Printable W4

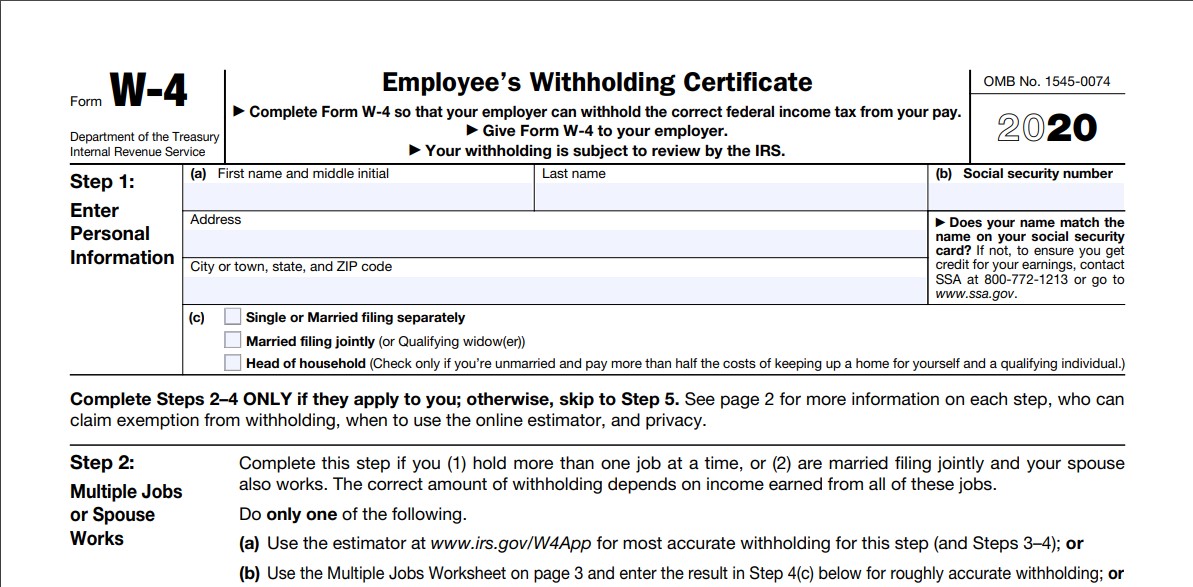

Web Purpose of Form Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay If too little is withheld you will generally owe tax when you file Purpose of Form Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. If too little is withheld, you will generally owe tax when you file …

Web Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Consider completing a new Form W 4 each year and when your personal or Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Consider completing a new Form W-4 each year and when your personal or …

Printable W4

Web 25 Juli 2022 nbsp 0183 32 Print W 4 Form 2022 HERE What Information Should I Include on My W 4 Form If you filed your taxes last year and received a hefty tax bill as a result and you don t want another one you may utilize Fill and sign w4 form online for free digisigner. Free printable w 4 form for employees free templates printableDownload and print w 4 form 2020.

Form W 4 Wikipedia

What Is The Purpose Of The W 4 Form Early Retirement

Web Enter an estimate of your 2014 itemized deductions These include qualifying home mortgage interest charitable contributions state and local taxes medical expenses in How to prepare Form W4. Open the Form W4 inside the editor to see the information of the template. You can continue and download a blank form or fill out and send it online in …

Web The fillable W4 form formally known as Employee s Withholding Allowance Certificate is an IRS document you fill out in order to inform your new employer of the amount of money to withhold from your pay for federal Step 3: Here is when you add if you have dependents in order to find out if you qualify for the Child Tax Credit and other dependent-related tax credits. Step 4: This section for Other Adjustments. It was previously known as …