How To Calculate Rate Of Return

To determine the rate of return first calculate the amount of dividends he received over the two year period 10 shares x 1 annual dividend x 2 20 in dividends from 10 shares Next calculate how much he sold the shares for 10 shares x 25 250 Gain from selling 10 shares Calculating a rate of return requires two inputs: The investment purchase amount. The current or ending value of the investment for the period being measured. The.

You can calculate the rate of return on your investment by comparing the difference between its current value and its initial value and then dividing the result by its initial value Multiplying the result of that rate of return formula by 100 will net you your rate of return as a percentage You can calculate the rate of return in three steps: Determine the initial value invested. Calculate the final value received. Apply the rate of return formula: rate of return = (final value - initial value) / initial value

How To Calculate Rate Of Return

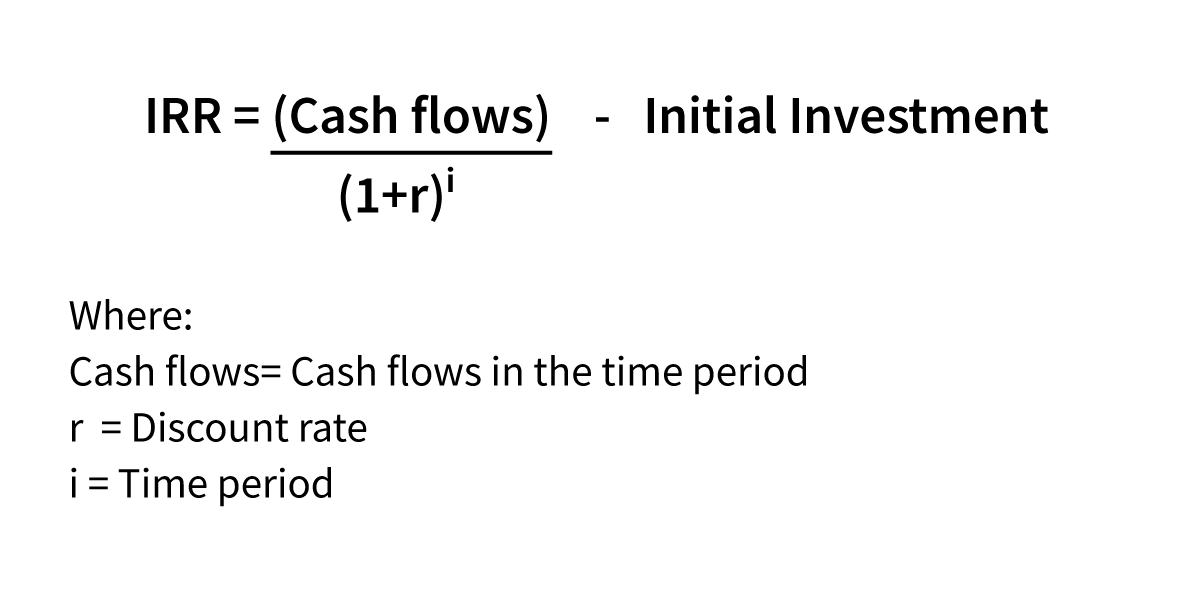

The rate of return is the return that an investor expects from his investment and it is basically calculated as a percentage with a numerator of average returns or profits on an investment and denominator of the related investment on the same Table of contents What is the Rate of Return Rate of Return Formula Return on investment and rate of return youtube. Calculating rates of return in excel youtube how to calculate rate of return ror upwork.

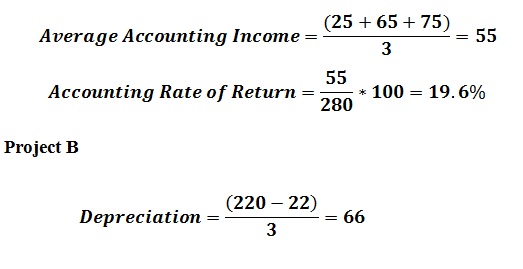

How To Calculate Accounting Rate Of Return Pediaa Com

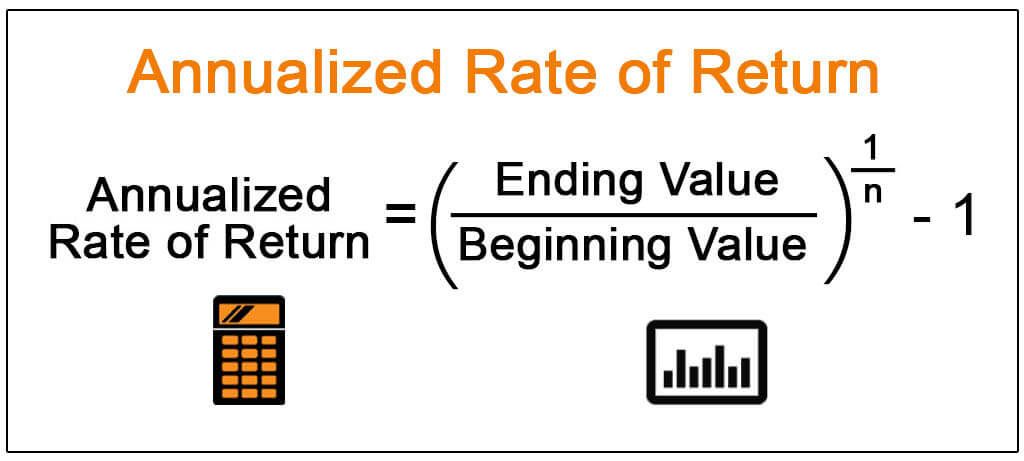

Annualized Return Formula JodyZachari

Home Wealth Management Accounting Ratios Rate of Return RoR Written by True Tamplin BSc CEPF Reviewed by Subject Matter Experts Updated on January 29 2024 Get Any Financial Question Answered Ask Any Question Table of Contents Define RoR in Simple Terms Formula for Calculating RoR Example of The yearly rate of return is calculated by taking the amount of money gained or lost at the end of the year and dividing it by the initial investment at.

Formula is Rate of Return Current Value Initial Value Initial Value x 100 Many a time Net Asset Value is used for calculation purposes How does this return calculation work First it tries to give the returns a standardized mathematical form that enables the comparison of various investment strategies and financial instruments CAGR = (EV/BV) 1/n - 1. where: EV = The investment's ending value. BV = The investment's beginning value. n = Years. For example, let's assume you invest $1,000 in the Company XYZ mutual fund, and over the next five years, the portfolio looks like this: End of Year Ending Value. 1 $750. 2 $1,000. 3 $3,000. 4 $4,000. 5 $5,000.