Free Fillable W2 Form 2024

Free File Fillable Forms are electronic federal tax forms you can fill out and file online for free enabling you to Choose the income tax form you need Enter your tax information online Electronically sign and file your return Print your return for recordkeeping Limitations with Free File Fillable Forms include And new in 2024, the IRS will pilot ... Access to free fillable forms is also available on the IRS website from mid-January to Oct. 20, 2023 [0] ... The Direct File pilot can support W-2 income ...

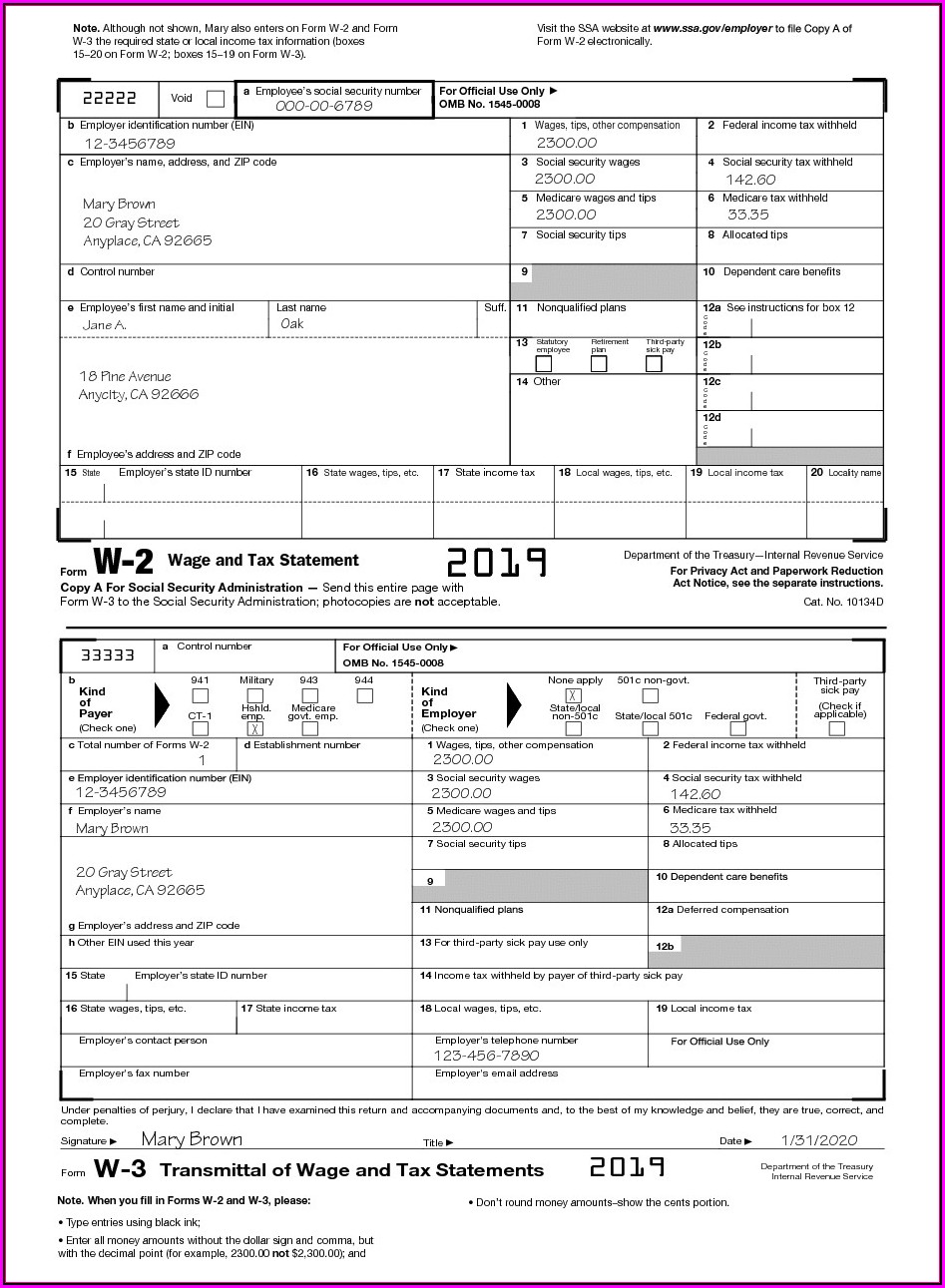

Instructions General Instructions for Forms W 2 and W 3 Introductory Material Future Developments What s New Forms W 2 including Forms W 2AS W 2GU and W 2VI redesigned Electronic filing of returns Disaster tax relief Penalties increased Reminders Due date for filing with SSA IRS Form W-2 | Wage and Tax Statement Updated November 06, 2023 A W-2 form, also known as a Wage and Tax Statement, is an IRS document used by an employer to report an employee's annual wages in a calendar year and the amount of taxes withheld from their paycheck.

Free Fillable W2 Form 2024

W 2s for the 2023 tax year should be issued to employees and filed with tax authorities by January 31 2024 There are two ways to send W 2 forms to tax authorities and employees electronically or by mail The IRS has implemented new regulations for employers filing and sending W 2s online in 2024 W2 form printable fill out sign online dochub. W2 income calculation worksheet 2022 printable word searches2022 w2 free fillable printable w 2 form fillable form 2023.

Fillable Form It 2023 Income Allocation And Apportionment Nonresident Rezfoods Resep Masakan

Free Fillable And Printable W2 PRINTABLE TEMPLATES

Form W 2 is filed by employers to report wages tips and other compensation paid to employees as well as FICA and withheld income taxes 2023 Form W-2 Attention: You may file Forms W-2 and W-3 electronically on the SSA's Employer W-2 Filing Instructions and Information page, which is also accessible at www.socialsecurity.gov/employer. You can create fill-in versions of Forms W-2 and W-3 for filing with SSA.

A draft of the 2024 General Instructions for Forms W 2 and W 3 was released Nov 22 by the Internal Revenue Service The draft instructions are the first to mention the lowered e filing threshold of 10 forms that takes effect for forms required to be filed in 2024 including 2023 Forms W 2 the IRS said The lowered filing threshold applies to Forms W 2AS W 2GU and W 2VI for American Samoa WASHINGTON — The Internal Revenue Service today urged taxpayers to take important actions now to help them file their 2023 federal income tax return next year. This is the second in a series of reminders to help taxpayers get ready for the upcoming filing season.