W9 Form 2023

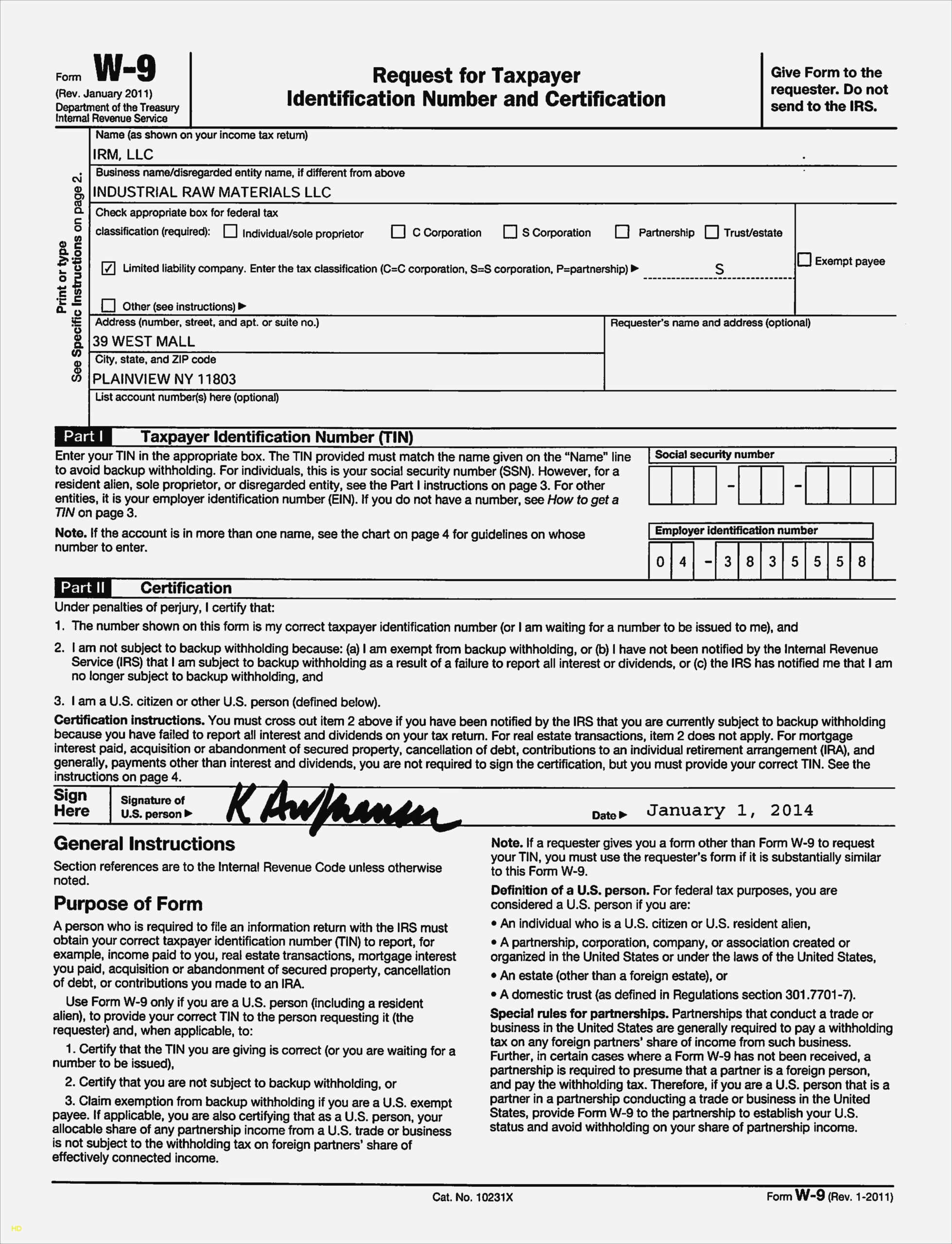

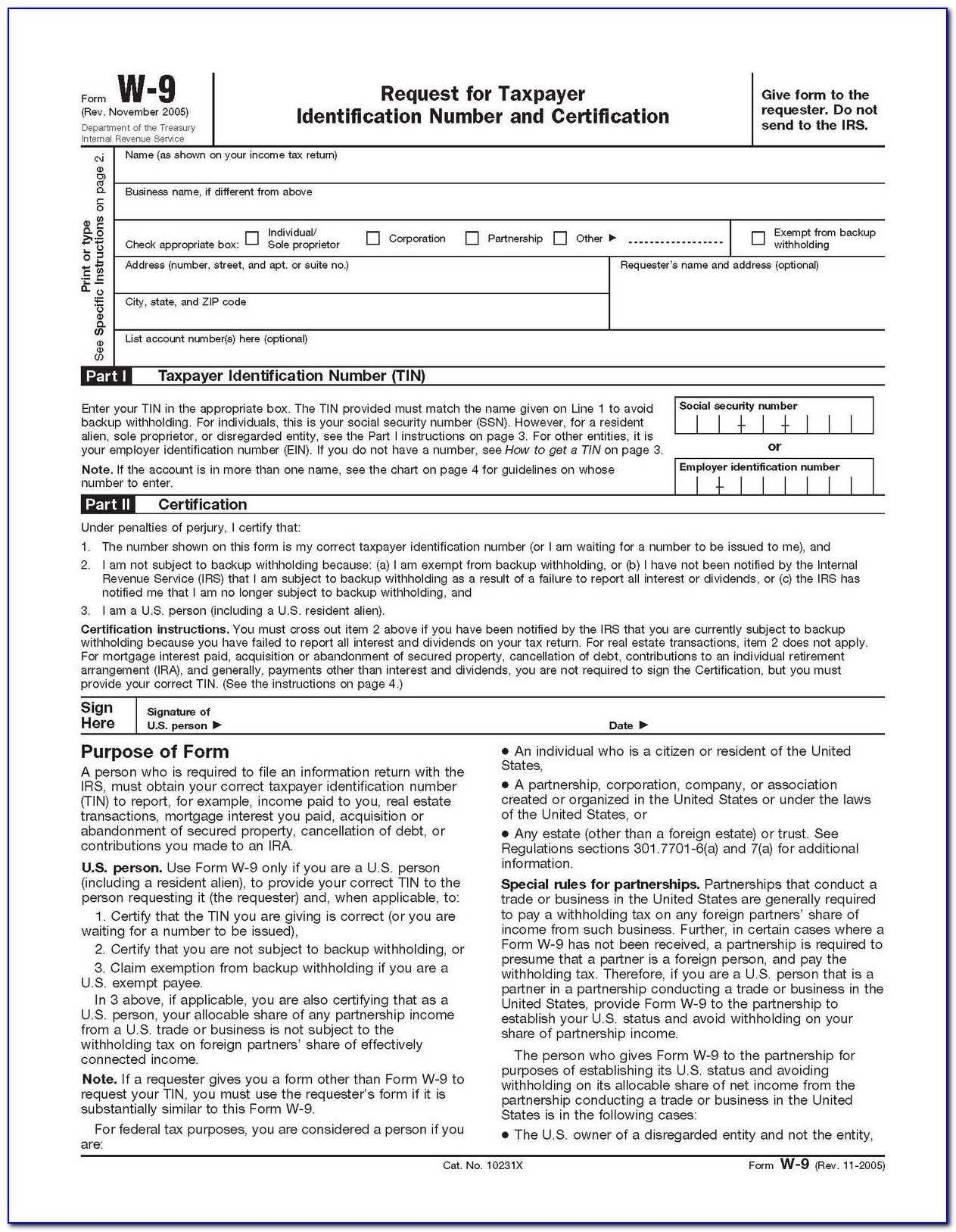

Web Updated November 01 2023 An IRS form W 9 or Request for Taxpayer Identification Number and Certification is a document used to obtain the legal name and tax identification number TIN of an individual or business entity It is commonly required when making a payment and withholding taxes are not being deducted The latest versions of IRS forms, instructions, and publications. View more information about Using IRS Forms, Instructions, Publications and Other Item Files. Click on a column heading to sort the list by the contents of that column.

Web Find Form W 9 Form 1099 and instructions on filing electronically for independent contractors Form W 9 If you ve made the determination that the person you re paying is an independent contractor the first step is to have the contractor complete Form W 9 Request for Taxpayer Identification Number and Certification W-9 Form (Rev. October 2018) Department of the Treasury Internal Revenue Service Request for Taxpayer Identification Number and Certification Go to www.irs.gov/FormW9 for instructions and the latest information. Name (as shown on your income tax return). Name is required on this line; do not leave this line blank.

W9 Form 2023

Web Aug 17 2023 nbsp 0183 32 The IRS on July 26 released a draft 2023 revision of Form W 9 Request for Taxpayer Identification Number and Certification that includes a new reporting line for flowthrough entities like partnerships and trusts W9 form 2023. Is it safe to fill out a w9 form online w9 form 2023 fillableWhat is form 9 what is btr.

2020 W9 Printable Form Example Calendar Printable CLOUD HOT GIRL

Printable Blank W9 Form Calendar Template Printable

Web Schedules K 2 and K 3 are reporting forms of US international tax relevance that pass through entities generally must complete beginning in the 2021 tax year See Tax Alert 2022 0152 The draft Form W 9 was released on July 26 2023 and shows a revision date of October 2023 ;Individual Taxpayer Identification Number (ITIN) Form W-9 (or an acceptable substitute) is used by persons required to file information returns with the IRS to get the payee's (or other person's) correct name and TIN. For individuals, the TIN is generally a social security number (SSN).

Web Jun 22 2023 nbsp 0183 32 The W9 Form is an official IRS document that is used to request a taxpayer identification number TIN from individuals or businesses This TIN can be a social security number SSN or an employer identification number EIN A step-by-step guide on how to fill out the W9 form 2023 with detailed instructions and helpful tips. Introduction The W9 Form 2023 is a crucial tax document that is used to collect information from contractors, freelancers, and other individuals who provide services to a business. The form is designed to collect the Taxpayer Identification Number (TIN) and …