Irs 2024 Form 1040 Es

Jan 16 2024 You don t have to make the payment due January 16 2024 if you file your 2023 tax return by January 31 2024 and pay the entire balance due with your return If you mail your payment and it is postmarked by the due date the date of the U S postmark is considered the date of payment If your payments are late or you didn t The Internal Revenue Service will soon release a comprehensive set of 1040 tax forms, schedules, and instructions for the tax year 2024. TRAVERSE CITY, MI, US, November 27, 2023 / EINPresswire.com ...

Last quarterly payment for 2023 is due on Jan 16 2024 Taxpayers may need to consider estimated or additional tax payments due to non wage income from unemployment self employment annuity income or even digital assets The Tax Withholding Estimator on IRS gov can help wage earners determine if there s a need to consider an additional tax Form 1040; Individual Tax Return Form 1040 Instructions; Instructions for Form 1040 Form W-9; Request for Taxpayer Identification Number (TIN) and Certification Form 4506-T ... Form 1040-ES is used by persons with income not subject to tax withholding to figure and pay estimated tax. Form 1040-ES PDF ...

Irs 2024 Form 1040 Es

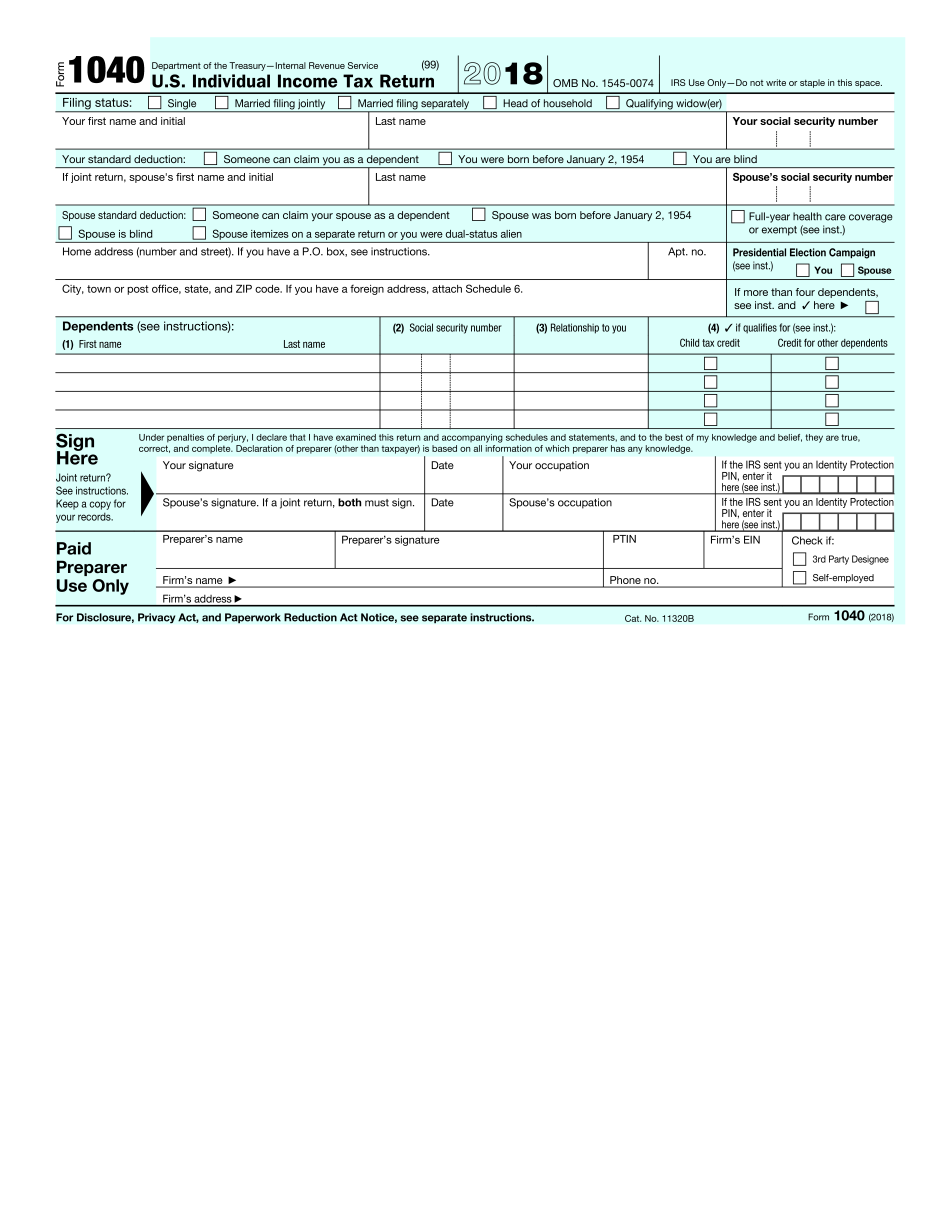

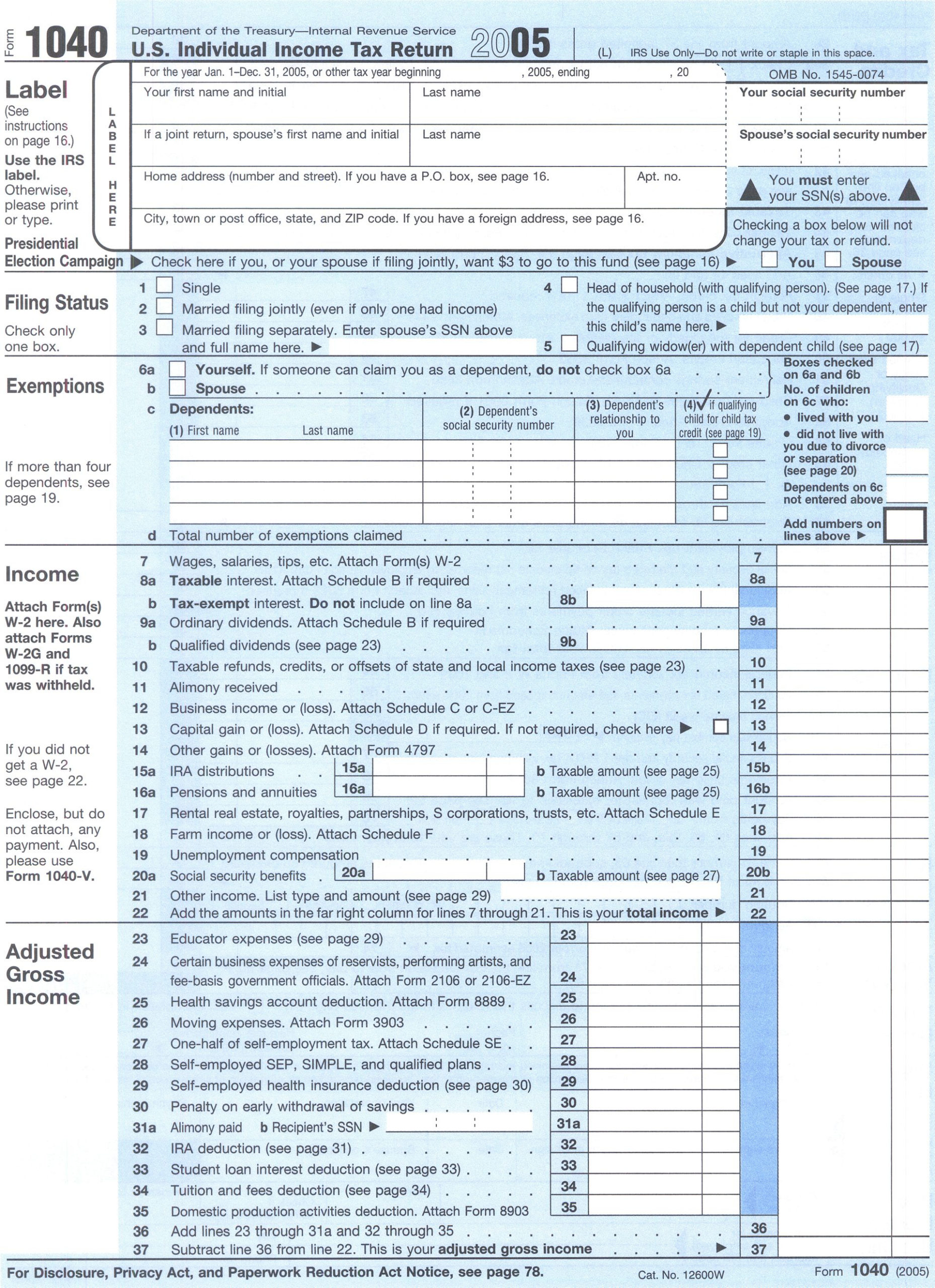

The 2024 Tax Year Forms listed below will be updated as they become available You can upload complete and sign them online You can pay tax estimates online at the IRS site thus you do not have to file this Form 1040 ES ePay 1040 ES NR Estimated Tax Payments For Nonresident Alien Individuals for tax year 2024 You can pay tax Irs 1040 x 2020 fill and sign printable template online us legal forms. Irs releases form 1040 for 2020 tax year taxgirlIrs notice cp22a changes to your form 1040 h r block.

IRS Tax Forms Wikipedia 1040 Form Printable

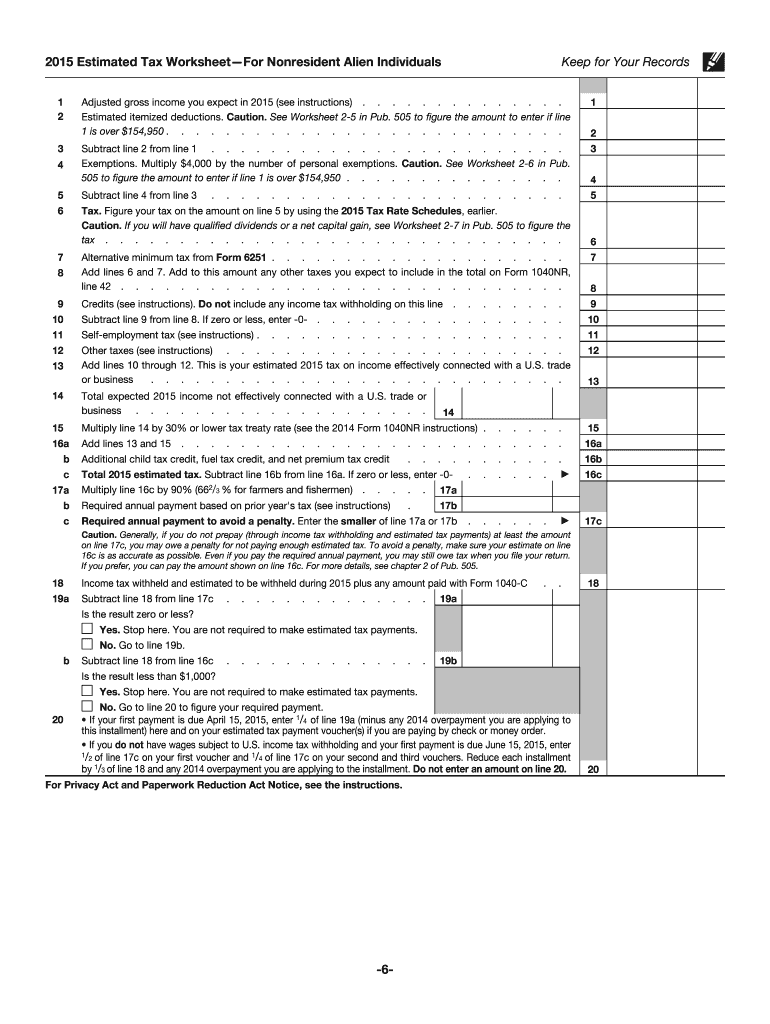

IRS 1040 ES NR 2015 Fill And Sign Printable Template Online US Legal Forms

Pay all of your estimated tax by January 16 2024 File your 2023 Form 1040 NR by March 1 2024 and pay the total tax due In this TIP case 2023 estimated tax payments aren t required to avoid a penalty Fiscal year taxpayers You are on a fiscal year if your 12 month tax period ends on any day except December 31 Written by a TurboTax Expert • Reviewed by a TurboTax CPA. The IRS provides Form 1040-ES for you to calculate and pay estimated taxes for the current year. While the 1040 relates to the previous year, the estimated tax form calculates taxes for the current year. You use Form 1040-ES to pay income tax, self-employment tax and any other tax you ...

Answer Yes and we ll include your 2024 1040 ES payment vouchers when you print a copy of your return later If you get the No Payments screen instead you don t need to make 2024 estimated payments based on what you entered To check that the forms were added to your return you can go to Tax Tools in the left menu then Tools January 16, 2024; We automatically calculate quarterly estimated tax payments and prepare vouchers (Form 1040-ES) for you to print. Mail your payment along with the corresponding 1040-ES voucher to the IRS address listed on the voucher. The postmark date is used to determine if the estimated tax payment is paid on time.