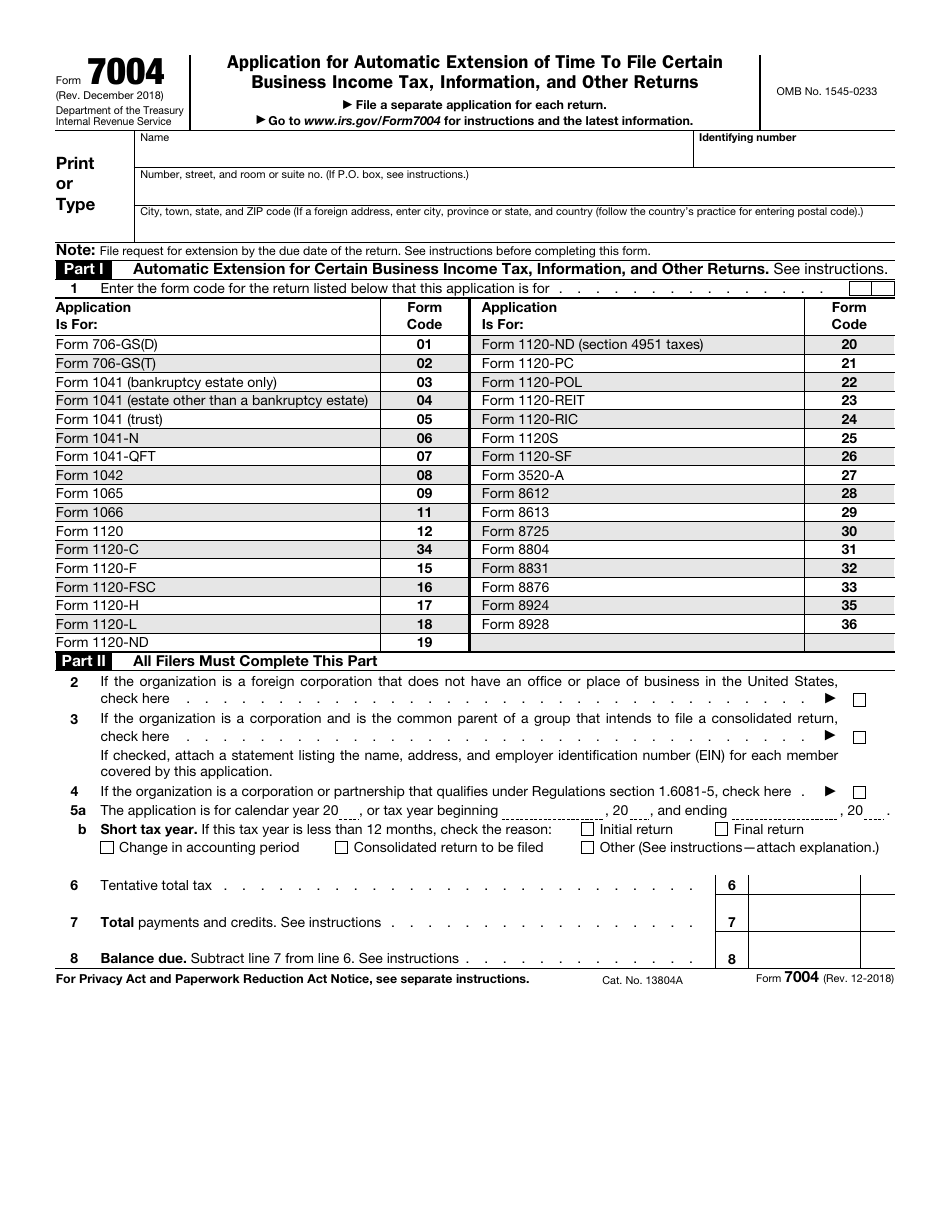

Irs 2024 Tax Extension Form

E file Your Extension Form for Free Individual tax filers regardless of income can use IRS Free File to electronically request an automatic tax filing extension Filing this form gives you until October 15 to file a return If October 15 falls on a Saturday Sunday or legal holiday the due date is delayed until the next business day For states that do levy a state income tax, Arizona, California, Massachusetts and New York have chosen to partner with the IRS for the 2024 Direct File pilot. The IRS anticipates the pilot will be available in those states as well in 2024. The IRS and the Departments of Revenue in Arizona, California, Massachusetts, New York and Washington ...

Here are the filing deadlines for extended 2023 tax returns October 15 2024 Deadline For Individual 2023 Tax Returns September 16 2024 Deadline For Partnerships Sole Proprietorship 2023 Tax Returns October 15 2024 Deadline For C corporation 2023 Tax Return the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. ... which form to use, and extensions of time to file. If you file Forms 1097, 1098, 1099 (except a ... ment of your 2024 estimated tax. Use Form 1040-ES. For more information, see Pub. 505. Household employers. If you paid cash

Irs 2024 Tax Extension Form

A tax extension is a request for additional time to file your federal income tax return with the IRS Tax extensions can help you avoid incurring a late filing penalty You can submit Form 4868 to Simulador de taxes 2023 irs forms imagesee. Irs tax extension form 4868Irs form 4868 extension for 2016 tax deadline in nj little silver nj patch.

Tax Extension Fillable Form Printable Forms Free Online

Printable Business Irs Extension Form Printable Forms Free Online

Employers are required to send employees their W 2 and 1099 income tax forms by the end of January the deadline to file a tax extension with the IRS Getting an extension doesn t change the TurboTax Live Assisted Basic Offer: Offer only available with TurboTax Live Assisted Basic and for those filing Form 1040 and limited credits only. Roughly 37% of taxpayers qualify. Must file between November 29, 2023 and March 31, 2024 to be eligible for the offer. Includes state (s) and one (1) federal tax filing.

Last quarterly payment for 2023 is due on Jan 16 2024 Taxpayers may need to consider estimated or additional tax payments due to non wage income from unemployment self employment annuity 2024 Tax Deadline to Pay Taxes Due for 2023 Tax Returns. Monday, April 15, 2024 is also the 2024 tax payment deadline for 2023 taxes due. If you owe taxes for 2023 and do not pay by April 15th, the IRS will add penalties and interest. Even if you file for an extension, you must pay taxes due by the 15th to avoid an even higher tax liability.