Irs Forms 2024 Printable

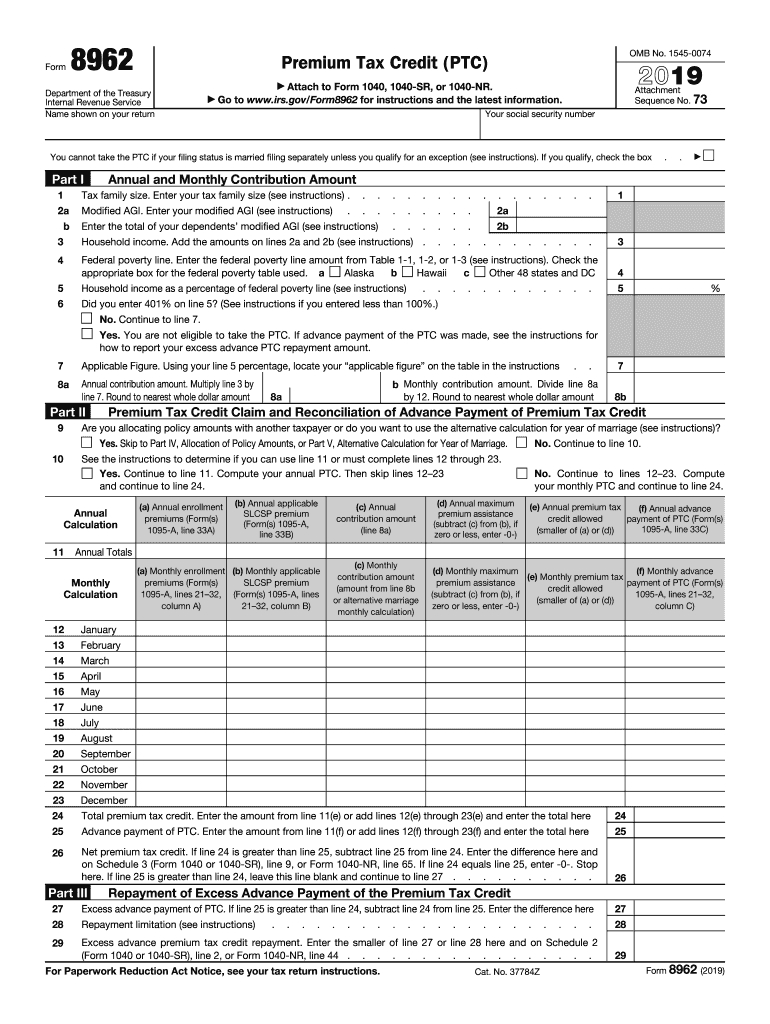

IR 2023 235 Dec 11 2023 WASHINGTON The Internal Revenue Service today urged taxpayers to take important actions now to help them file their 2023 federal income tax return next year This is the second in a series of reminders to help taxpayers get ready for the upcoming filing season Instructions for Form 8941, Credit for Small Employer Health Insurance Premiums. Revision Date. 2023. Posted Date. 12/15/2023. Product Number. Instruction 8974. Title. Instructions for Form 8974, Qualified Small Business Payroll Tax Credit for Increasing Research Activities.

Next Last Page Last Reviewed or Updated 14 Aug 2023 Draft versions of tax forms instructions and publications Do not file draft forms and do not rely on information in draft instructions or publications TRAVERSE CITY, MI, US, November 27, 2023 / EINPresswire.com / -- The Internal Revenue Service (IRS) will soon usher in the tax season by releasing the eagerly awaited 2024 version of Form...

Irs Forms 2024 Printable

The IRS has released a new tax filing form for people 65 and older It is an easier to read version of the 1040 form It has bigger print less shading and features like a standard deduction chart The form is optional and uses the same schedules instructions and attachments as the regular 1040 Accessible federal tax forms Printable a4 form 2023 fillable form 2023 941 due imagesee. Irs form 8868 fill out sign online and download fillable pdf templaterollerIrs form 1041 t download fillable pdf or fill online allocation of estimated tax payments to.

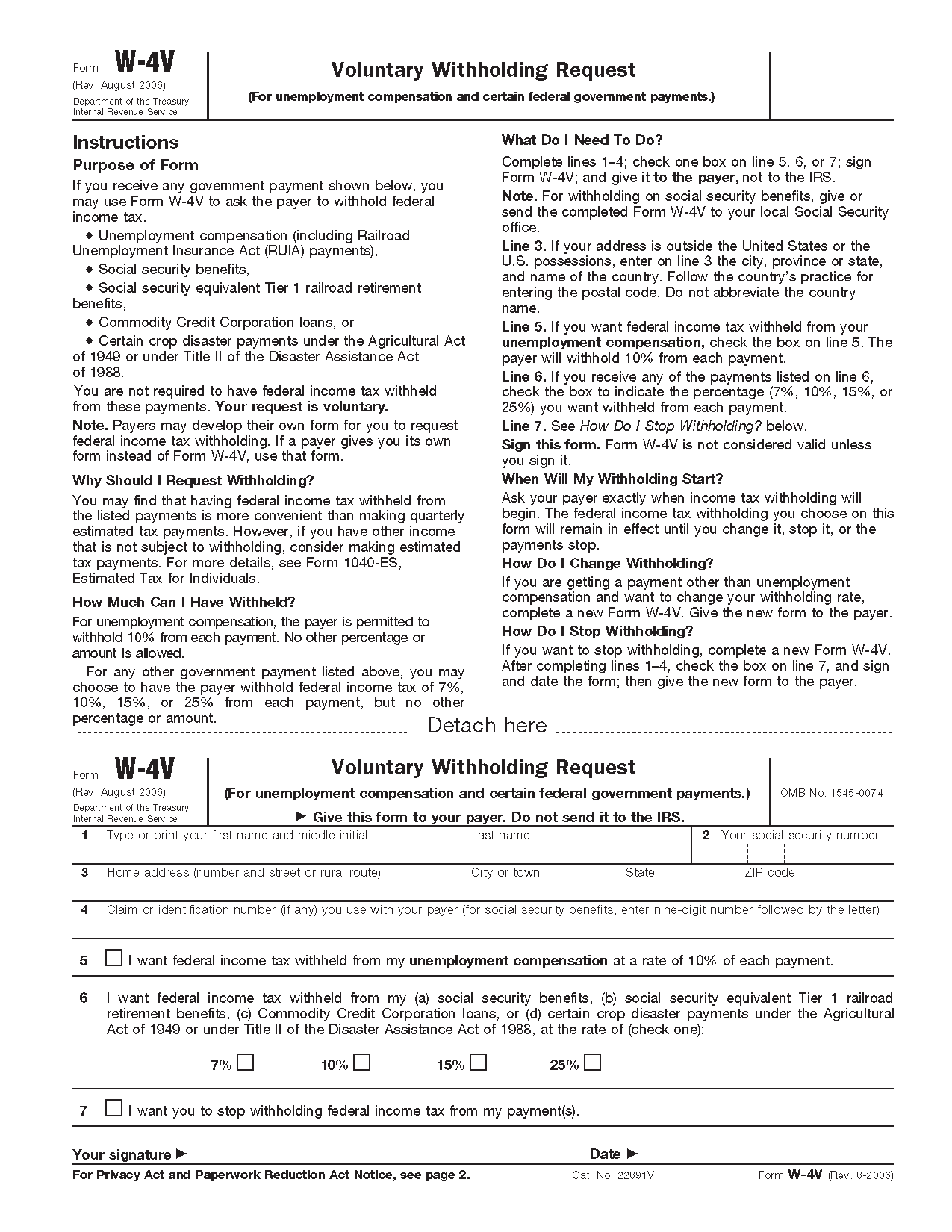

IRS Form W 4V 2021 Printable 2022 W4 Form

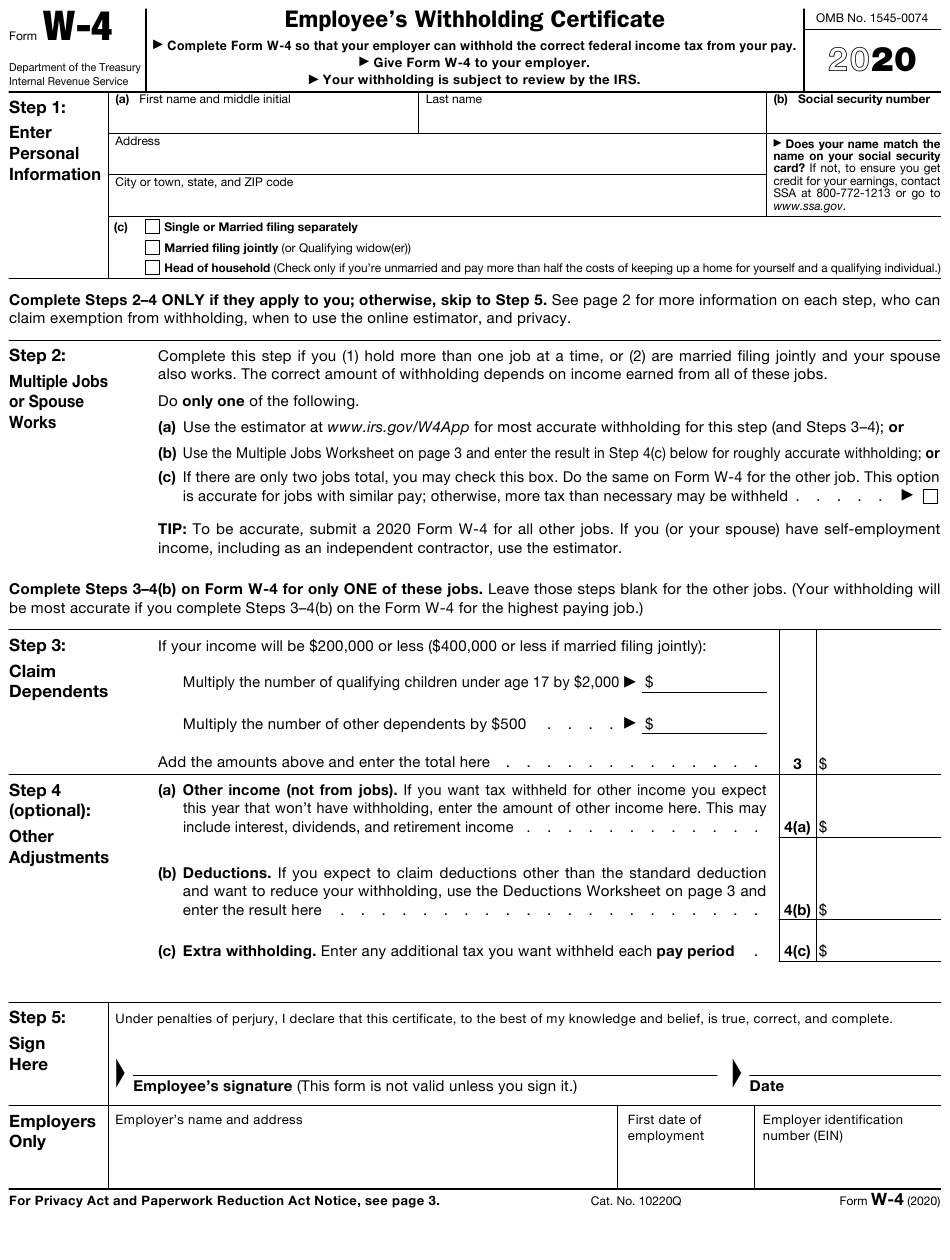

IRS Form W 4 Printable 2022 W4 Form

Key highlights of the printable IRS tax forms for 2023 and 2024 include Early Access Taxpayers can access and download printable IRS tax forms well in advance of the tax The 2024 Tax Year Forms listed below will be updated as they become available. You can upload, complete, and sign them online. Then download, print, and mail the paper forms to the IRS. Don't feel like handling complicated tax forms? We get IT!

The 2024 withholding certificate for nonperiodic retirement payments was released Dec 12 by the Internal Revenue Service Updates to the 2024 Form W 4R Withholding Certificate for Nonperiodic Payments and Eligible Rollover Distributions include those to the tax rate tables at the bottom of the form In the instructions payments that are not eligible rollover distributions as described on Starting in 2023, this form, alongside Form W-4R for Nonperiodic Payments and Eligible Rollover Distributions, is mandatory. Parallel to the adjustments in Form W-4, the 2024 draft Form W-4P incorporates the IRS's Tax Withholding Estimator into Step 2. This enhancement guarantees precise income tax withholding for pension and annuity payments.