Irs 1099 Form 2024 Order

Order Tax Forms If you are an employer or business and need to order information returns all series of forms W 2 W 3 W 4 1096 1098 1099 3921 5498 and other products please visit Online Ordering for Information Returns and Employer Returns to submit an order Need to find a product or place a telephone order Following feedback from taxpayers, tax professionals and payment processors and to reduce taxpayer confusion, the IRS delayed the new $600 Form 1099-K reporting threshold for third party settlement organizations for calendar year 2023.

Electronically file any Form 1099 for free with the Information Returns Intake System IRIS Individual and bulk forms File direct through the taxpayer portal or use software through IRIS Application to Application If you want to file them on paper, you can place an order for the official IRS information returns, which include a scannable Copy A for filing with the IRS and all other applicable copies of the form, at IRS.gov/EmployerForms. We'll mail you the forms you request and their instructions, as well as any publications you may order.

Irs 1099 Form 2024 Order

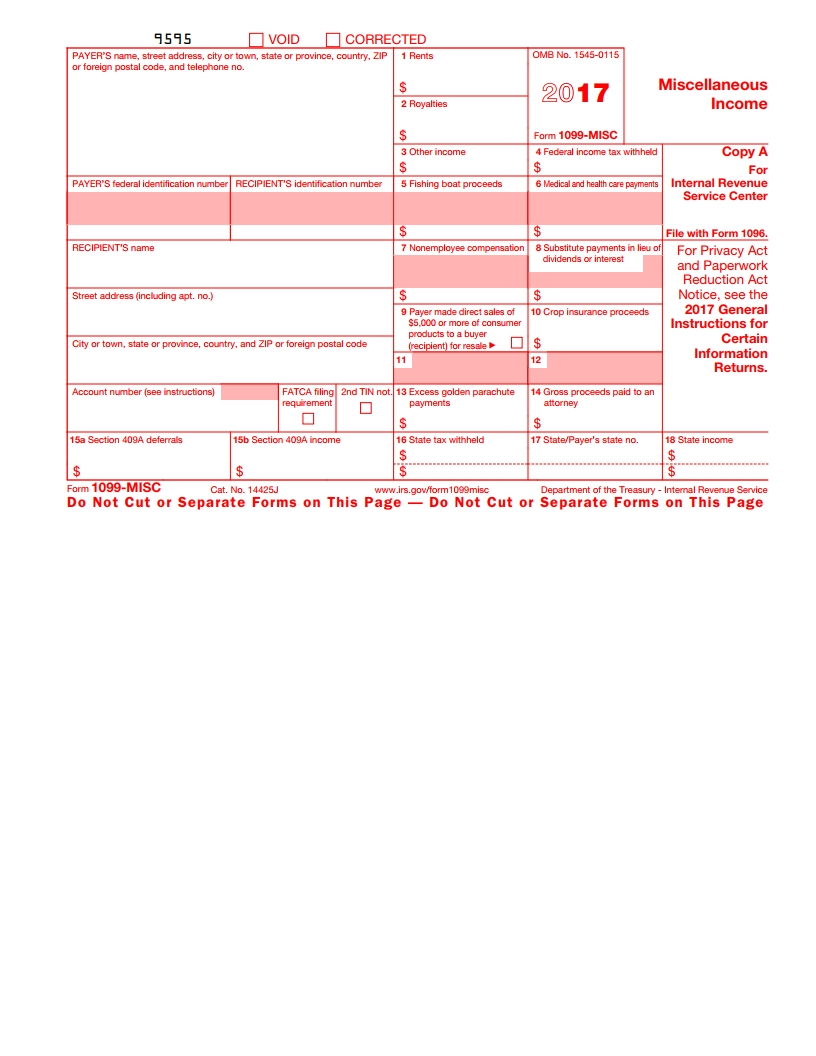

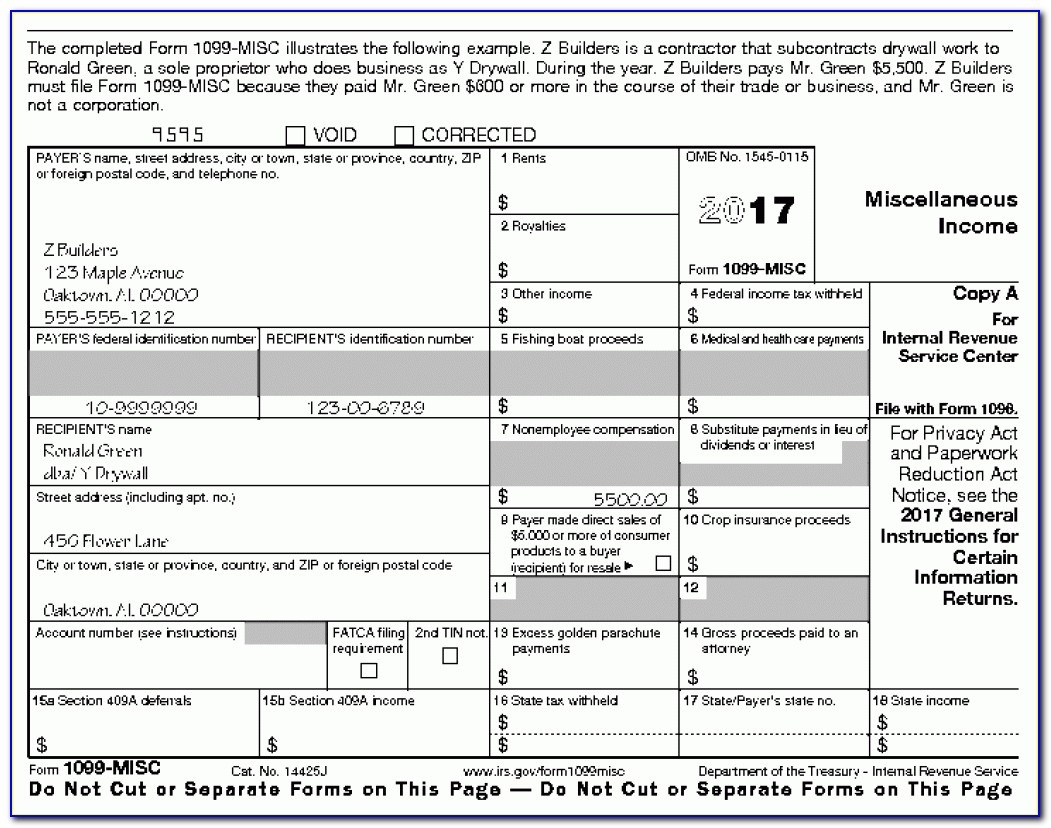

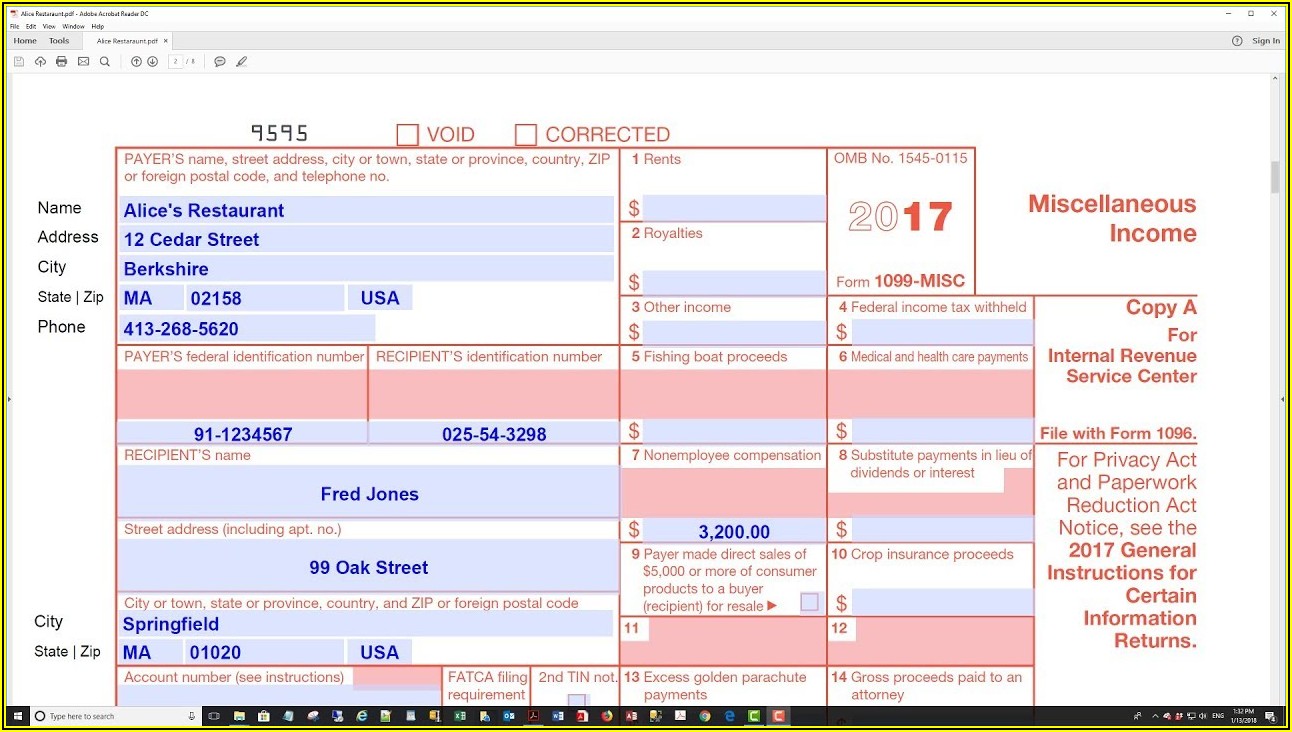

IRS gov Form1099NEC Form 1099 NEC box 1 Box 1 will not be used for reporting under section 6050R regarding cash payments for the purchase of fish for resale purposes Form 1099 NEC box 2 Payers may use either box 2 on Form 1099 NEC or box 7 on Form 1099 MISC to report any sales totaling 5 000 or more of consumer products for 1099 g irs form. Irs form 1099 int order form resume examples n8vzdebo9w11 common misconceptions about irs form 11 form information free printable 1099 misc forms.

11 Common Misconceptions About Irs Form 11 Form Information Free Printable 1099 Misc Forms

Irs Form 1099 Misc Form Resume Examples dP9l7NZW2R

The IRS delayed the new 600 Form 1099 K reporting threshold requirement for third party payment organizations for tax year 2023 For 2023 and prior years payment apps and online marketplaces are required to send out Forms 1099 K only to taxpayers who receive over 20 000 and have over 200 transactions For tax year 2024 the IRS plans for Form. 1099-NEC (Rev. January 2024) Nonemployee Compensation. Copy 1. For State Tax Department. Department of the Treasury - Internal Revenue Service. OMB No. 1545-0116 For calendar year. VOID CORRECTED. PAYER'S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no. PAYER'S TIN ...

Beginning in 2024 for information returns filed for tax year 2023 including Forms 1099 MISC and 1099 NEC employers will have to file electronically if they file at least 10 information returns in a year Medlock said Currently employers do not have to file electronically unless they file at least 250 returns in a year Starting January 1, 2024, entities with 10 or more forms in total (including various form types like Form 1042-S, Form 1099 series, and Form W-2) will need to file electronically. : The...