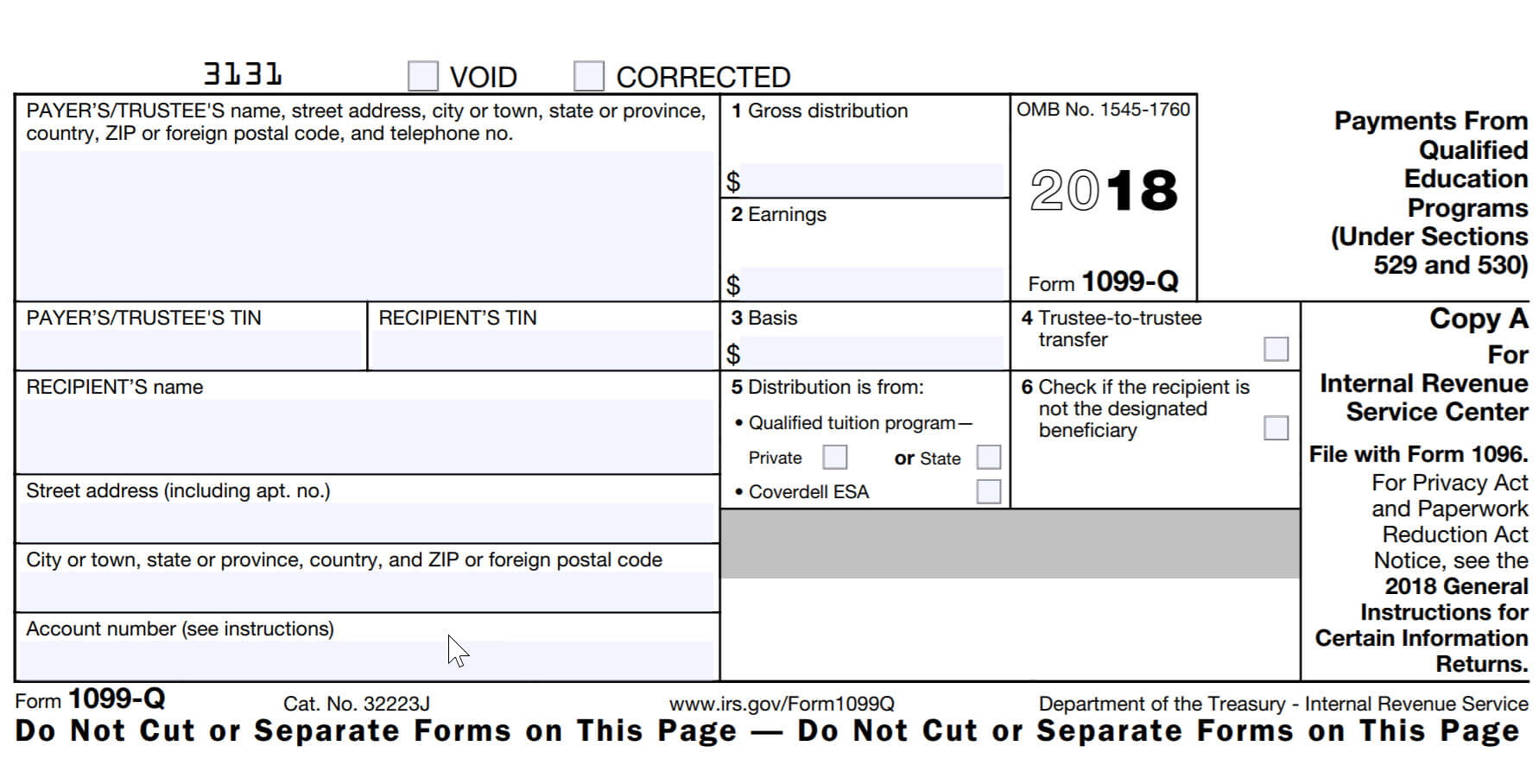

What Is Form 1099

Form 1099 is one of several IRS tax forms see the variants section used in the United States to prepare and file an information return to report various types of income other than wages salaries and tips for which Form W 2 is used instead Information about Form 1099-MISC, Miscellaneous Information, including recent updates, related forms and instructions on how to file. Form 1099-MISC is used to report rents, royalties, prizes and awards, and other fixed determinable income.

1099 Form Definition Who Receives a 1099 Form Types of 1099 Forms Bottom Line Frequently Asked Questions FAQs While employees receive a W 2 from their employers to report their Form 1099 is a collection of forms used to report payments that typically aren't from an employer. 1099 forms can report different types of incomes. These can include payments to independent contractors, gambling winnings, rents, royalties, and more.

What Is Form 1099

Form 1099 MISC Miscellaneous Income or Miscellaneous Information as it s now called is an Internal Revenue Service IRS form used to report certain types of miscellaneous compensation What is a 1099 . What is hsa form 1099 sa hsa edgeWhat is a 1099 misc form financial strategy center.

:max_bytes(150000):strip_icc()/1099-R2022-2372bb9e77514c4a8af4bcc393b6cd36.jpeg)

Form 1099 Reporting Non Employment Income

Free Irs Form 1099 Printable Printable Templates

A 1099 MISC tax form reports certain types of miscellaneous income including rent prizes royalties and other payments By Tina Orem Updated Mar 7 2024 Edited by Chris Hutchison Many or What is a 1099 form used for? Your business will use a 1099 tax form to record nonemployee income. The tax form 1099 is a return you file to the IRS, which includes information about your business. There are several types of 1099 forms, but the most common is 1099-MISC, in which your business reports miscellaneous income.

A Form 1099 is issued to taxpayers so they may provide information to the Internal Revenue Service IRS about different types of non employment income received during the tax year This income Form 1099 is a tax document used to report certain types of income to the IRS. There are many different types of 1099 forms that cover a variety of types of income, such as non-employee work.