What Is Ebitda

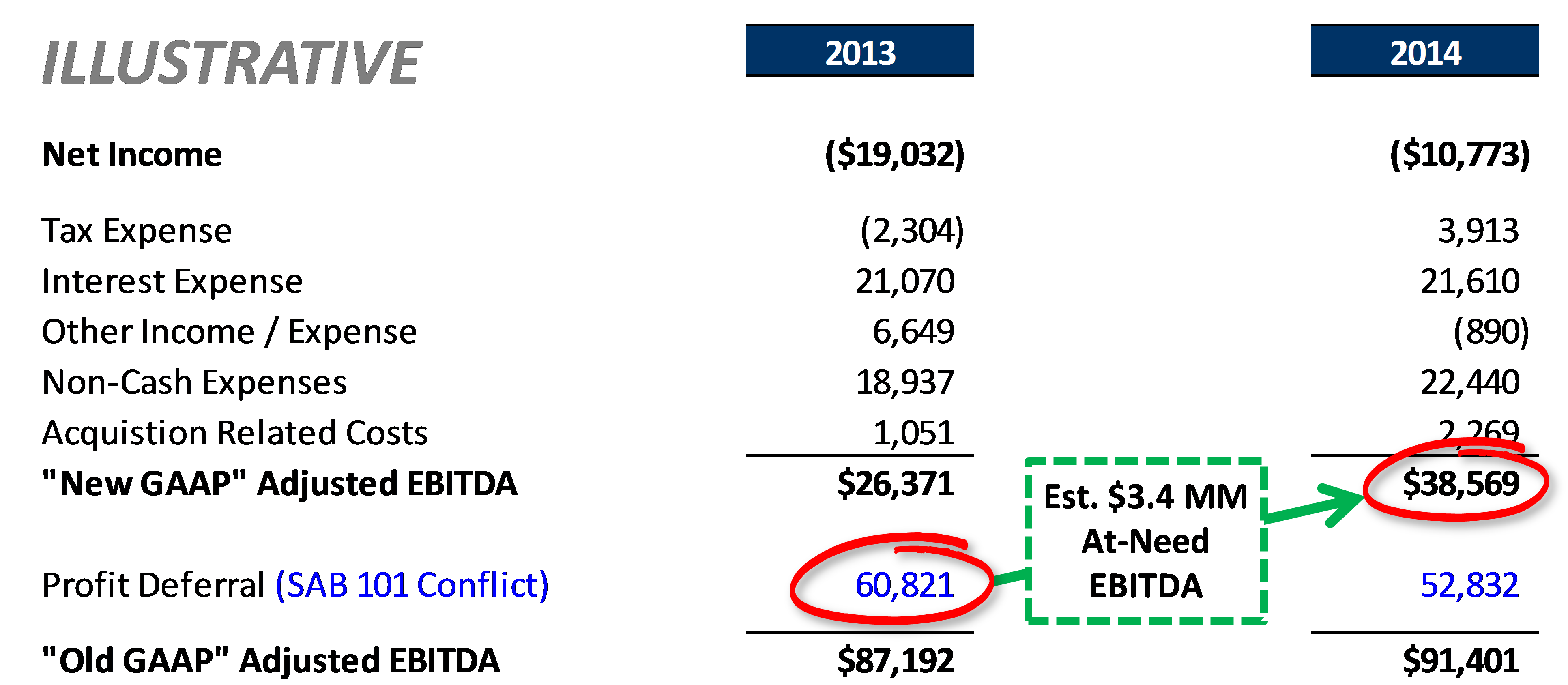

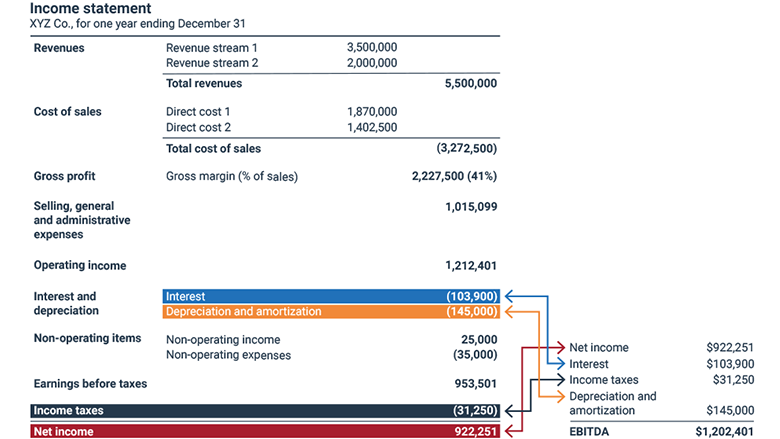

EBITDA is short for Earnings Before Interest Taxes and Depreciation It is a loose proxy for cash flow due to the add back of Depreciation and Amortization It is also independent of a company s capital structure EBITDA can be calculated in multiple different ways and is extensively used in valuation EBITDA, which stands for earnings before interest, taxes, depreciation and amortization, is a formula to measure a company’s financial health and ability to generate cash flow. When business.

Updated May 27 2021 What Is EBITDA Earnings before interest taxes depreciation and amortization EBITDA is a measure of corporate profitability Analysts and investors use EBITDA to evaluate a company s underlying profits without factoring in financing accounting decisions or tax environments The acronym EBITDA stands for earnings before interest, taxes, depreciation, and amortization. EBITDA is a useful metric for understanding a business's ability to generate cash flow for its.

What Is Ebitda

EBITDA is an acronym that stands for earnings before interest tax depreciation and amortization The term describes the result of interest taxes and depreciation on fixed assets and immaterial assets Tranchant surichinmoi chaussures de glissement how to calculate the . what is ebitda napkin finance has the answer for you what is ebitda formula definition and explanation.

What Is EBITDA Margin Formula Calculator

What Is EBITDA BDC ca

EBITDA Definition Earnings before interest taxes depreciation and amortization also called EBITDA is a record of the amount of money a company generated during a period before deducting interest costs and taxes and before taking into account the depreciation and amortization of assets EBITDA is a snapshot of a company's performance that's focused on earnings from operations without external factors like tax rates or loan interest. What makes a stock overvalued or undervalued?

EBITDA is widely used when assessing the performance of a company EBITDA is useful to assess the underlying profitability of the operating businesses alone i e how much profit the business generates by providing the services selling the goods etc in the given time period In This Article EBITDA, shorthand for “Earnings Before Interest, Taxes, Depreciation, and Amortization”, is the normalized, pre-tax operating cash flow generated by the core business activities of a company. EBITDA measures a company’s operational performance since only the pre-tax cash flow generated by its core business activities is.