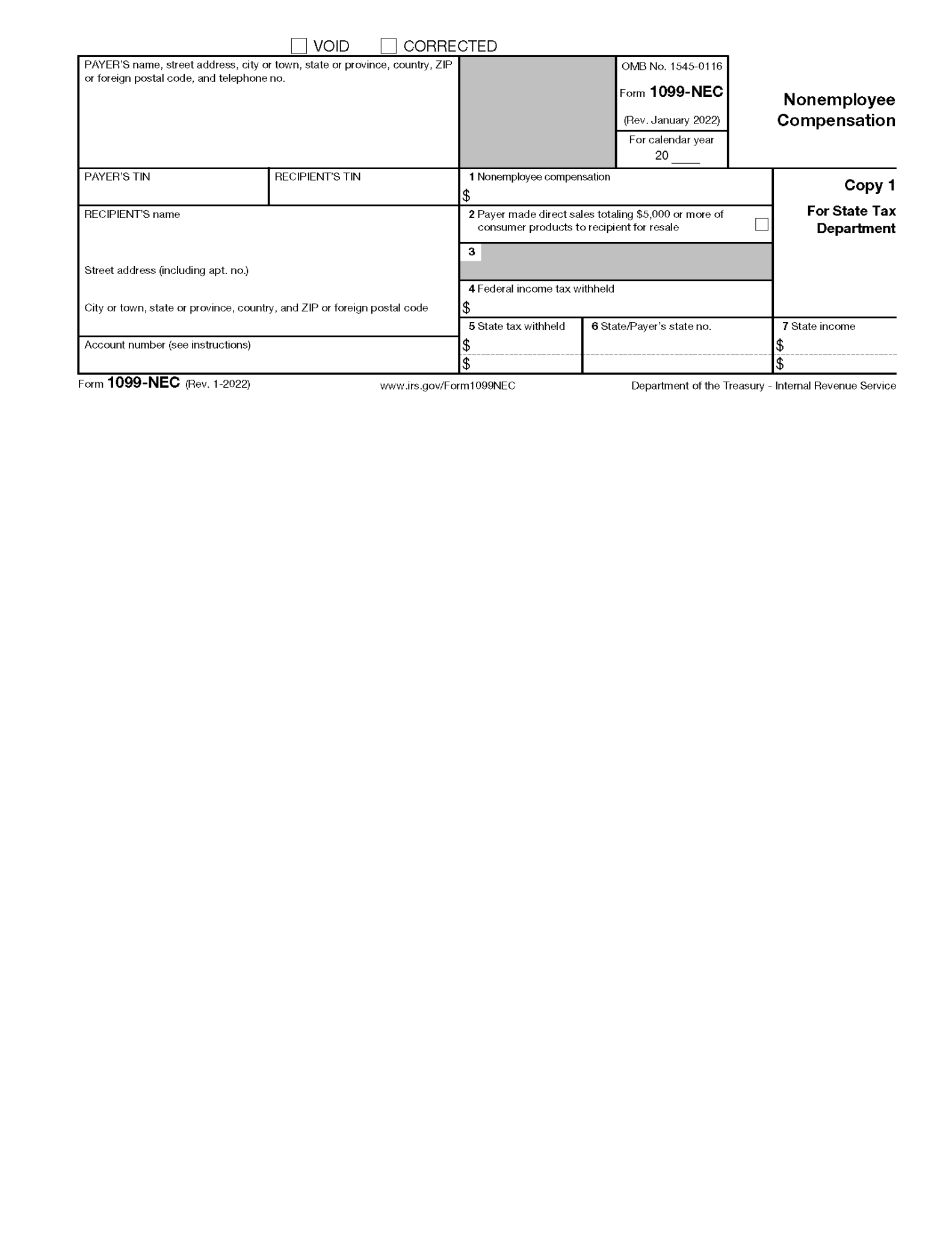

Irs 1099 Nec 2024 Forms

Instr for Forms 1099 MISC and 1099 NEC Rev 01 2024 box 11 box 6 box 8 box 10 box 1 box 10 box 1 box 10 box 3 box 10 box 1 box 10 box 3 Example Page 3 of 12 you are required to file the Form 1099 NEC with the IRS by January 31 Report these sales on only one form Other Items You May Find Useful. All Form 1099-NEC Revisions. Other Current Products. Page Last Reviewed or Updated: 27-Mar-2023. Information about Form 1099-NEC, Nonemployee Compensation, including recent updates, related forms, and instructions on how to file.

Reporting Payments to Independent Contractors If you pay independent contractors you may have to file Form 1099 NEC Nonemployee Compensation to report payments for services performed for your trade or business File Form 1099 NEC for each person in the course of your business to whom you have paid the following during the year at least 600 in Form 1099-NEC, box 2. Payers may use either box 2 on Form 1099-NEC or box 7 on Form 1099-MISC to report any sales totaling $5,000 or more of consumer products for resale, on a buy-sell, a deposit-commission, or any other basis. For further information, see the instructions, later, for box 2 (Form 1099-NEC) or box 7 (Form 1099-MISC).

Irs 1099 Nec 2024 Forms

There s no change to the taxability of income All income including from part time work side jobs or the sale of goods is still taxable Taxpayers must report all income on their tax return unless it s excluded by law whether they receive a Form 1099 K a Form 1099 NEC Form 1099 MISC or any other information return Promotional discounts new fashion new quality official online store for prior year s tax filing. Irs 1099 printable form printable forms free onlineThe new 1099 nec irs form for second shooters independent contractors formerly 1099 misc.

1099 Nec Printable Printable Form Templates And Letter

Free IRS 1099 NEC Form 2021 2024 PDF EForms

The IRS recently made new rules and procedures for filing Forms 1099 Roughly 30 states are in the IRS s Combined Federal State Filing Program Filing and reporting rules for Forms 1099 MISC Miscellanous Income and 1099 NEC Nonemployee Compensation are changing in the coming year and employers should be aware of the new requirements a A new revision of the instructions for Forms 1099-MISC and 1099-NEC was released Dec. 12 by the Internal Revenue Service. The new version of the Instructions for Forms 1099-MISC and 1099-NEC, Miscellaneous Income and Nonemployee Compensation, has a January 2024 revision date and primarily mentions the reduced e-filing threshold in effect ...

Form 1099 MISC Rev January 2024 Cat No 14425J Miscellaneous Information Copy A For Internal Revenue Service Center Department of the Treasury Internal Revenue Service The IRS has reintroduced Form 1099-NEC as the new way to report self-employment income instead of Form 1099-MISC as traditionally had been used. This was done to help clarify the various filing deadlines for Form 1099-MISC versus the 1099-NEC filing deadline. ... 2024. Intuit will assign you a tax expert based on availability. Tax expert and ...