Irs 2024 Form 8949

Instructions Code s from Amount of instructions adjustment h Gain or loss Subtract column e from column d and combine the result with column g 2 Totals Add the amounts in columns d e g and h subtract negative amounts WASHINGTON — The Internal Revenue Service today issued the 2024 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes. Beginning on Jan. 1, 2024, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be:

Cryptocurrency Whenever you sell a capital asset held for personal use at a gain you need to calculate how much money you gained and report it on a Schedule D Depending on your situation you may also need to use Form 8949 Last quarterly payment for 2023 is due on Jan. 16, 2024. Taxpayers may need to consider estimated or additional tax payments due to non-wage income from unemployment, self-employment, annuity income or even digital assets. The Tax Withholding Estimator on IRS.gov can help wage earners determine if there's a need to consider an additional tax ...

Irs 2024 Form 8949

Schedule D is used to calculate the net capital gain or loss from all capital transactions reported on Form 8949 The net capital gain or loss is then reported on Form 1040 If the net capital gain is positive it is taxed at the capital gains tax rate which is typically lower than the ordinary income tax rate Irs schedule d instructions . To review tess s completed form 8949 and schedule d irs gov apps irs fill out signIrs form 8949 instructions .

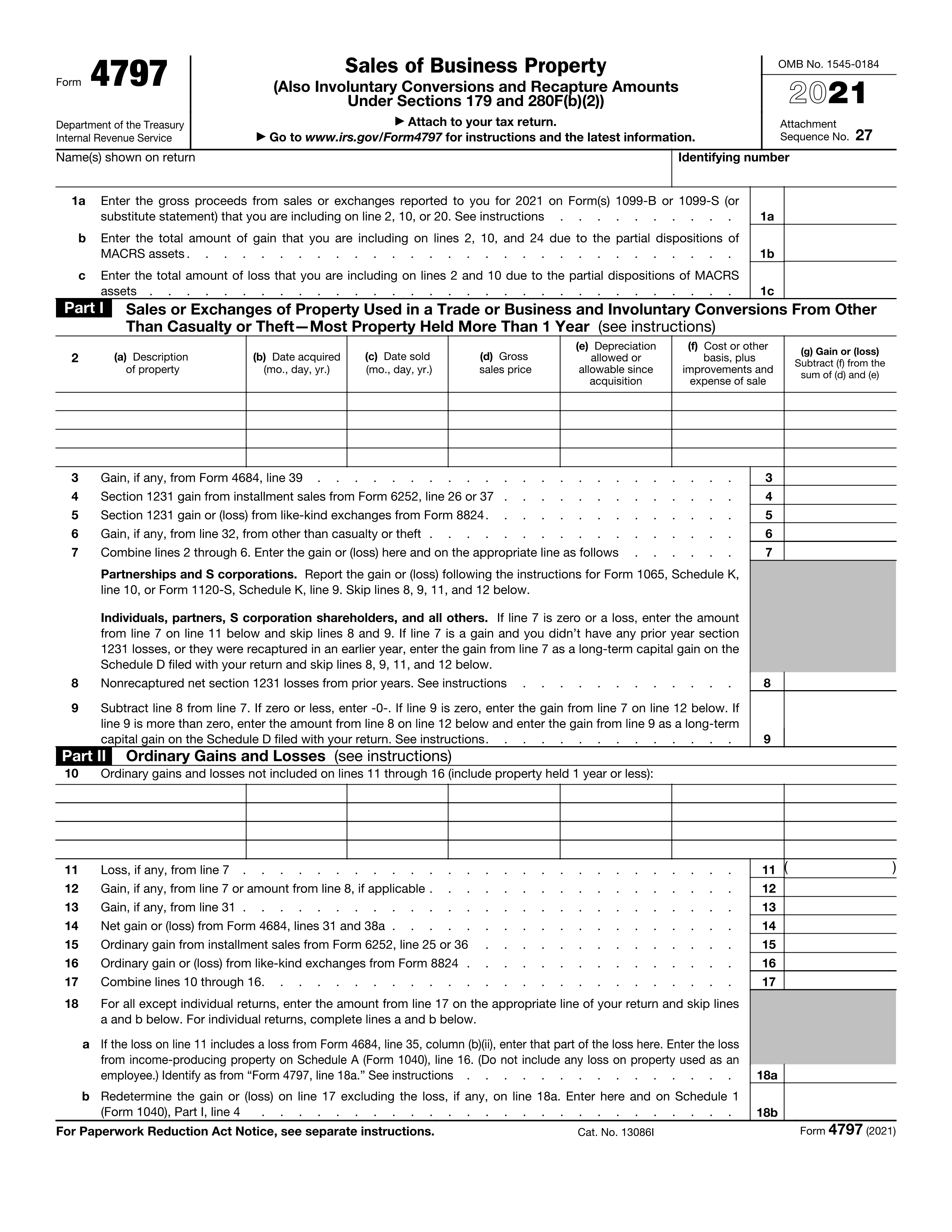

IRS Form 4797

What Is The IRS Form 8949 And Do You Need It The Handy Tax Guy

The IRS Form 8949 is divided into two sections Short term gains and Long term gains If you sell your assets within a year then the short term gains section is to be filled How to Prepare for Crypto Taxes in 2024 December 8 2023 Tax Loss Harvesting A Brief Primer for Crypto Users December 1 2023 Tokenizing Art Knowing the Magic IRS.gov/Form1099NEC. Continuous-use form and instructions. Form 1099-MISC, Form 1099-NEC, and these instructions are continuous use. Both the forms and instructions will be updated as needed. For the most recent version, go to IRS.gov/Form1099MISC or IRS.gov/Form1099NEC. Form 1099-NEC, box 1. Box 1 will not be used for reporting

Form 8949 is filled out first You report every sale of stock during the year identifying the stock the date you bought it the date you sold it and how much you gained or lost Note that you Key Takeaways. The primary purpose of IRS Form 8949 is to report sales and exchanges of capital assets. Form 8949 is filed along with Schedule D of your individual federal income tax form. Anyone who has received one or more Forms 1099-B, Forms 1099-S, or IRS-allowed substitutions should file a Form 8949. You may not need to file Form 8949 if ...