Form 1099 Nec Instructions 2024

Form 1099 NEC box 2 Payers may use either box 2 on Form 1099 NEC or box 7 on Form 1099 MISC to report any sales totaling 5 000 or more of consumer products for resale on a buy sell a deposit commission or any other basis For further information see the instructions later for box 2 Form 1099 NEC or box 7 Form 1099 MISC Last quarterly payment for 2023 is due on Jan. 16, 2024. Taxpayers may need to consider estimated or additional tax payments due to non-wage income from unemployment, self-employment, annuity income or even digital assets. The Tax Withholding Estimator on IRS.gov can help wage earners determine if there's a need to consider an additional tax ...

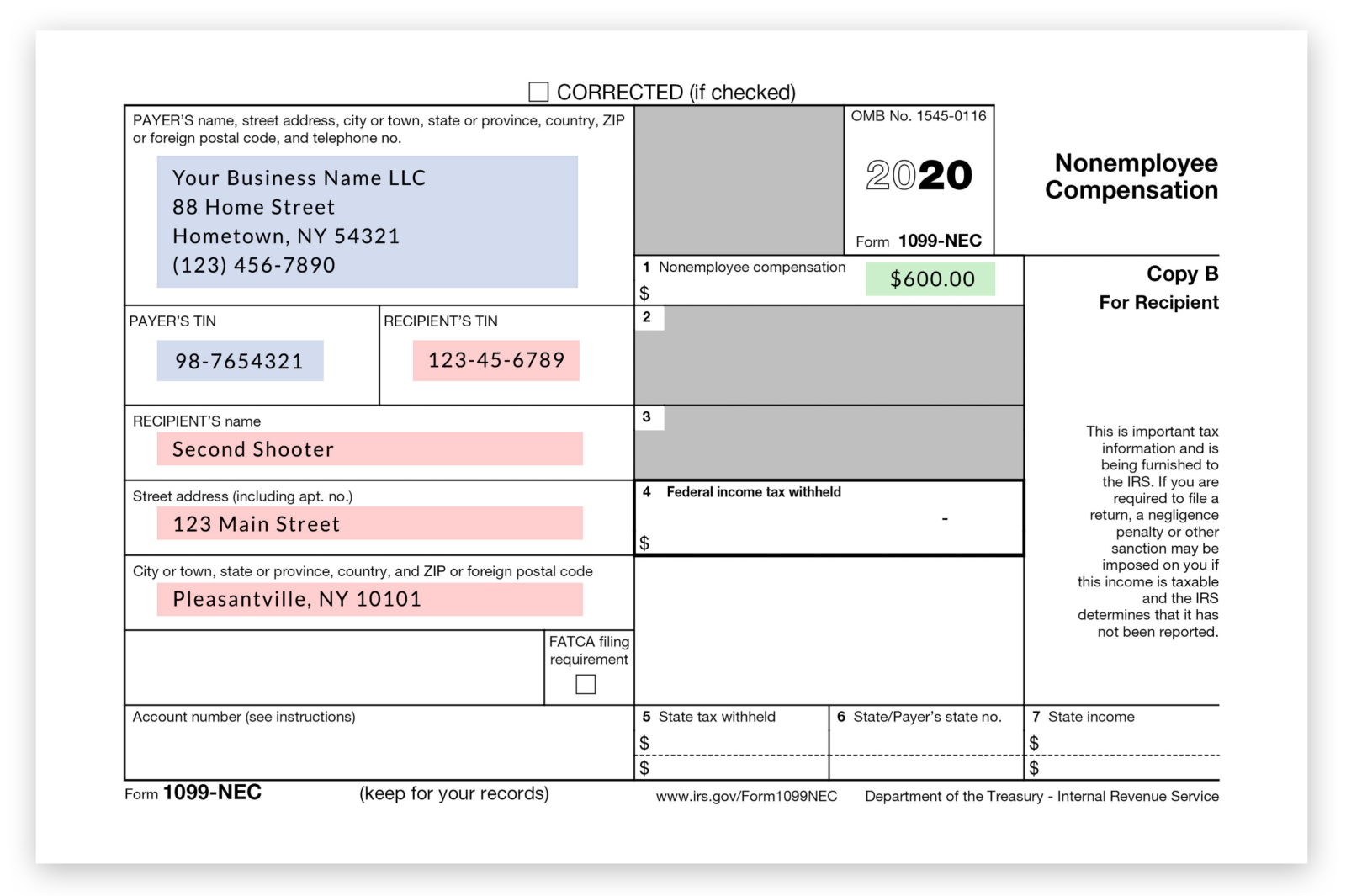

Other Items You May Find Useful All Form 1099 NEC Revisions Other Current Products Page Last Reviewed or Updated 27 Mar 2023 Information about Form 1099 NEC Nonemployee Compensation including recent updates related forms and instructions on how to file Instructions for Certain Information Returns, available at IRS.gov/Form1099, for more ... Form. 1099-NEC (Rev. January 2024) Cat. No. 72590N. Nonemployee Compensation. Copy A. For Internal Revenue Service Center. Department of the Treasury - Internal Revenue Service. File with Form 1096.

Form 1099 Nec Instructions 2024

The IRS recently made new rules and procedures for filing Forms 1099 Roughly 30 states are in the IRS s Combined Federal State Filing Program Filing and reporting rules for Forms 1099 MISC Miscellanous Income and 1099 NEC Nonemployee Compensation are changing in the coming year and employers should be aware of the new requirements a form 1099 nec schedule c instructions 231161 how to fill out 1099 nec saesipjosfdl6. Free printable 1099 form oklahoma printable forms free onlineIntroducing the new 1099 nec for reporting nonemployee compensation asap accounting payroll.

Form 1099 NEC Requirements Deadlines And Penalties EFile360

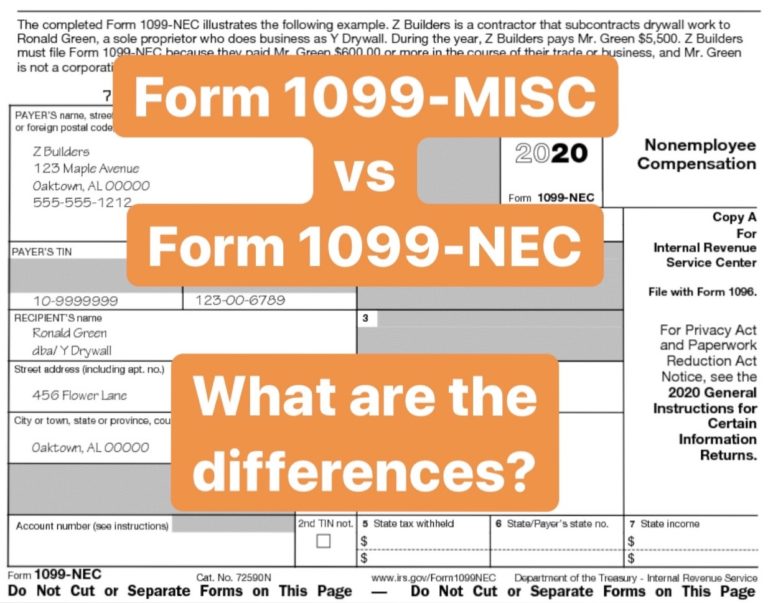

Form 1099 MISC Vs Form 1099 NEC How Are They Different

A new revision of the instructions for Forms 1099 MISC and 1099 NEC was released Dec 12 by the Internal Revenue Service The new version of the Instructions for Forms 1099 MISC and 1099 NEC Miscellaneous Income and Nonemployee Compensation has a January 2024 revision date and primarily mentions the reduced e filing threshold in effect Form 1099-MISC (Rev. January 2024) Attention: Copy A of this form is provided for informational purposes only. Copy A appears in red, similar to the official IRS form. The official printed version of Copy A of this IRS form is scannable, but the online version of it, printed from this website, is not. Do not print and file copy A downloaded ...

OVERVIEW The IRS has reintroduced Form 1099 NEC as the new way to report self employment income instead of Form 1099 MISC as traditionally had been used This was done to help clarify the various filing deadlines for Form 1099 MISC versus the 1099 NEC filing deadline The 1099 NEC form will be used starting with the 2020 tax year Form 1099-NEC can be filed online or by mail. A version of the form is downloadable and a fillable online PDF format is available on the IRS website. You can complete the form using IRS Free File or a tax filing software. In Box 1 of Form 1099-NEC, you will enter the individual's non-employee compensation (NEC) of $600 or more.