How To Calculate Cagr

CAGR Formula Ending value Beginning value 1 No of years 1 100 The formula can also be expressed by adding one to the absolute return on investment ROI then raising the result to the power of reciprocity of the tenure of investment and then finally subtracting one CAGR 1 Absolute ROI 1 No of You can get it by using the Omni Calculator's CAGR tool or by the next steps: Imagine you have 1000 USD and want to double it to 2000 USD in 3 years. Then, you start dividing 2000 by 1000. You get 2. Calculate the cube root (because you have three periods). We obtain 1.26. Subtract one and multiply by 100%.

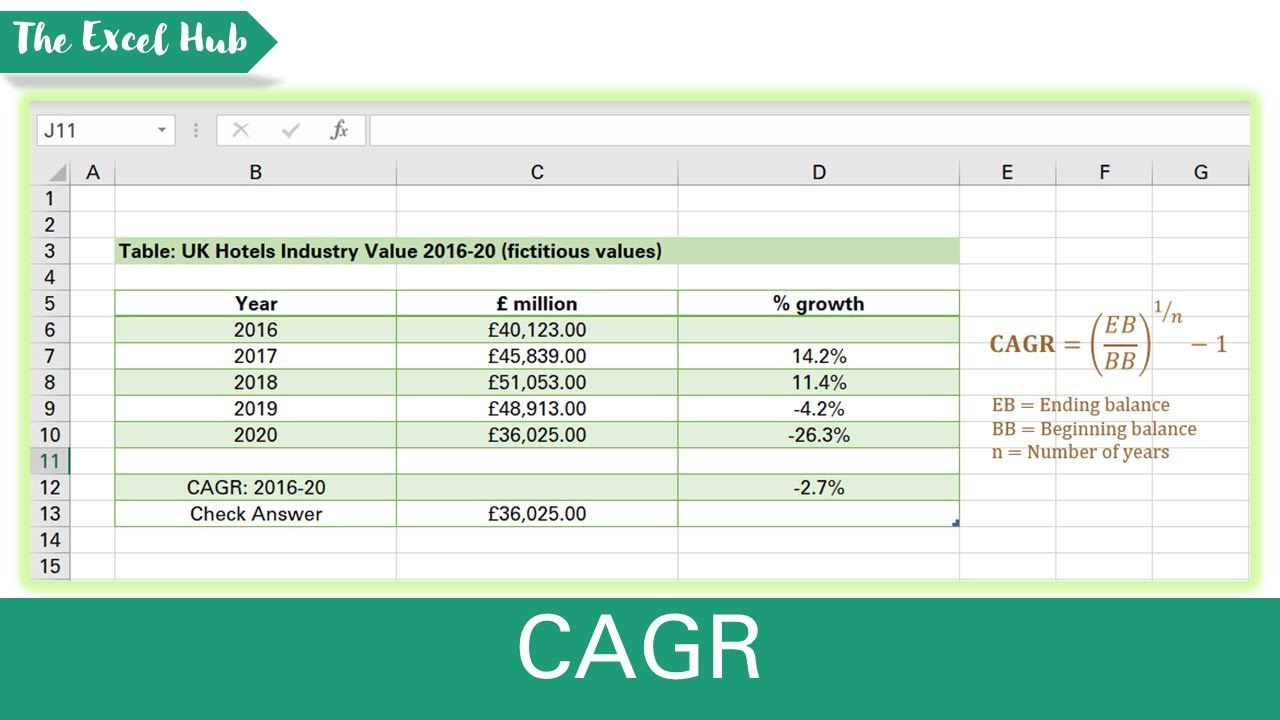

The CAGR formula is equal to Ending Value Beginning Value 1 No of Periods 1 CAGR Formula The Compound Annual Growth Rate formula requires only the ending value of the investment the beginning value and The formula is: \begin {aligned} &CAGR=\left (\frac {EB} {BB}\right)^ {\frac {1} {n}}-1\\ &\textbf {where:}\\ &EB = \text {Ending balance}\\ &BB = \text {Beginning balance}\\ &n = \text {Number.

How To Calculate Cagr

To calculate CAGR use the XIRR function Example Note When you compare the CAGRs of different investments make sure that each rate is calculated over the same investment period Cagr formula in excel examples how to use cagr formula . How to calculate cagr in excel 8 steps with pictures wikihowHow calculate cagr in excel accounting methods.

How To Calculate Cagr Using Rate Formula Haiper

How To Calculate Growth Cagr Haiper

How CAGR is calculated We can use the formula above to calculate the CAGR Assume an investment s starting value is 1 000 and it grows to 10 000 in 3 years The CAGR calculation is as follows CAGR 10000 1000 1 3 1 CAGR 1 1544 Hence CAGR percentage CAGR x 100 1 1544 x 100 115 44 Calculation of CAGR with Excel The step-by-step process to calculate CAGR is as follows. Divide the Ending Value (or Future Value) by the Beginning Value (or Present Value) Raise the Resulting Figure to the Inverse Number of Compounding Periods (1 ÷ t) Subtract by One to Convert the Implied CAGR into Percent Form; CAGR Formula

The typical CAGR formula is as follows Ending balance Starting balance 1 n 1 The n in the formula is the number of years you ve held the investment which is a good place to start if you opened your investment portfolio with 5 000 three years ago To calculate the CAGR, you take the nth root of the total return, where n is the number of years you held the investment—this calculation is the geometric mean. In this example, you take the.