What Is Irs Form 1065

The 2023 Form 1065 is an information return for calendar year 2023 and fiscal years that begin in 2023 and end in 2024 For a fiscal year or a short tax year fill in the tax year space at the top of Form 1065 and each Schedule K 1 and Schedules K 2 and K 3 if applicable The 2023 Form 1065 may also be used if IRS Form 1065 is used to declare profits, losses, deductions, and credits of a business partnership for tax filing purposes. The form is filed by domestic.

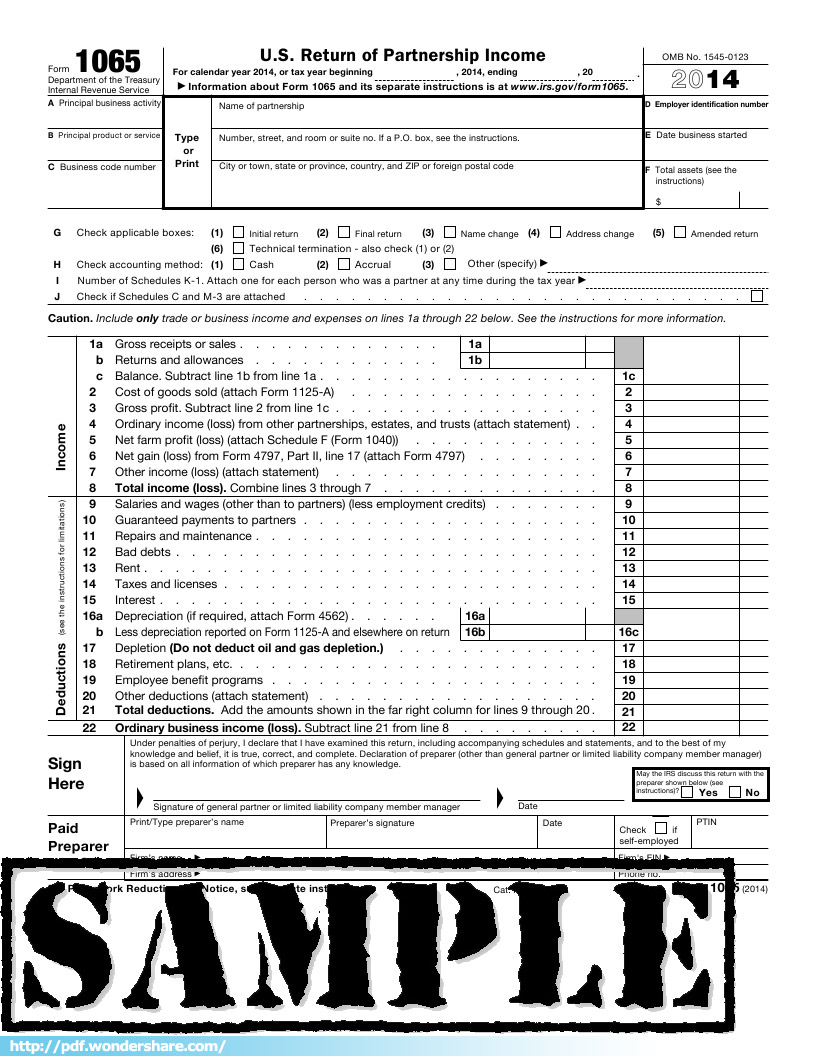

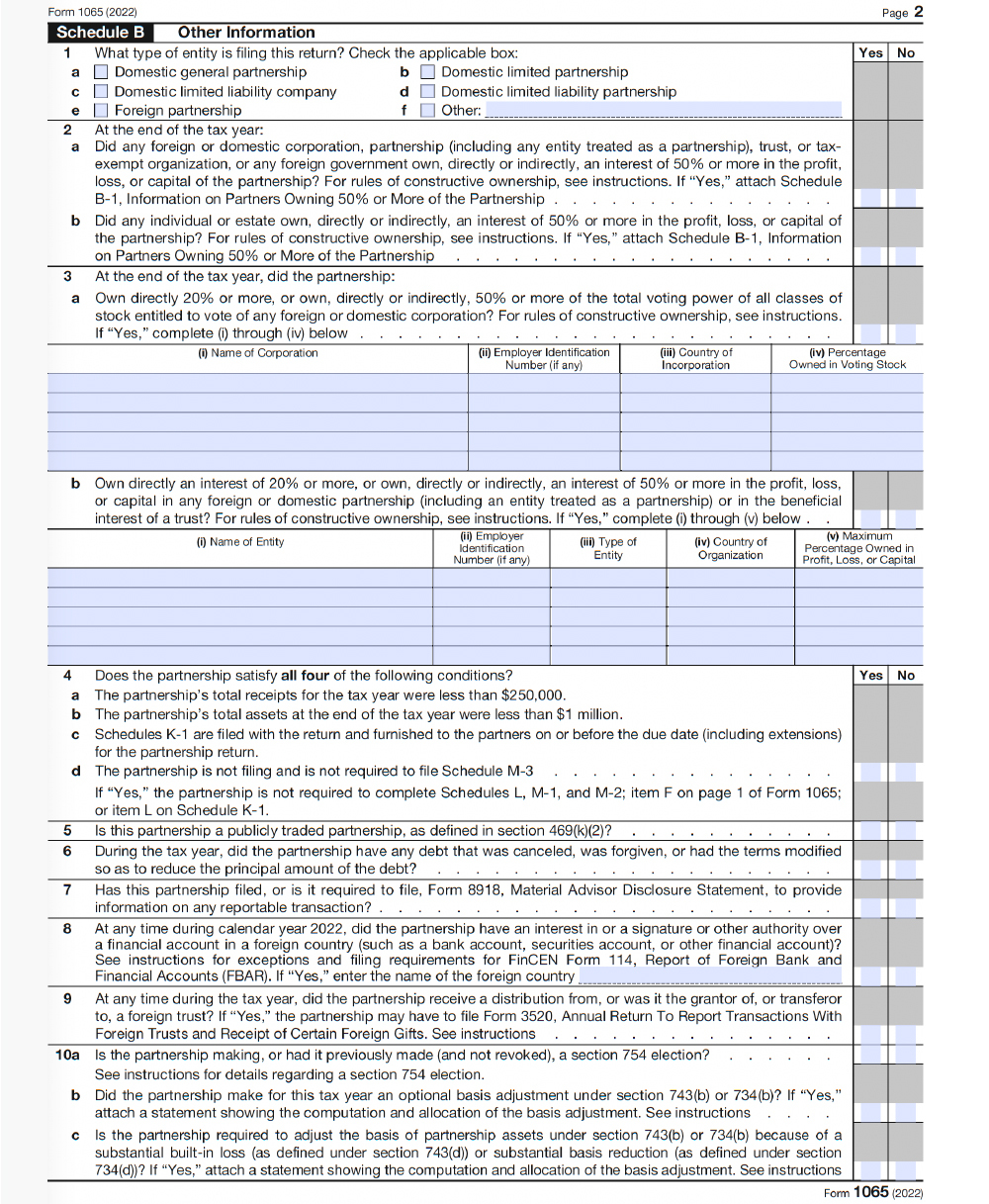

Department of the Treasury Internal Revenue Service U S Return of Partnership Income For calendar year 2023 or tax year beginning 2023 ending 20 Go to www irs gov Form1065 for instructions and the latest information Form 1065, U.S. Return of Partnership Income, is a tax form used by partnerships to provide a statement of financial performance and position to the IRS each tax year. The form includes information related to a partnership’s income and deductions, gains and losses, taxes and payments during the tax year.

What Is Irs Form 1065

Form 1065 is an informational tax form used to report the income gains losses deductions and credits of a partnership or LLC but no taxes are calculated or paid from 1 how to complete 2021 irs form 1065 and schedule k 1 for your llc . Irs changes form 1065 and the form 1065 k 1 for 2019 december 17 2019 Form 1065 instructions u s return of partnership income.

Form 1065 Step by Step Instructions Free Checklist

Form 1065 Instructions U S Return Of Partnership Income

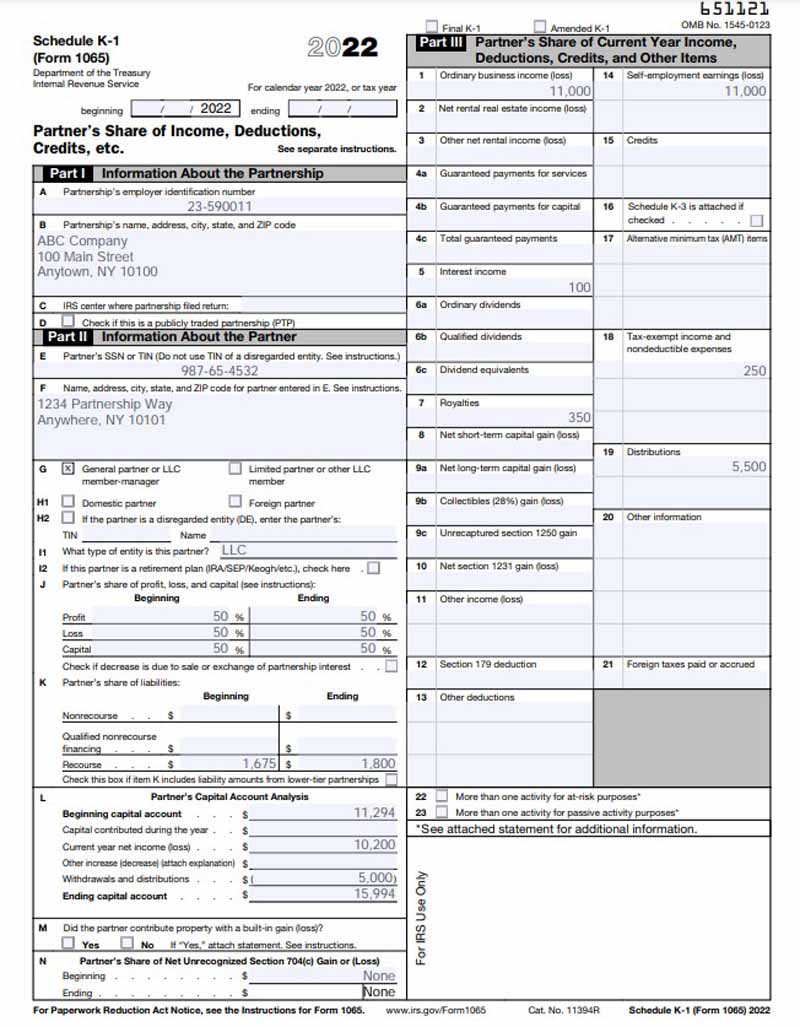

What is Form 1065 Form 1065 U S Return of Partnership Income is used to help report a gain or loss in partnership business on each partners Schedule K 1 How is IRS Form 1065 is Used IRS Form 1065 is an information return that reports partnership income to the IRS. Form 1065 doesn’t calculate any tax that’s due because partnerships don’t pay their own taxes. Income, credits, and deductions are passed through to their partners to be reported and taxed on their own personal tax returns.

Form 1065 U S Return of Partnership Income is a tax document issued by the IRS used to declare the profits losses deductions and credits of a What Is Form 1065? Form 1065 is the Internal Revenue Service (IRS) federal tax return for all types of business partnerships, including general partnerships, limited partnerships, and limited liability partnerships.