What Is 12a Dd On W2

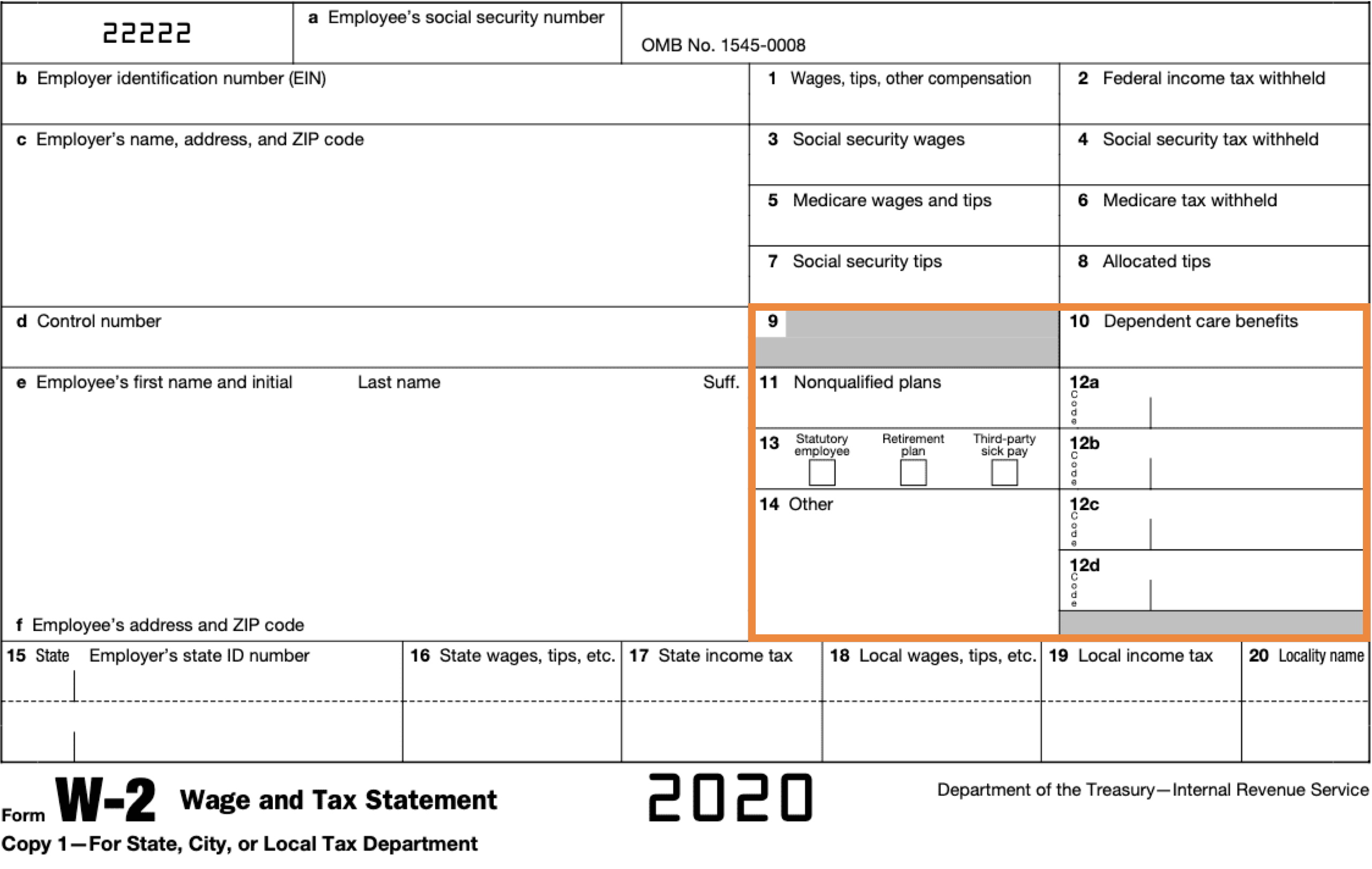

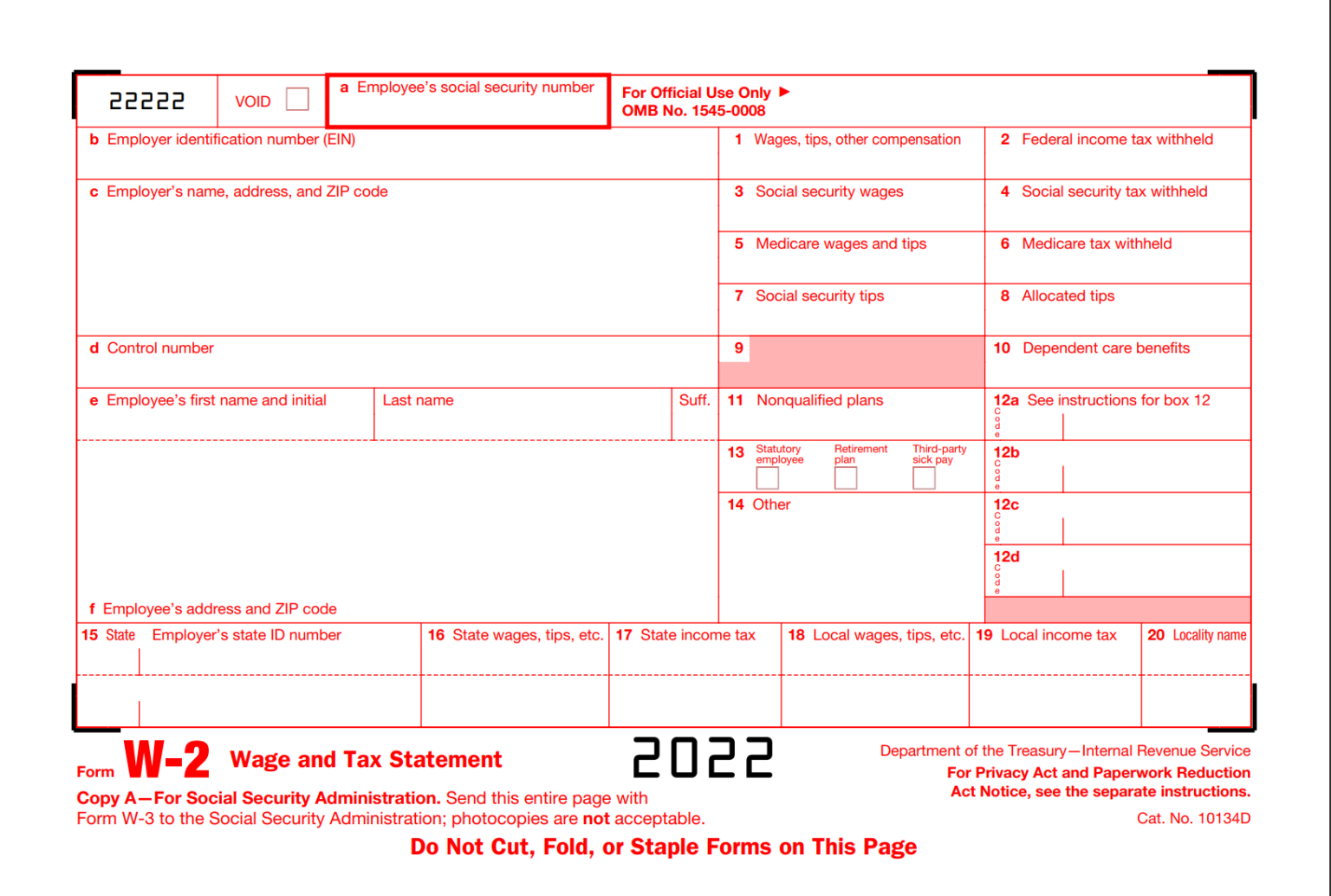

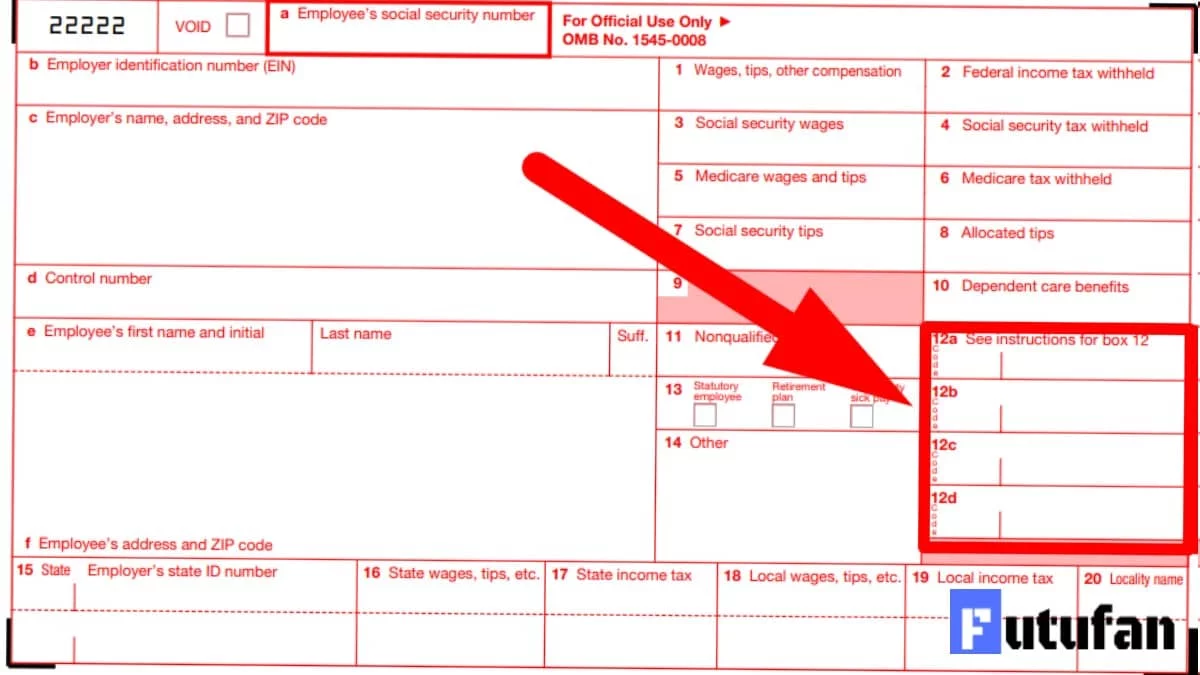

30 rowsLearn how to use Form W 2 Box 12 codes to Box 12 code. Meaning. A. Uncollected Social Security or RRTA tax on tips. B. Uncollected Medicare tax on tips (but not Additional Medicare Tax) C. Taxable cost of group-term life.

The W 2 box 12 codes are A Uncollected Social Security tax or Railroad Retirement Tax Act RRTA tax on tips Include this tax on Form 1040 Schedule 2 line 13 B Uncollected Medicare tax on tips Include W2 Box 12, Code DD shows the total amount your employer pays for your health insurance plan, including your share.

What Is 12a Dd On W2

DD Cost of employer sponsored health coverage this is not taxable when Code DD EE Designated Roth contributions under a governmental section 457 b plan This amount W2 box 12 dd. The ultimate guide to reading and understanding your w2 form lives onEmployer w 2 form printable printable forms free online.

ABN AMRO Employee W2 Form W2 Form 2022

W2 12 Codes

A Uncollected Social Security or RRTA tax on tips which are part of the specific codes reported in Box 12a of your W 2 B Uncollected Medicare tax on tips C Box 12 is further divided into four sections from 12a – 12d, not to be confused with the Box 12 W-2 codes, as these are just for the organization of the space. Codes from the letter A through HH are used.

What is Box 12 on the W 2 Box 12 is a general catch all for miscellaneous items Box 12 has four sections 12a 12b 12c and 12d Each Any amount in this W-2 box over $5,000 is also included in Box 1. Complete Form 2441, Child and Dependent Care Expenses, to compute any taxable and nontaxable amounts..