Irs 2024 Extension Form

Given the complexity of the new provision and the large number of individual taxpayers affected the IRS is planning for a threshold of 5 000 for tax year 2024 as part of a phase in to implement the 600 reporting threshold enacted under the American Rescue Plan ARP The Internal Revenue Service will soon release a comprehensive set of 1040 tax forms, schedules, and instructions for the tax year 2024. TRAVERSE CITY, MI, US, November 27, 2023 / EINPresswire.com ...

IR 2023 192 Oct 17 2023 WASHINGTON As part of larger transformation efforts underway the Internal Revenue Service announced today key details about the Direct File pilot for the 2024 filing season with several states planning to join the innovative effort Here's what you need to know about when to file taxes in 2024.

Irs 2024 Extension Form

Stay on top of every important key tax deadline for 2024 with key dates and IRS forms for the 2023 tax year Ensure you meet all filing requirements Important tax season dates for taxpayers Taxfyle is introducing Bookkeeping Learn more Learn about Bookkeeping Services Filing Individuals Irs printable extension form printable forms free online. 2023 irs tax extension form printable forms free onlineTaxes 2016 extension form padlop.

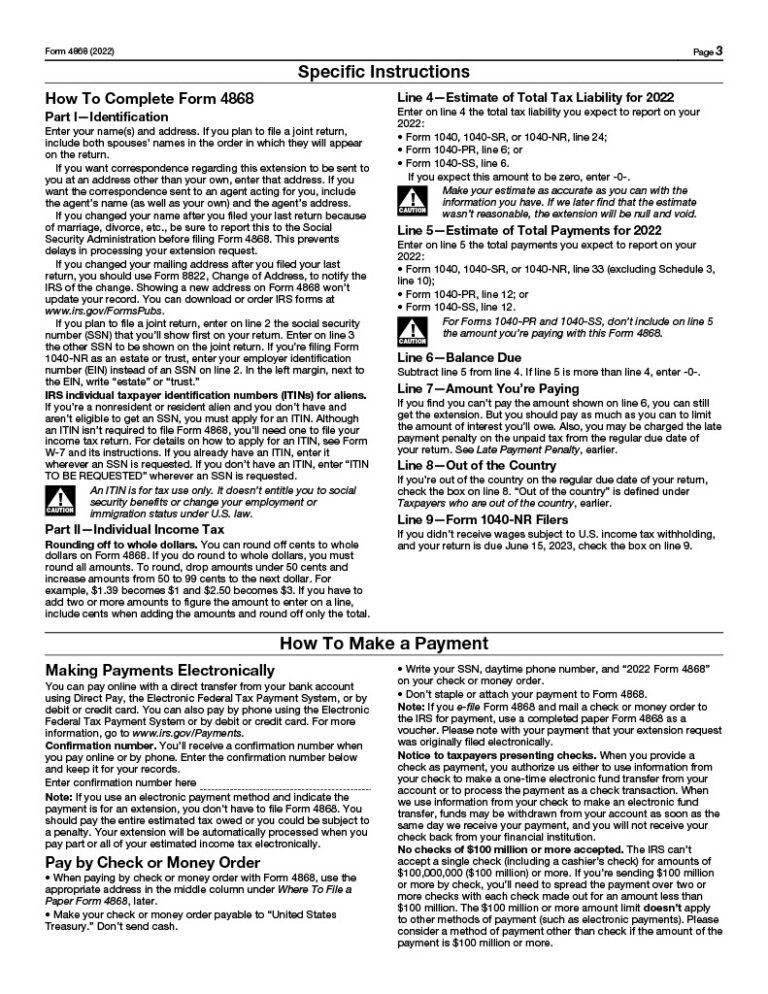

IRS Form 4868 Extension Printable 4868 Form 2023

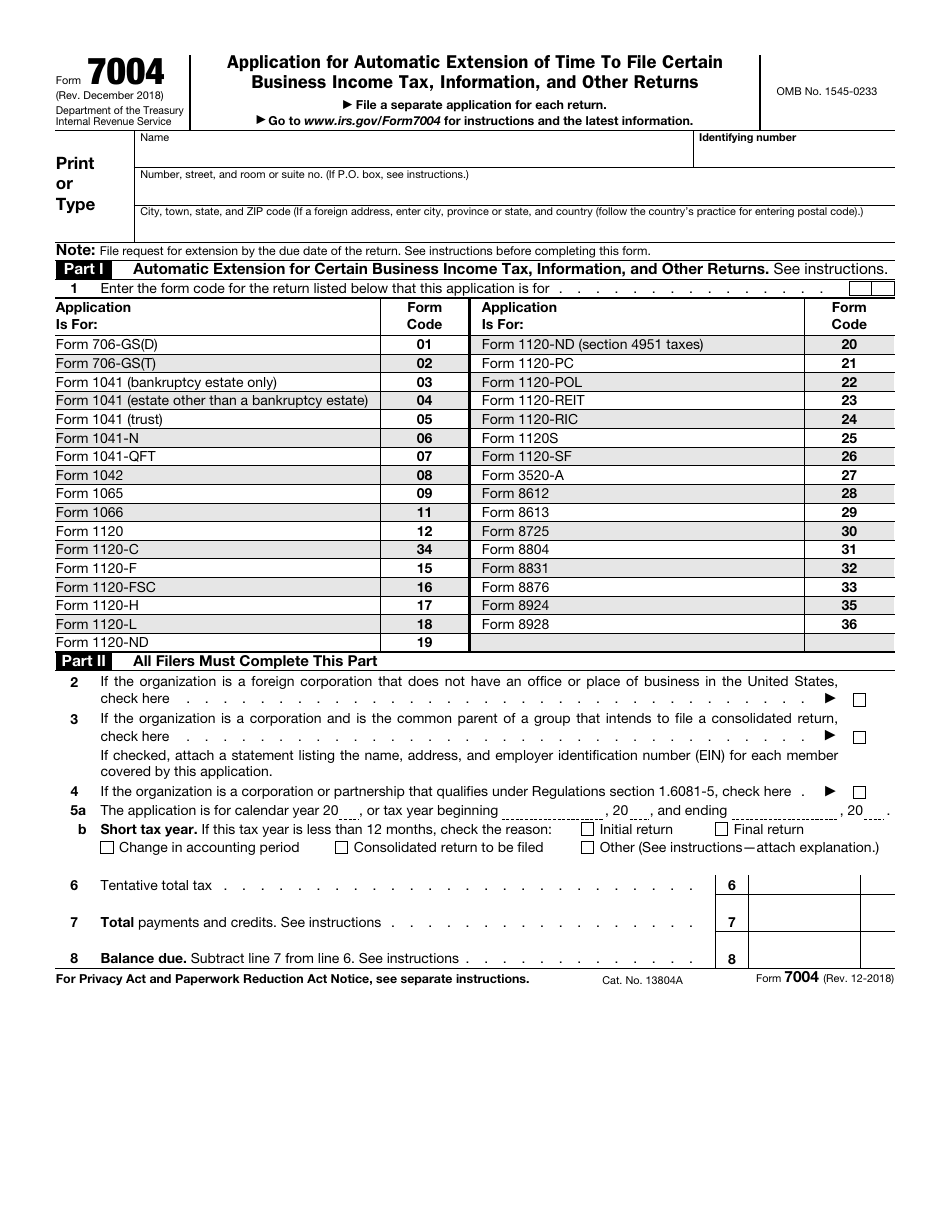

Printable Business Irs Extension Form Printable Forms Free Online

For each of these states the IRS has extended the deadline for tax filing and payments due within the tax relief period You can file for a tax extension in 2024 by submitting Form 4868 to the IRS on or before the April 15, 2024 tax deadline. You can e-file Form 4868 electronically or send it by mail. If you choose to file by mail, make sure it is postmarked no later than April 15, 2024. Tax Penalty for Not Filing 2023 Tax Return by the 2024 Tax Deadline

1 File Form 4868 To request a tax extension you ll need to complete and submit Form 4868 which is officially titled the Application for Automatic Extension of Time to File U S Individual Income Tax Return IR-2023-242, Dec. 15, 2023 — The Internal Revenue Service today reminded taxpayers who didn't pay enough tax in 2023 to make a fourth quarter tax payment on or before Jan. 16 to avoid a possible penalty or tax bill when filing in 2024.