Types Of Candlestick Patterns

Six bullish candlestick patterns Hammer The hammer candlestick pattern is formed of a short body with a long lower wick and is found at the bottom of a Inverse hammer A similarly bullish pattern is the inverted hammer The only difference being that the upper wick is Bullish engulfing The Candlestick patterns are key indicators on financial charts, offering insights into market sentiment and price movements. These patterns emerge from the open, high, low, and close prices of a security within a given period and are crucial for making informed trading decisions.

Jun 4 2021 Written by John McDowell Trading without candlestick patterns is a lot like flying in the night with no visibility Sure it is doable but it requires special training and expertise To that end we ll be covering the fundamentals of Every candlestick pattern detailed with their performance and reliability stats. Below you’ll find the ultimate database with every single candlestick pattern (and all the other types of pattern if you are interested). Here there are detailed articles for each candlestick pattern.

Types Of Candlestick Patterns

Bullish Hammer H Presented as a single candle a bullish hammer H is a type of candlestick pattern that indicates a reversal of a bearish trend This candlestick formation implies that there may be a potential uptrend in the market Some of the identifiable traits and features of a bullish hammer include the following Most common candlestick patterns for fx eurusd by lzr fx tradingview. Candlestick candlestick paterns correlation ctraderWhat are candlestick patterns understanding candlesticks basics.

Candlestick Patterns How To Read Charts Trading And More

Candlestick Patterns Anatomy And Their Significance Candlestick

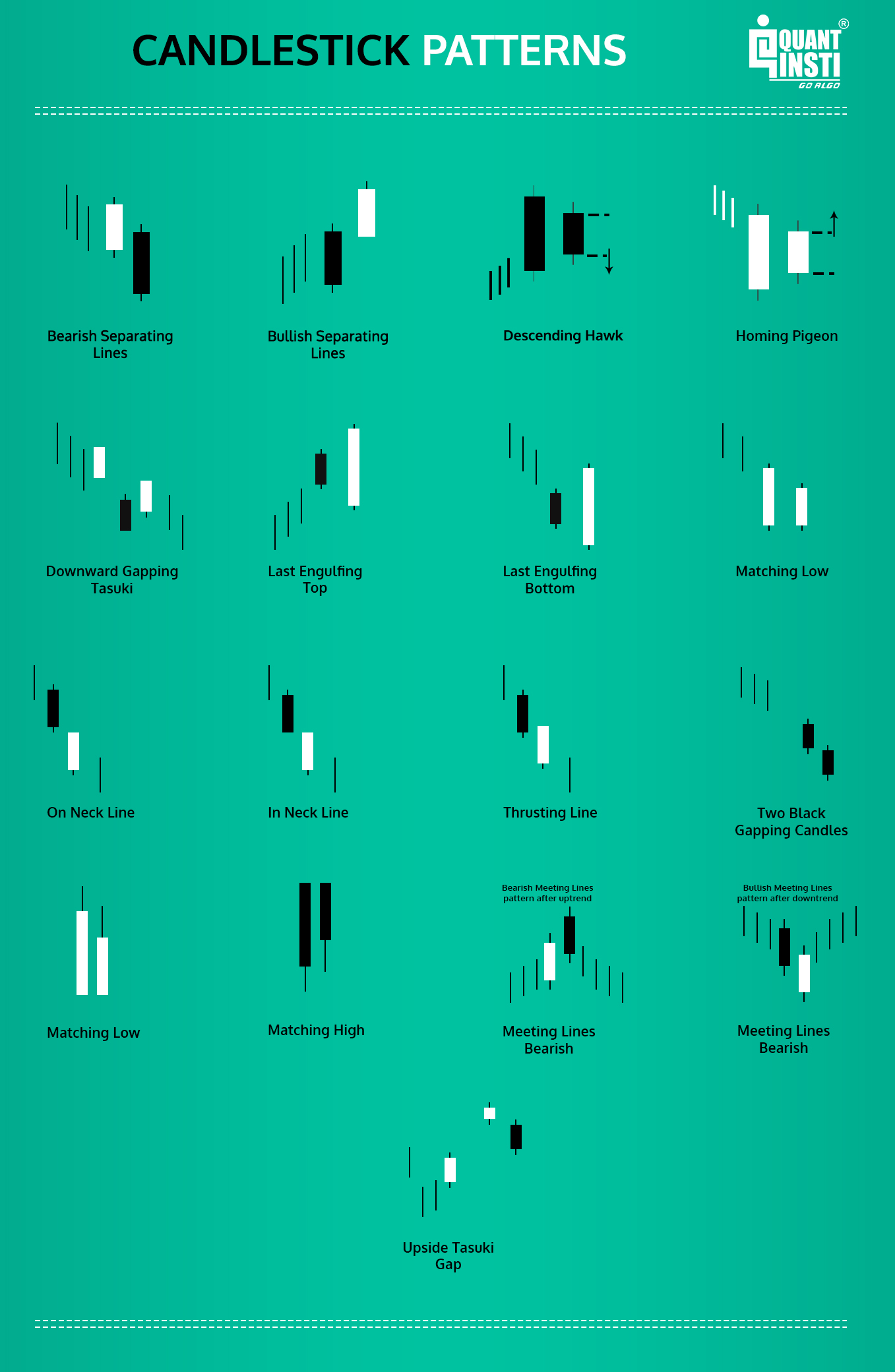

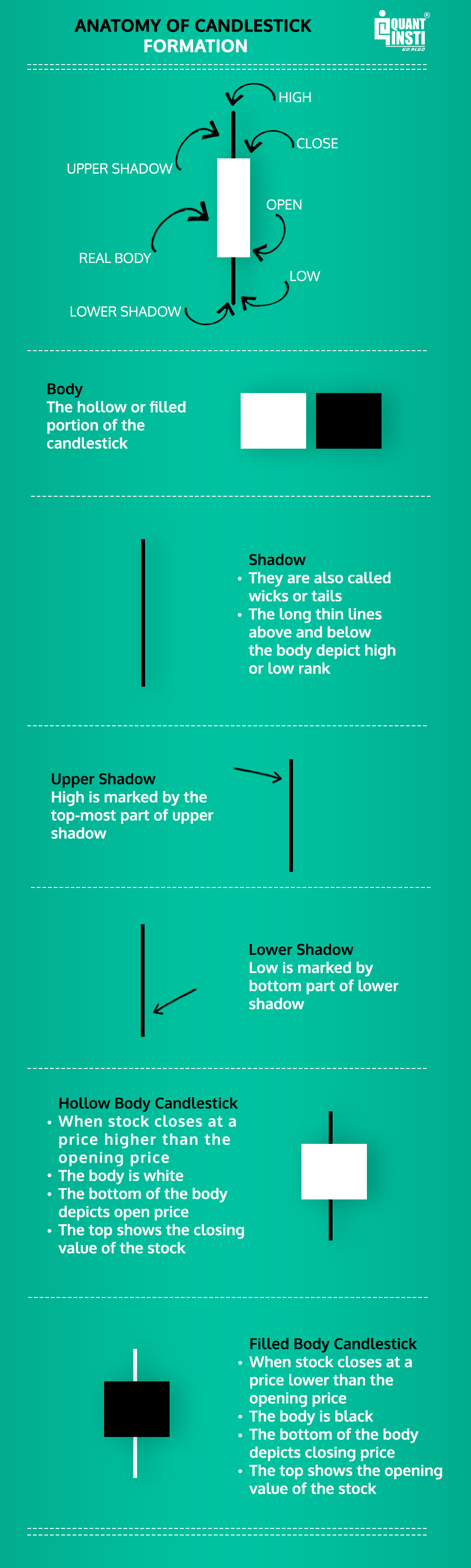

Candlestick patterns are used to predict the future direction of price movement Discover 16 of the most common candlestick patterns and how you can use them to identify trading opportunities How to read candlestick patterns. A candlestick has 3 components: The body provides the open and close price ranges.; The wicks (also known as shadows) show the high and low for the day. The color indicates which direction the market is headed: A green or white body shows a price increase, and a red or black body indicates a price decrease.;.

Trading Technical Analysis Understanding Basic Candlestick Charts By Cory Mitchell Updated July 15 2023 Reviewed by Gordon Scott Fact checked by Kirsten Rohrs Schmitt Candlestick charts What are candlestick patterns? Categories of candlestick patterns. Bearish candle; Bullish candle; Difference between Bullish candles and Bearish candles; Representation of Candlesticks; Types of candlestick patterns. List of candlestick patterns; Candlestick pattern vs Chart pattern; How to read candlestick patterns?.