Are you looking for free printable Bible coloring pages in PDF format? Look no further! We have a wide selection of beautiful and inspiring designs … Read more

Continue reading

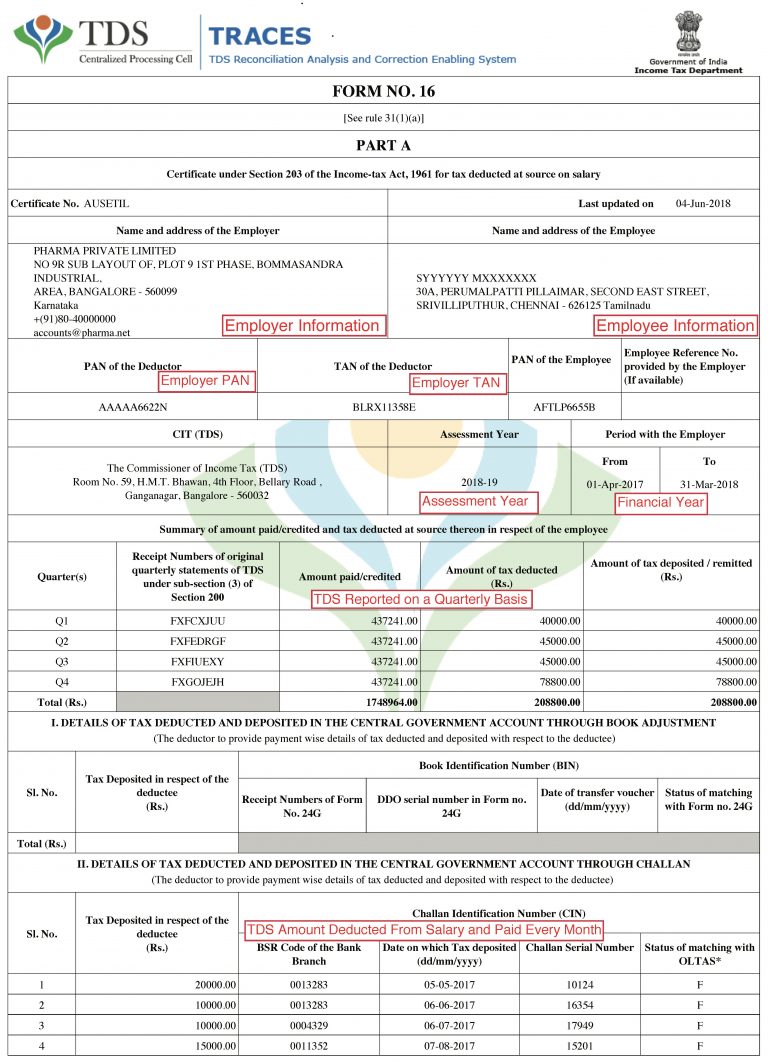

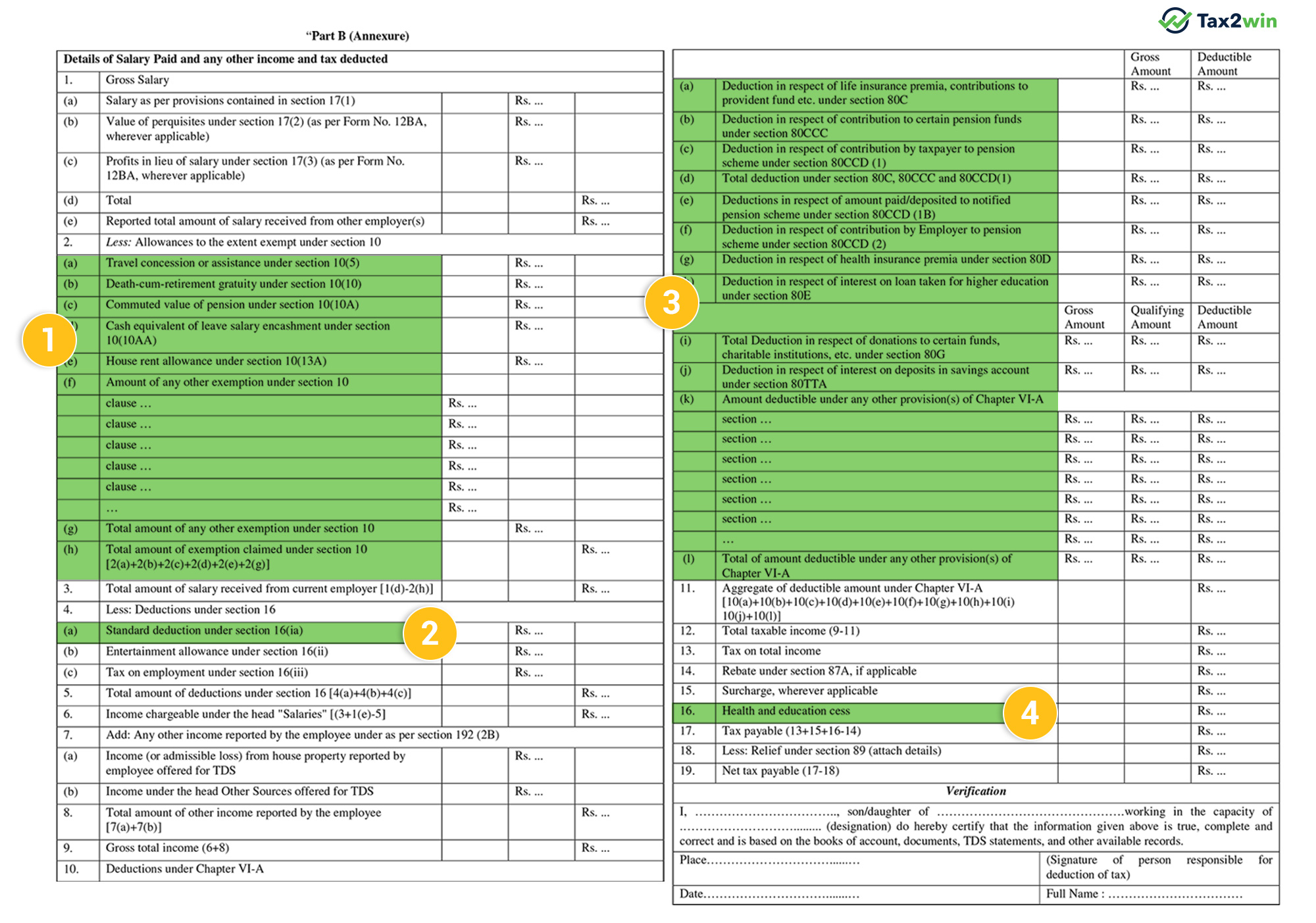

1 Click on TRACES PDF Converter 1 4L to download utility for Part A of Form 16 2 Click on TRACES PDF Converter 1 1L to download utility for Part B You will need to run the PDF Converter Utility program Converter V1 4L Form 16 Part A After extracting the zip file access the folder and select the JAR file Created on. October 18, 2023. What’s Inside. What is Form 16? Why is Form 16 Required? When is Form 16 Issued? What is Part A of Form 16 or Form 16A? Can we Download Form 16 A Online? What is Part B of Form 16 or Form 16B? What is the Difference Between Form 16, Form 16A, and Form 16B? Form 16 In Case of a Job Change.

Follow the below given steps to download Form A Firstly go to the TRACES portal Log in to the portal with your login ID and password Hover over to the downloads tab where you can find Form 16A Once you have opened the Form fill in all the required details Components of Form 16 Step 1: Visit the official website of the Income Tax Department. Step 2: Click on ' Tax Laws & Rules ' and Select ' Income-tax Forms ' under ' Forms/Downloads ' section. Step 3: After, clicking on ' Income Tax Forms ' button you will be directed to the Forms Page.

How To Get Form 16

1 What is FORM 16 Form 16 is an annual tax document issued to salaried individuals by employers This document contains details of income earned by an employee the tax saving investments and deductions that were availed as well as any tax deducted at source TDS for the applicable Financial Year What is form 16 upload form 16 and file income tax return online. Form 16 part a part b download procedure pdf instapdfAll you need to know about form 16a income tax return itr filing.

Income Tax Know About Form 16A Before Filing ITR For 2016 17 Zee

Form 16 What Is Form 16 How To Download Form 16 When Will Form 16 Be

1 Form 16 Concept and Components Form 16 is a certificate that reflects the total salary paid and the amount of tax deducted TDS during the year It also contains the details of salary and tax benefits availed by your employees in the last financial year July 22, 2022 6 Mins Read. Form 16, also known as the TDS certificate, is a certificate that employers issue to employees. It is valid proof that TDS has been deducted and deposited with the employer. TDS (Tax deducted at source) is the tax collected at the very source of income. But what happens to this amount deducted from employee salary?

Form 16 is issued by the employer to the employee It is issued on or before 15th June of the following financial year For instance if you re working in the financial year 2022 23 your employer should issue Form 16 on or before 15th June 2023 For employees. Income tax filing: Form 16 is the most critical document required by an employee to file their income tax return as it provides a comprehensive overview of their salary and the tax deducted at source by the employer.

Are you looking for free printable Bible coloring pages in PDF format? Look no further! We have a wide selection of beautiful and inspiring designs … Read more

Continue reading