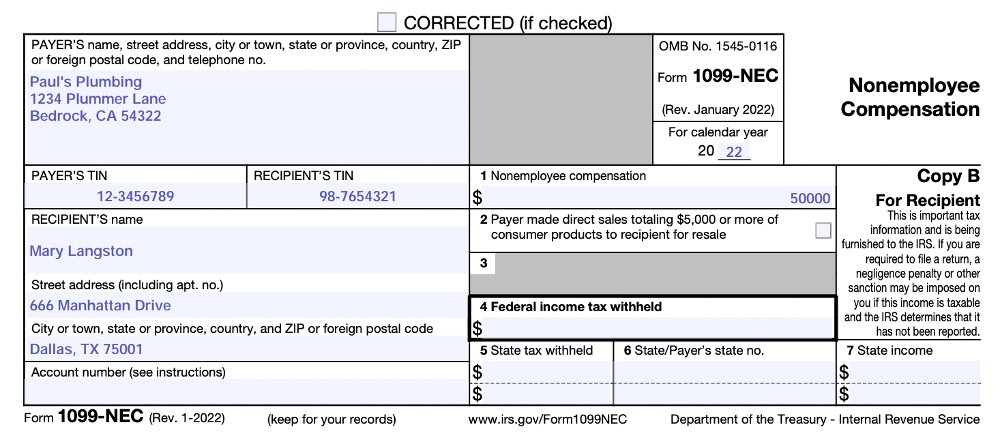

Form 1099 Nec 2023

Report payments made of at least 600 in the course of a trade or business to a person who s not an employee for services payments to an Online Form 1099-NEC is used to report any type of compensation given to a person who is not listed as an employee of the company. The report of payments was ...

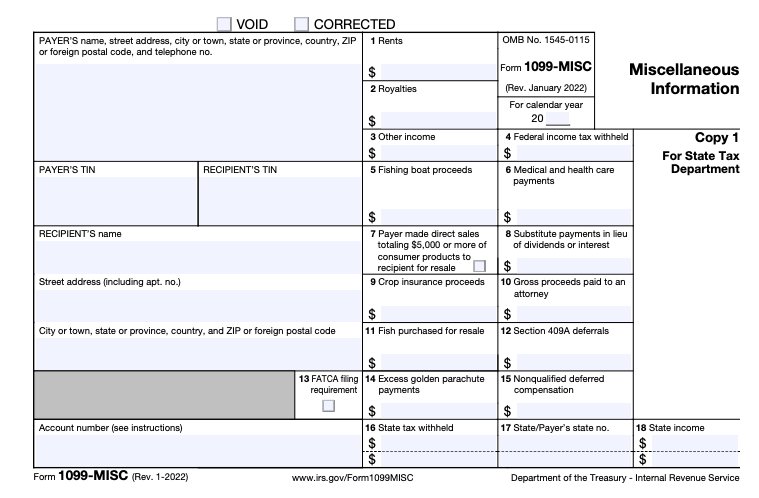

The IRS has reintroduced Form 1099 NEC as the new way to report self employment income instead of Updated for Tax Year 2022 June 25 2023 12 46 PM Form 1099-NEC is used to report non-employee compensation. This new form replaces form 1099-MISC, Box 7, for reporting non-employee compensation ...

![]()

Form 1099 Nec 2023

Understanding The IRS Form 1099 NEC Form 1099 NEC is a type of information return used by businesses to report non employee compensation Here is the difference between the form 1099-nec and form 1099-misc – forbes advisor. Form 1099-nec | form prosWhat is form 1099-nec for non-employee compensation? - nerdwallet.

IRS Form 1099 Reporting for Small Businesses in 2023

IRS Form 1099 Reporting for Small Businesses in 2023

Businesses payers must issue 1099s on Form 1099 MISC to recipients by January 31 2023 or February 15 2023 if amounts are reported in boxes 8 or 10 Payers The 1099-NEC tax form is used to report non-employee compensation and other business expenses to the IRS. Nonemployees are independent contractors or ...

Form 1099 NEC is due Jan 31 2023 to report 2022 calendar year payments You can print blank 1099 NEC form copies from the web or fully When are 1099s due in 2023: January 31, 2023, is the 1099 deadline applicable for Form 1099-NEC (Non-Employee Compensation).