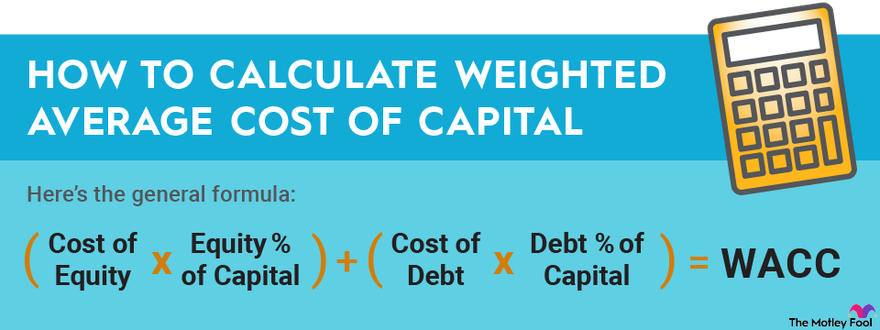

How To Calculate Weighted Average Cost

Weighted Average Cost WAC Method Formula The formula for the weighted average cost method is as follows Where Costs of goods available for sale is calculated as beginning inventory value purchases Units available for sale are the number of units a company can sell or the total number of units in inventory and is calculated as beginning When using the weighted average method, divide the cost of goods available for sale by the number of units available for sale, which yields the weighted-average cost per unit. In this calculation, the cost of goods available for sale is the sum of beginning inventory and net purchases.

To get a weighted average of the price paid the investor multiplies 100 shares by 10 for year one and 50 shares by 40 for year two then adds the results to get a total of 3 000 In this post, learn how to calculate a weighted average and go through two worked examples. Weighted Average Formula. Calculating the mean is a simple process of summing all your values and dividing them by the number of values. That process gives each value an equal weight.

How To Calculate Weighted Average Cost

To calculate the weighted average of a set of numbers you multiply each value by its weight and follow up by adding the products Let s go over the process step by step Identify the weights In some scenarios determining the weight of each value is rather straightforward albeit arbitrary Explained how to calculate weighted average cost of capital wacc in . Ppt inventories powerpoint presentation free download id 6365598Solved calculate weighted average unit cost round chegg.

Konzul tus Mert Fel p t how To Calculate Weighted Average Cost Of

How To Calculate Percentage Score Haiper

The average cost method utilizes a weighted average calculation as a compromise between FIFO and LIFO The process of calculating the average cost method for inventory recognition is a two step process Step 1 The first step is to identify each cost of production incurred in a specified period and the ascribed dollar value Weighted average cost of capital (WACC) represents a company's cost of capital, with each category of capital (debt and equity) proportionately weighted. WACC can be calculated by.

The weighted average cost is the total inventory purchased in the quarter 113 300 divided by the total inventory count from the quarter 100 for an average of 1 133 per unit The The formula for weighted average cost per unit is: Weighted Average Cost Per Unit = Cost of Goods Sold/Number of Units Bought. To find your cost of goods sold, add up how much it cost you to buy all of your inventory over multiple purchases. The number of units is the total number of units you purchased over the same period..