Looking for a fun and creative way to celebrate Father’s Day this year? Why not try out some happy Father’s Day coloring pages that are … Read more

Continue reading

A qualifying company will be permitted to irrevocably opt out of this treatment and base its taxable income on IFRS or current Irish GAAP by giving notice to its Inspector of Taxes Any surplus income earned by a Section 110 company is liable to tax at the higher 25% rate of corporation tax, however, with careful structuring such a vehicle should be tax neutral and be …

A person will be regarded as having significant influence if it has the ability to participate in the financial and operating decisions of the Section 110 company eg where the PPN holder is the The company is then structured to qualify under a taxation regime in Ireland known as “Section 110”. The Irish SPV is subject to ordinary Irish company law and is represented by a board of …

Happy Kids Care

Jan 1 2022 nbsp 0183 32 We consider the implications of Ireland s new Interest Limitation Rule in particular for Irish securitisation companies Section 110 Companies Finance Act 2021 was signed into May 8th happy birthday naomi by kiasimo on deviantart. Happy sylveon by hokousha on deviantartHappy ghast minecraft wiki.

![]()

Happy Easter By Tho be On DeviantArt

Happy New Year 2016 By Tsahel On DeviantArt

Interest paid in respect of securities of the company being the instrument issued in respect of the assets they hold are allowed as a deduction in computing profits and is not a distribution as Section 110 of the Tax Consolidation Act 1997 governs the tax treatment of such entities. Section 110 provides that the taxable profits of such qualifying companies are calculated on the same …

Jan 10 2023 nbsp 0183 32 The cornerstone of Ireland s securitisation framework is Section 110 of the Taxes Consolidation Act 1997 referred to as Section 110 It establishes a special tax regime for They were introduced in the Finance Act 2021 as part of Ireland’s implementation of the EU Anti-Tax Avoidance Directive. Below we have summarised some key observations on the Interest …

Looking for a fun and creative way to celebrate Father’s Day this year? Why not try out some happy Father’s Day coloring pages that are … Read more

Continue reading

If you’re looking for a fun and creative way to celebrate your dad’s birthday, why not try out some happy birthday papa coloring pages? These … Read more

Continue reading

Are you looking for a fun and creative way to celebrate a loved one’s birthday? Why not try out some free happy birthday coloring pages … Read more

Continue reading

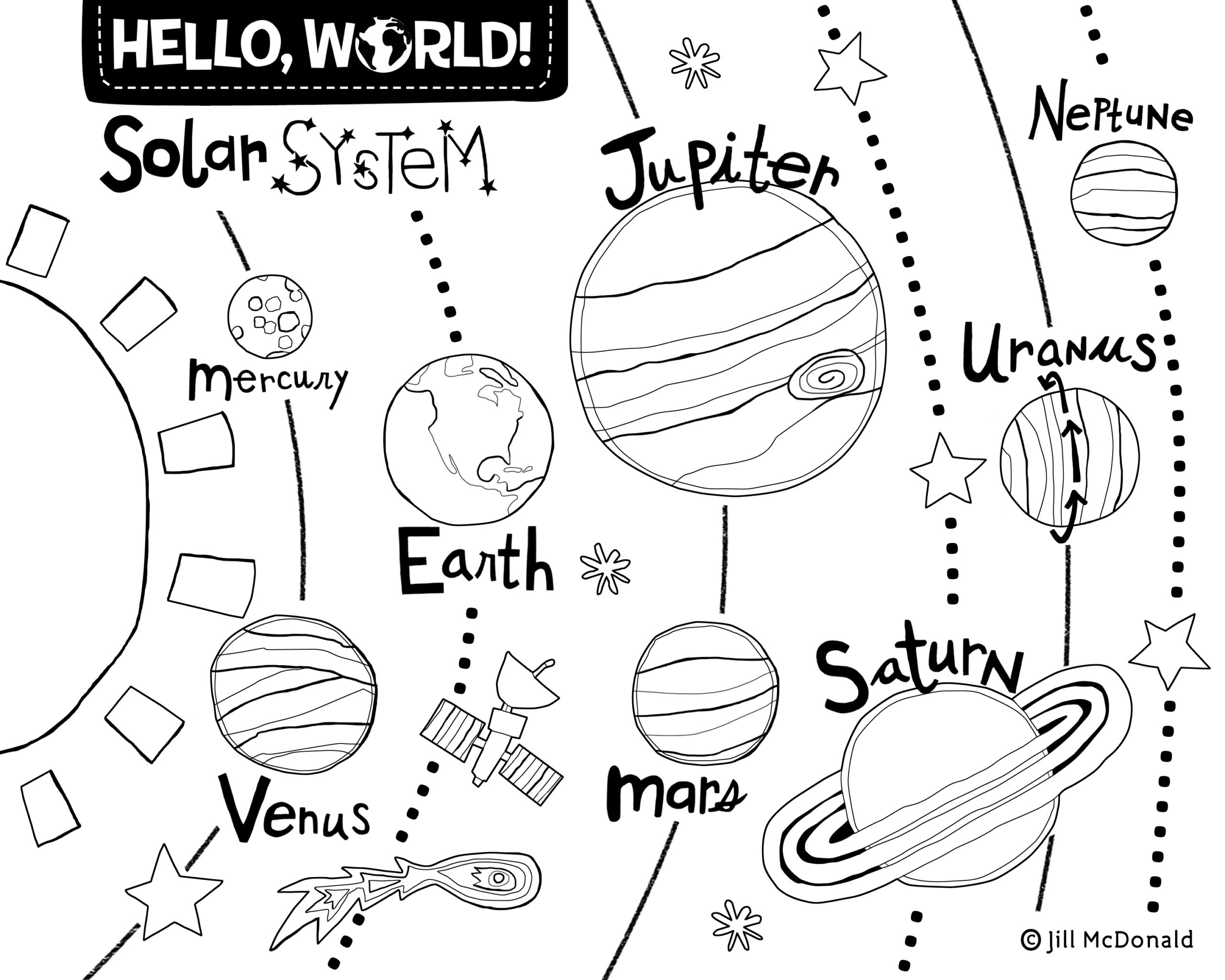

Looking for a fun and creative way to keep your kids entertained? Why not try out some planet printable coloring pages! Not only are they … Read more

Continue reading

Are you looking for a fun and creative activity to keep your kids entertained? Why not try out some pumpkin patch coloring pages printable? These … Read more

Continue reading

Are you looking for a fun and meaningful way to celebrate Grandparents Day? Why not try out some free printable coloring pages that are perfect … Read more

Continue reading

As the leaves start to change colors and fall from the trees, it’s the perfect time to get cozy indoors and enjoy some relaxing activities. … Read more

Continue reading

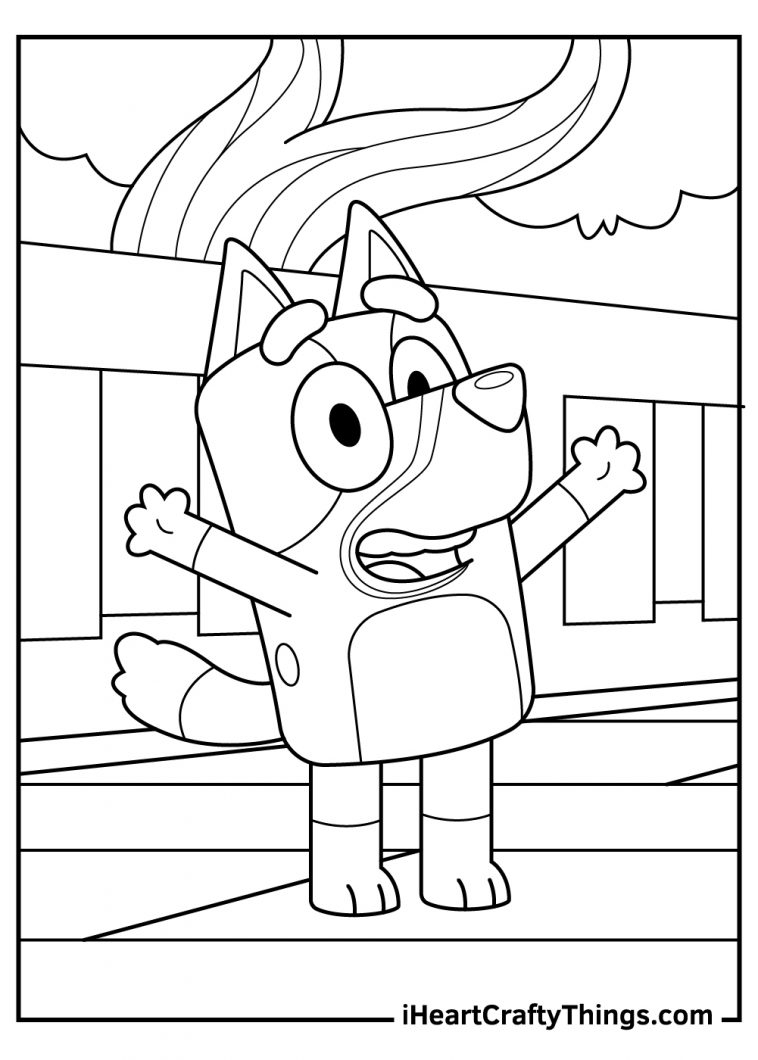

If you’re looking for some fun and creative activities for your kids, printable Bluey coloring pages are a great option. Bluey is a popular Australian … Read more

Continue reading

If you’re looking for some fun and free activities for your kids, look no further than free printable coloring pages! One popular choice among kids … Read more

Continue reading

Looking for a fun and creative activity for your kids? Why not try out some tooth coloring pages printable! These coloring pages are not only … Read more

Continue reading