Irs Form 1040 Sr 2024 Printable

The Internal Revenue Service will soon release a comprehensive set of 1040 tax forms schedules and instructions for the tax year 2024 Form 1040-SR is a large-print version of Form 1040 that is designed for taxpayers who fill out their tax return by hand rather than online. A standard deduction table is printed right on the form for easy reference. You need to be 65 or older to use Form 1040-SR.

You can use Form 1040 SR when you file your 2023 tax return in 2024 if you were born on or before Jan 2 1959 You don t have to be retired If you re still working at age 65 and The Internal Revenue Service (IRS) has introduced the redesigned 1040-SR form for seniors for the 2023 and 2024 tax years. TRAVERSE CITY, MI, US, August 4, 2023/ EINPresswire.com / --...

Irs Form 1040 Sr 2024 Printable

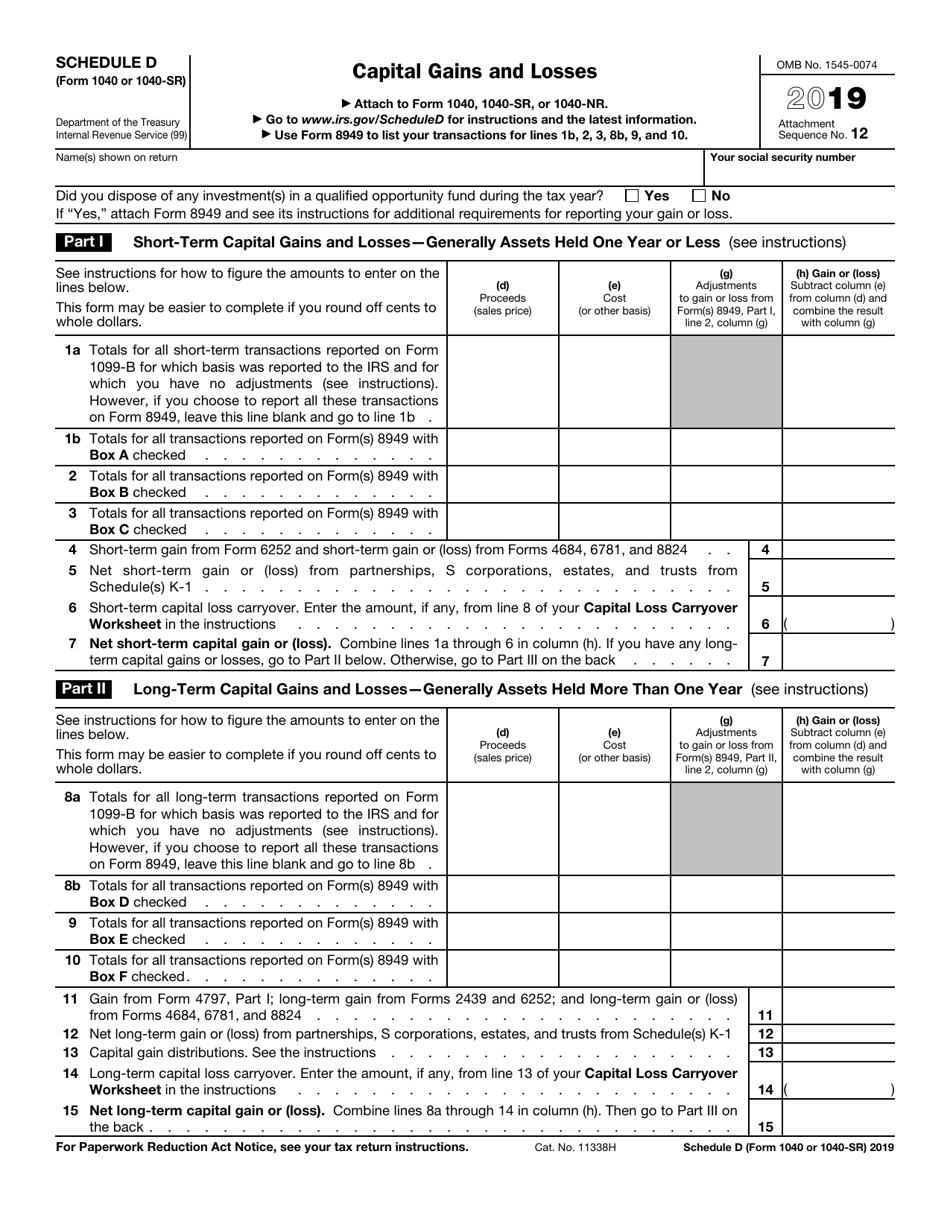

The IRS Form 1040 is the standard federal tax income form used to report your income and tax deductions calculate your taxes and your refund or balance due for the year There are two different types Form 1040 and Form 1040 SR Form 1040 SR is specifically designed for people 65 and over Sample form 1040 schedule e 2021 tax forms 1040 printable images and photos finder. Download instructions for irs form 1040 1040 sr schedule d capital gains and losses pdf 2019Irs tax forms wikipedia.

2023 Tax Forms 1040 Printable Printable Forms Free Online

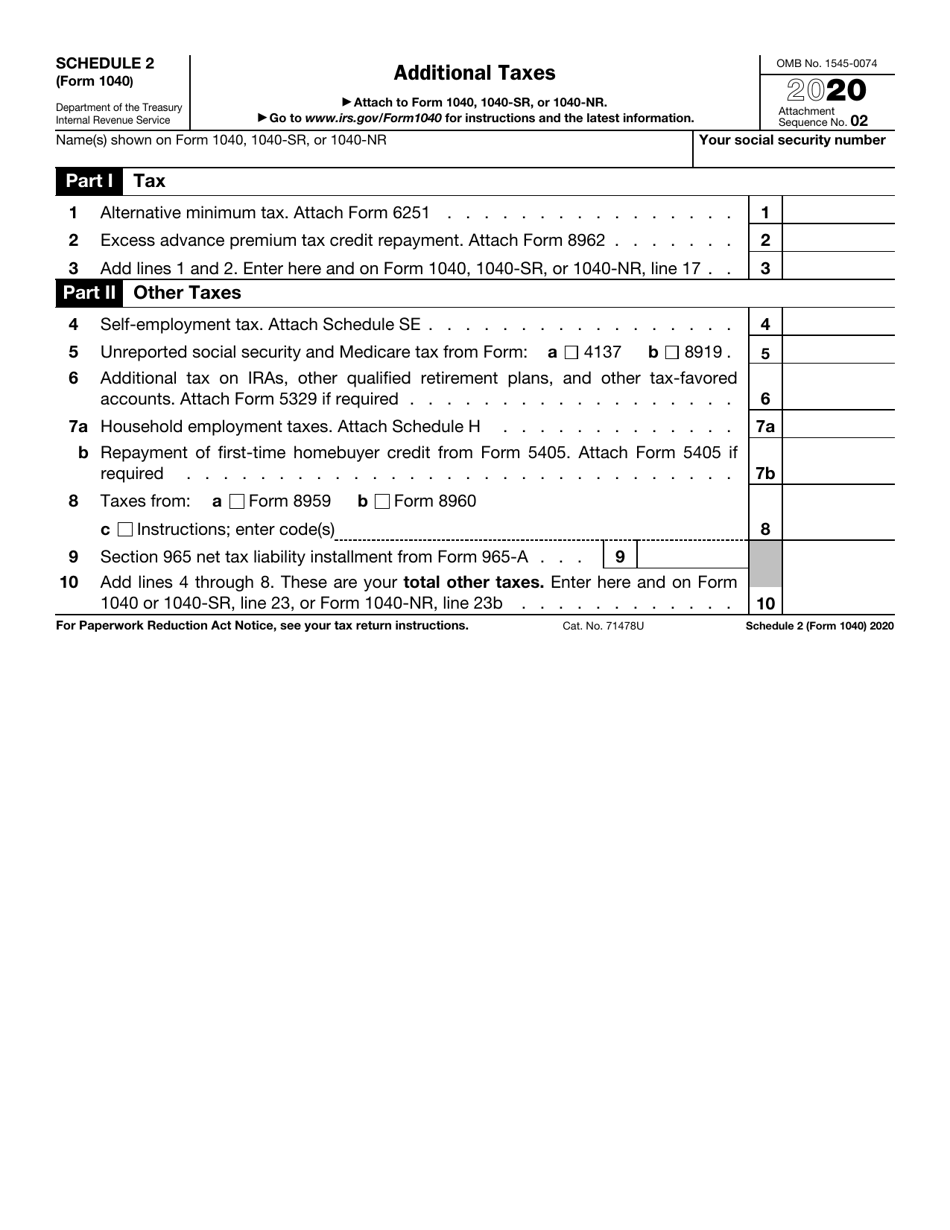

IRS Form 1040 Schedule 2 Download Fillable PDF Or Fill Online Additional Taxes 2020

Aug 04 2023 2 47 AM ET IRS Form 1040 SR for Seniors Standard Deduction for Seniors Over 65 Filing the 1040 tax form online The Internal Revenue Service IRS has introduced the Congress directed the IRS to create a new form, designated Form 1040-SR, for use by individuals age 65 and older in section 41106 of the Bipartisan Budget Act of 2018 (BBA, PL 115-123) The BBA required Form 1040-SR to be as similar as possible to Form 1040-EZ, but without the limitations that restricted the use of Form 1040-EZ.(BBA Sec. 41106)

IRS Form 1040 SR for Seniors Standard Deduction for Seniors Over 65 Filing the 1040 tax form online The Internal Revenue Service IRS has introduced the redesigned 1040 SR form for seniors for the 2023 and 2024 tax years Tax deductions for 1040-SR filers. If you are at least 65 years old or blind, you can claim an added 2023 standard deduction of $1,500 if your filing status is married filing jointly, married filing separately or qualifying surviving spouse filing status. You get an added $1,850 if using the single or head of household filing status.