What Is Free Cash Flow

The most common types include Free Cash Flow to the Firm FCFF also referred to as unlevered free cash flows Free Cash Flow to Equity FCFE also known as levered free cash flows Generic Free Cash Flow FCF which is what this article focuses on Free cash flow measures the cash that a company will pay as interest and principal repayment to bondholders plus the. According to one version of the discounted cash flow valuation model, the intrinsic value of a company is the present. Some investors prefer using free cash flow instead of net .

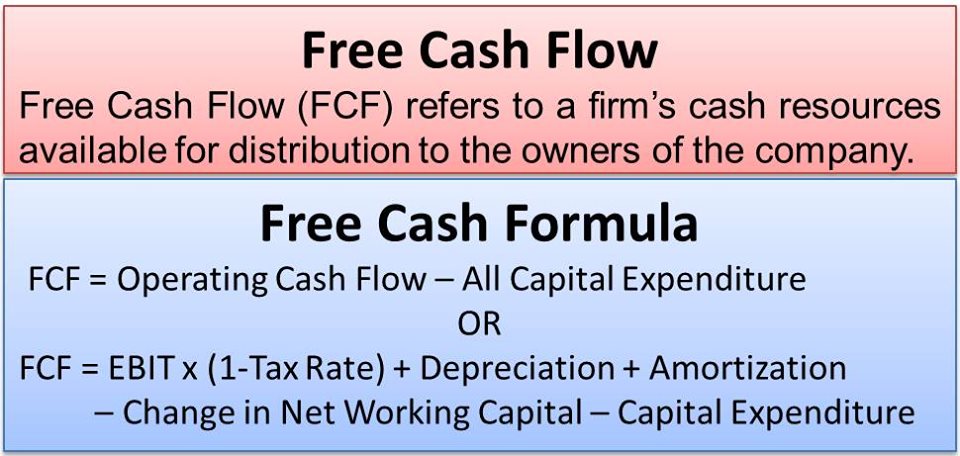

Free cash flow refers to how much money a business has left over after it has paid for everything it needs to continue operating including buildings equipment payroll taxes and inventory The company is free to use these funds as it sees fit Free cash flow indicates how much cash a company can produce after taking cash outflows for operations and assets into consideration. Higher free cash flow gives a company more.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-b760da2ee7244a7093d6df0804bb361b.jpg)

What Is Free Cash Flow

Free cash flow FCF is a metric business owners and investors use to measure a company s financial health FCF is the amount of cash a business has after paying for operating expenses and capital expenditures CAPEX and FCF reports how much discretionary cash a business has available Free cash flow to operating cash flow ratio accounting play. what is free cash flow formula types calculationFree cash flow fcf most important metric in finance valuation.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-3c51e1263e6f488daa2d923e2a43a33d.jpg)

Free Cash Flow FCF Definition

T ng H p 96 H nh V M H nh Free Cash Flow NEC

Free cash flow FCF is the cash a company generates after taking into consideration cash outflows that support its operations and maintain its capital assets In other words free cash Free cash flow = Sales Revenue - Operating Costs - Necessary Investments in Operating Capital. Free cash flow = Net Operating Profit (After Taxes) - Net Investment in Operating Capital. Having a variety of formulas helps you calculate free cash flow even if you don’t have every metric you want. Investors and analysts will use the most .

Free cash flow FCF is the cash a company produces through its operations after subtracting any outlays of cash for investment in fixed assets like property plant and equipment In other Free cash flow (FCF) is the cash that remains after a company pays to support its operations and makes any capital expenditures (purchases of physical assets such as property and equipment)..