How Long Do You Have To Keep Payroll Records

Mike Kappel Aug 15 2022 Your to do list as a business owner seems to get longer every day There s one more item you ll have to check off and this one is part of federal law You re required to retain payroll records sometimes for up to four years Don t worry This isn t an impossible task Encourage your employees to keep their own paystub records for at least 12 months or until they file their annual tax returns. They may also need to show documentation when buying a new house or refinancing. If you offer cloud-based HR software, they will be able to access these documents as needed. Length of Time.

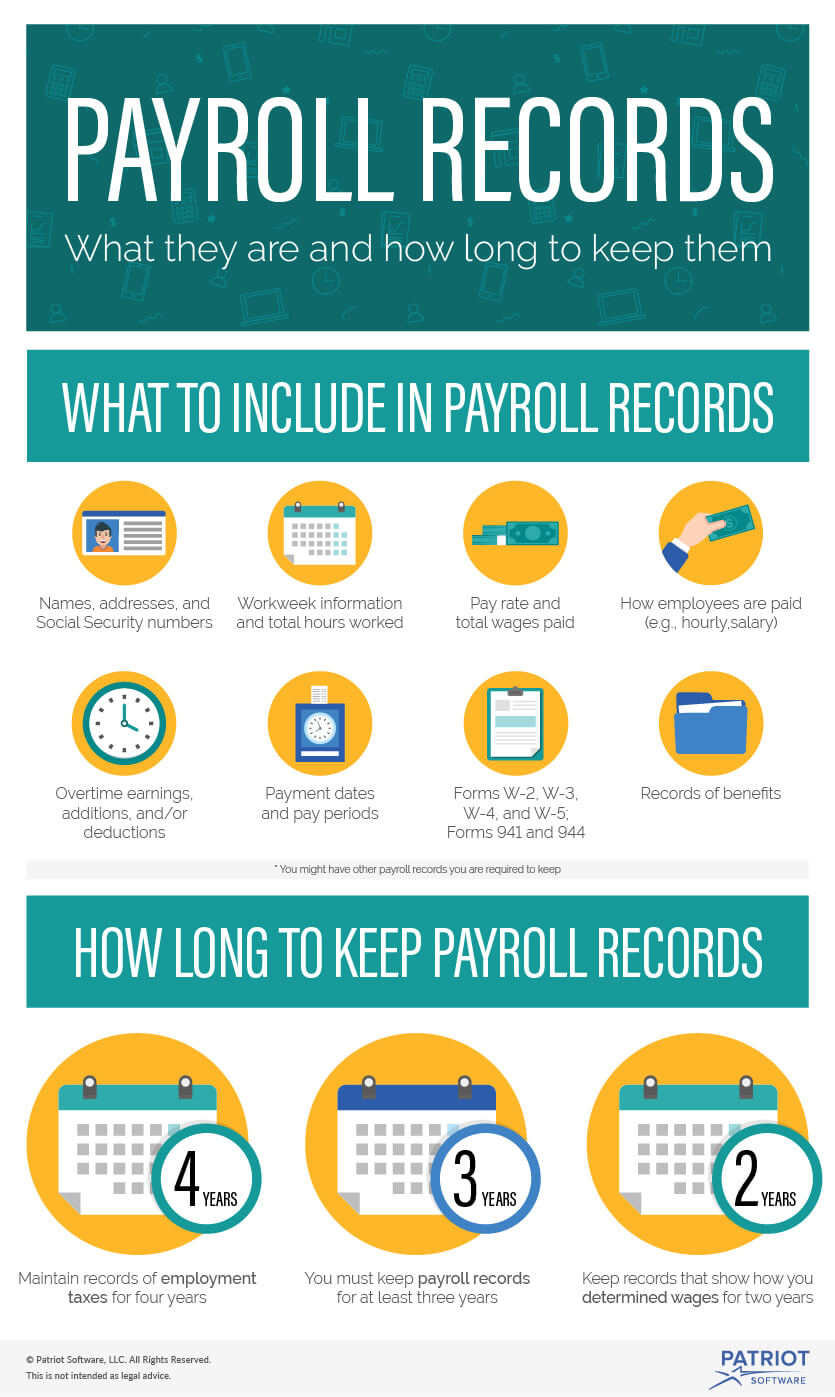

What are payroll records Payroll Payroll Records Payroll records are the combined documents pertaining to payroll that businesses must maintain for each individual that they employ This includes pay rates total compensation tax deductions hours worked benefit contributions and more What documents make up payroll records Keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax, whichever is later, if you file a claim for credit or refund after you file your return. Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction.

How Long Do You Have To Keep Payroll Records

The following chart includes federal requirements for record keeping and retention of employee files and other employment related records Individual states also have requirements not addressed 4 advantages of outsourcing payroll. How long should you keep payroll records eversignHow long do you have to keep payroll records bamboohr blog.

How Long Do You Have To Keep Payroll Records Hourly Inc

How Long To Keep Payroll Records Retention Requirements

The IRS says you must keep records related to employment taxes for at least four years after your last completed tax filing whether those filings are annual or quarterly You ll need records to be available should the IRS choose to conduct a review Here is what you need to keep records of Your employer identification number or EIN Total wages paid each pay period. Date of payment and the pay period covered by the payment. How Long Should Records Be Retained: Each employer shall preserve for at least three years payroll records, collective bargaining agreements, sales and purchase records.

Overview What are payroll records Payroll records document anything related to employee compensation from name and address to hours worked to payroll taxes and deductions Your Some states and laws require you to keep records for six years, however, so it's a good idea to consult with a financial advisor before disposing of payroll records. These records include employee data, like full names and addresses, as well as paycheck and payroll tax records.